- China

- /

- Food and Staples Retail

- /

- SZSE:003010

Global Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets navigate a landscape of mixed economic signals and trade negotiations, investors are keeping a close eye on growth opportunities that can withstand uncertainty. In this environment, companies with high insider ownership often stand out, as they typically reflect strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.3% | 66.1% |

| Vow (OB:VOW) | 13.1% | 81% |

| Laopu Gold (SEHK:6181) | 31.9% | 40.5% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 51.9% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.7% |

Here we highlight a subset of our preferred stocks from the screener.

Ningbo Jifeng Auto Parts (SHSE:603997)

Simply Wall St Growth Rating: ★★★★☆☆

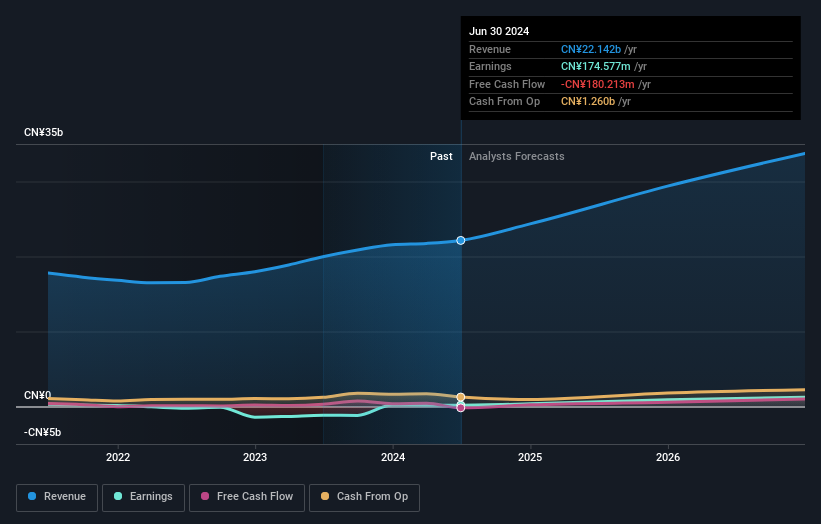

Overview: Ningbo Jifeng Auto Parts Co., Ltd. manufactures automotive interior parts in China and has a market cap of CN¥16.41 billion.

Operations: Revenue segments for the company include automotive interior parts, amounting to CN¥16.41 billion.

Insider Ownership: 25.7%

Earnings Growth Forecast: 74.5% p.a.

Ningbo Jifeng Auto Parts demonstrates potential as a growth company with forecasted revenue growth of 14.8% annually, outpacing the market. Despite a recent dip in quarterly sales to CNY 5.04 billion, net income surged to CNY 104.44 million from CNY 19.07 million a year ago, indicating improved profitability prospects. The stock trades significantly below its estimated fair value and analysts expect a price increase of 20.8%, although insider trading activity remains minimal recently.

- Take a closer look at Ningbo Jifeng Auto Parts' potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Ningbo Jifeng Auto Parts is priced lower than what may be justified by its financials.

