- China

- /

- Auto Components

- /

- SHSE:688155

A Piece Of The Puzzle Missing From Shanghai SK Automation Technology Co.,Ltd's (SHSE:688155) 49% Share Price Climb

Shanghai SK Automation Technology Co.,Ltd (SHSE:688155) shareholders would be excited to see that the share price has had a great month, posting a 49% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 57%.

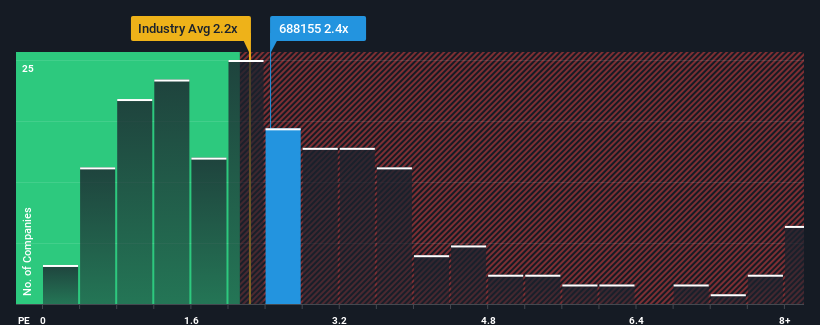

Even after such a large jump in price, it's still not a stretch to say that Shanghai SK Automation TechnologyLtd's price-to-sales (or "P/S") ratio of 2.4x right now seems quite "middle-of-the-road" compared to the Auto Components industry in China, where the median P/S ratio is around 2.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Shanghai SK Automation TechnologyLtd

How Shanghai SK Automation TechnologyLtd Has Been Performing

Shanghai SK Automation TechnologyLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Shanghai SK Automation TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Shanghai SK Automation TechnologyLtd's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.2%. Even so, admirably revenue has lifted 196% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 39% during the coming year according to the lone analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 23%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Shanghai SK Automation TechnologyLtd's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Shanghai SK Automation TechnologyLtd's P/S

Shanghai SK Automation TechnologyLtd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Shanghai SK Automation TechnologyLtd's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You should always think about risks. Case in point, we've spotted 3 warning signs for Shanghai SK Automation TechnologyLtd you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688155

Shanghai SK Automation TechnologyLtd

Engages in the research, development, production, and sale of intelligent manufacturing equipment for new energy vehicles and fuel vehicles.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)