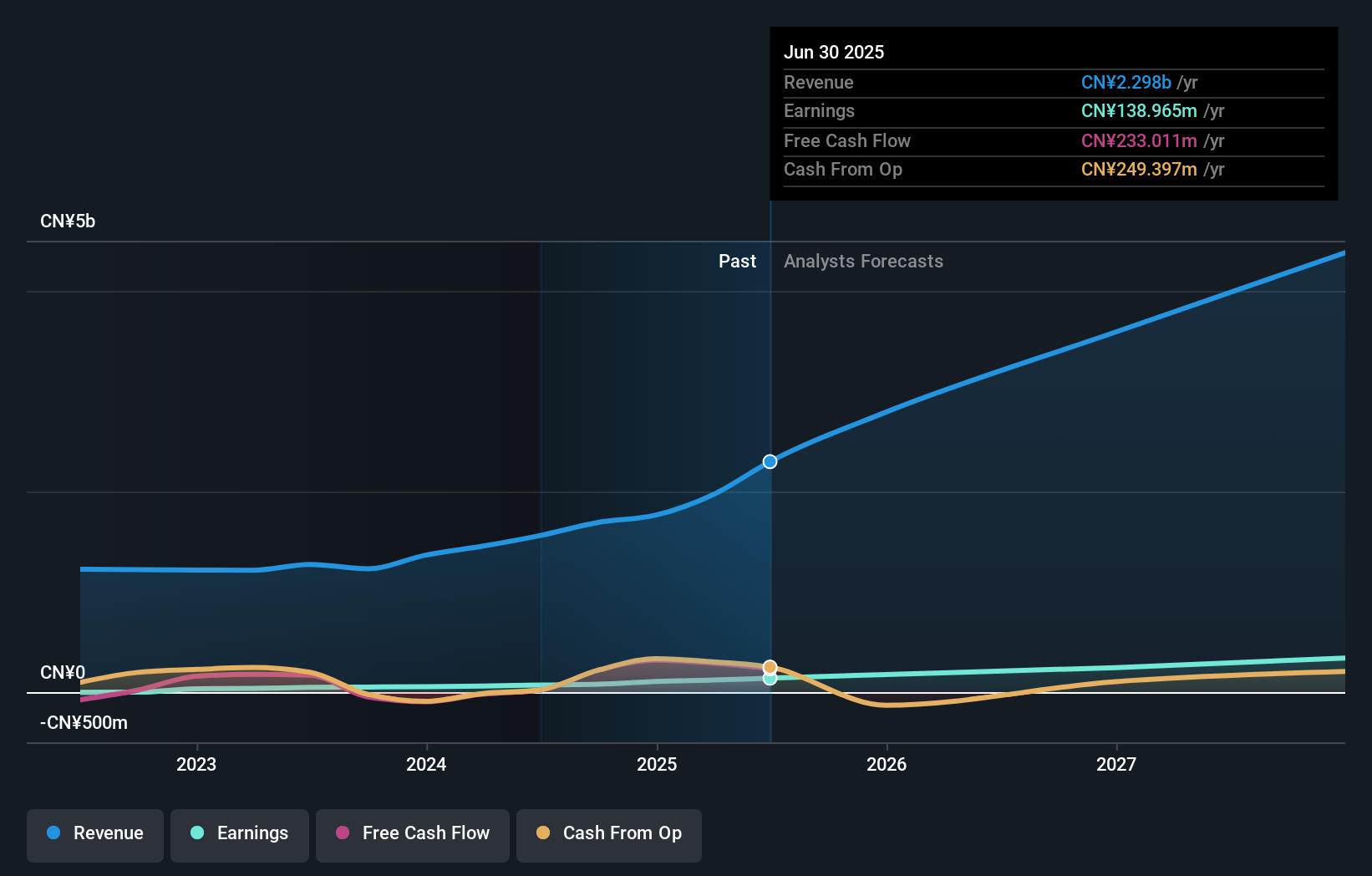

Guangzhou Ruoyuchen TechnologyLtd (SZSE:003010)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Ruoyuchen Technology Co., Ltd. offers brand integrated marketing solutions in China and has a market cap of CN¥8.37 billion.

Operations: Guangzhou Ruoyuchen Technology Co., Ltd. generates revenue through its provision of brand integrated marketing solutions within China.

Insider Ownership: 37.2%

Earnings Growth Forecast: 30.1% p.a.

Guangzhou Ruoyuchen Technology shows promise with earnings projected to grow 30.12% annually, surpassing the Chinese market average. Recent Q1 results highlight robust growth, with sales reaching CNY 573.81 million and net income doubling year-over-year to CNY 27.42 million. Despite high share price volatility, the company trades below its estimated fair value and has initiated a share buyback program for capital reduction, reflecting strategic financial management without recent insider trading activity.

- Get an in-depth perspective on Guangzhou Ruoyuchen TechnologyLtd's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Guangzhou Ruoyuchen TechnologyLtd shares in the market.

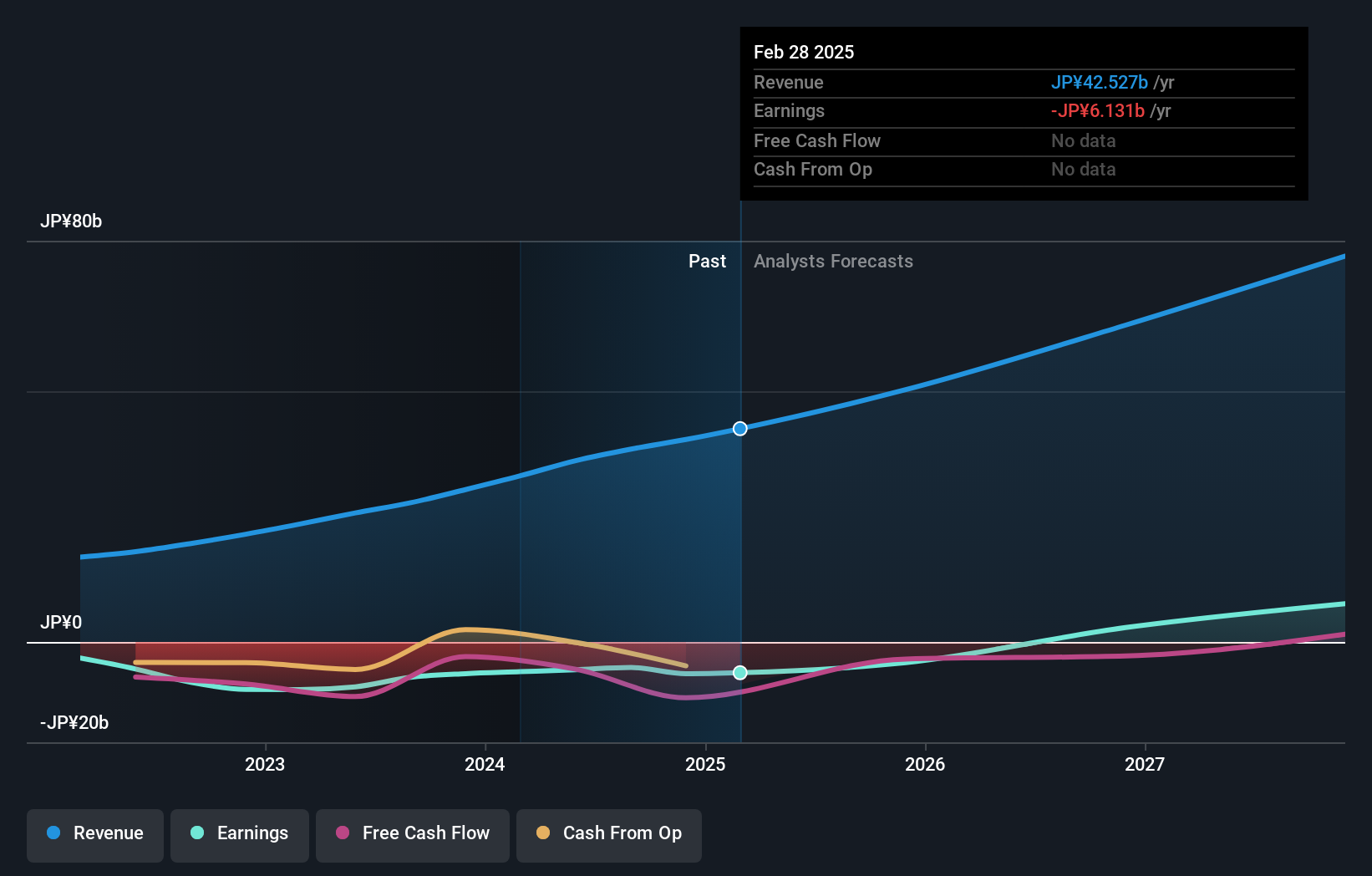

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations mainly in Japan, with a market cap of ¥253.40 billion.

Operations: The Platform Services Business segment generates ¥42.53 billion in revenue, providing financial solutions primarily in Japan.

Insider Ownership: 18.6%

Earnings Growth Forecast: 60.5% p.a.

Money Forward anticipates becoming profitable within three years, with earnings projected to grow 60.46% annually, outpacing the Japanese market's average. Despite a volatile share price and trading 70.4% below its estimated fair value, revenue is expected to rise by 18.5% per year. Recent guidance revisions lowered net sales expectations due to Nexsol Co., Ltd.'s exclusion from consolidation, though analysts foresee a potential stock price increase of 22.4%. No recent insider trading activity noted.

- Delve into the full analysis future growth report here for a deeper understanding of Money Forward.

- Our valuation report unveils the possibility Money Forward's shares may be trading at a discount.

Key Takeaways

- Click through to start exploring the rest of the 837 Fast Growing Global Companies With High Insider Ownership now.

- Seeking Other Investments? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade Guangzhou Ruoyuchen TechnologyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003010

Guangzhou Ruoyuchen TechnologyLtd

Provides brand integrated marketing solutions in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives