- China

- /

- Auto Components

- /

- SHSE:603949

Uncovering January 2025's Hidden Gems With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a choppy start to 2025, marked by U.S. inflation concerns and small-cap stocks underperforming their larger counterparts, investors are keenly observing economic indicators that could influence future growth prospects. Amidst this backdrop, identifying stocks with strong fundamentals and resilience becomes crucial for those seeking opportunities in the small-cap space.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ha Giang Mineral Mechanics | NA | 23.21% | 43.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Xuelong GroupLtd (SHSE:603949)

Simply Wall St Value Rating: ★★★★★★

Overview: Xuelong Group Co., Ltd is involved in the research, development, production, and sale of internal combustion engine cooling systems and automotive lightweight plastic products for commercial vehicles, construction machinery, and agricultural machinery sectors, with a market cap of CN¥2.50 billion.

Operations: Xuelong Group generates revenue primarily from the sale of internal combustion engine cooling systems and automotive lightweight plastic products. The company's net profit margin has shown variability, reflecting changes in operational efficiency and cost management over time.

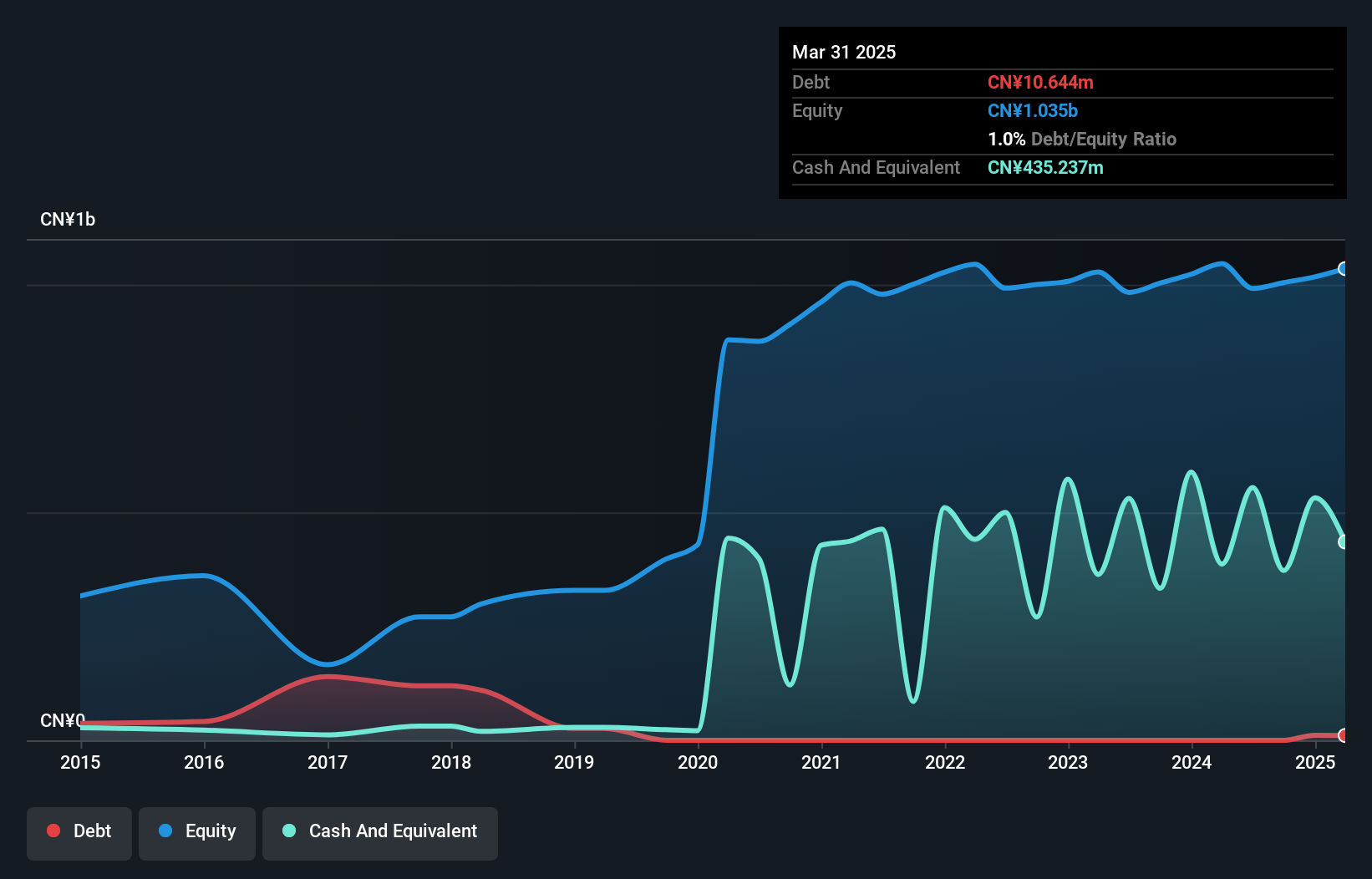

Xuelong Group, a relatively small player in its sector, has seen its earnings grow by 5% over the past year, though this lags behind the Auto Components industry average of 10.1%. The company is debt-free and boasts high-quality past earnings. However, over the last five years, earnings have decreased by 16.8% annually. Recent reports indicate a dip in sales to CNY 268 million from CNY 281 million and net income dropping to CNY 45 million from CNY 53 million year-over-year. Basic earnings per share fell to CNY 0.21 from CNY 0.25 during the same period.

- Unlock comprehensive insights into our analysis of Xuelong GroupLtd stock in this health report.

Explore historical data to track Xuelong GroupLtd's performance over time in our Past section.

HangZhou Everfine Photo-e-info (SZSE:300306)

Simply Wall St Value Rating: ★★★★★★

Overview: HangZhou Everfine Photo-e-info Co., Ltd. specializes in providing photoelectric, biometric, infrared, UV, EMC, and DNA diagnosis products in China with a market capitalization of CN¥2.99 billion.

Operations: The company's revenue streams are derived from its diverse range of products, including photoelectric, biometric, infrared, UV, EMC, and DNA diagnosis solutions. It focuses on optimizing its cost structure to enhance profitability. The net profit margin reflects the company's efficiency in converting revenue into actual profit.

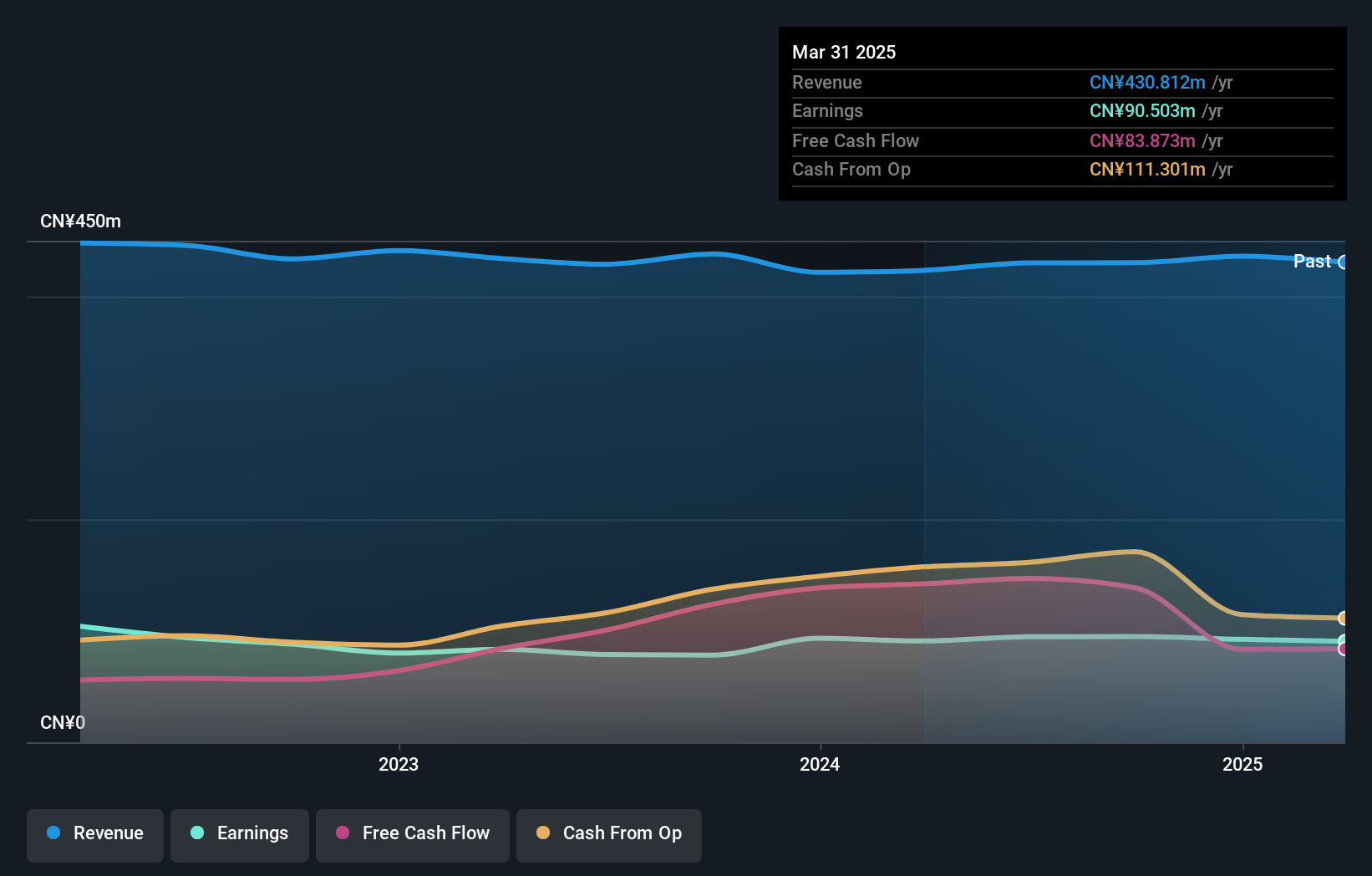

HangZhou Everfine Photo-e-info, a smaller company in the electronics sector, has shown promising financial health with no debt over the past five years. The company's earnings grew by 21% last year, significantly outpacing the industry average of 1.9%, suggesting robust operational performance. Despite a one-off gain of CN¥21.5 million affecting recent results, it remains profitable and free cash flow positive. Trading at nearly 30% below its estimated fair value enhances its appeal for potential investors seeking undervalued opportunities. Recent earnings for nine months showed sales of CNY 298 million and net income of CNY 54 million compared to last year’s figures.

Shenzhen Longli TechnologyLtd (SZSE:300752)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Longli Technology Co.,Ltd focuses on the research, development, production, and sale of LED backlight display modules both in China and internationally, with a market cap of CN¥3.86 billion.

Operations: Longli Technology generates revenue primarily from its Backlight Display Module segment, amounting to CN¥1.22 billion. The company has a market cap of approximately CN¥3.86 billion.

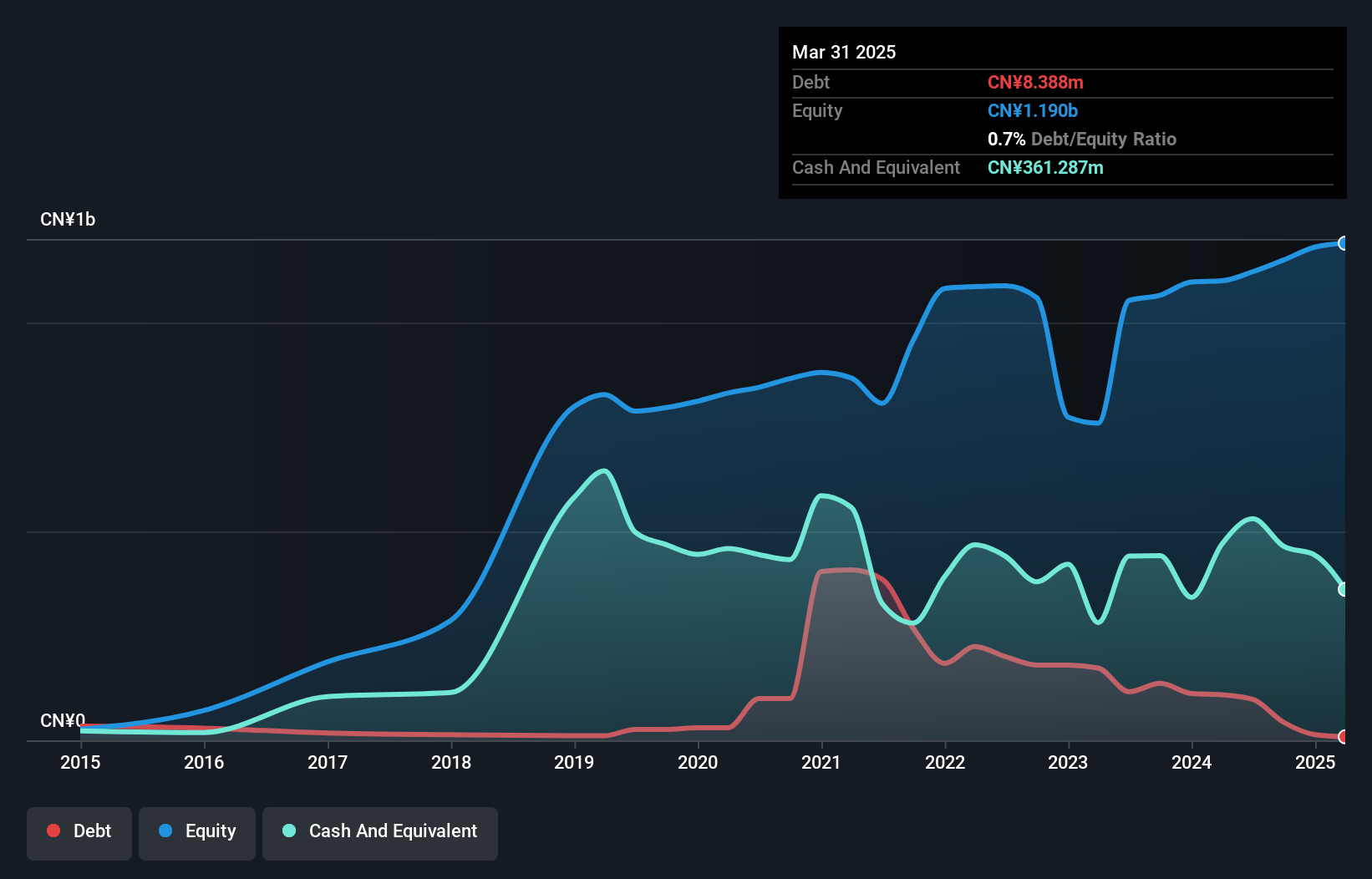

Shenzhen Longli Technology seems to be making waves with its recent profitability, showcasing high-quality earnings and a positive free cash flow. Trading at 32.3% below its estimated fair value, the company has seen its debt to equity ratio rise slightly from 3.3 to 3.7 over five years but maintains more cash than total debt, ensuring interest payments are well-covered. Recent financials reveal impressive growth; net income soared to CNY 77 million from just CNY 1 million a year ago on sales of CNY 941 million. A share repurchase program worth up to CNY 60 million further underscores confidence in future prospects.

- Get an in-depth perspective on Shenzhen Longli TechnologyLtd's performance by reading our health report here.

Gain insights into Shenzhen Longli TechnologyLtd's past trends and performance with our Past report.

Key Takeaways

- Gain an insight into the universe of 100 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603949

Xuelong GroupLtd

Engages in the research, development, production, and sale of internal combustion engine cooling systems and automotive lightweight plastic products that are used in commercial vehicles, construction machinery, and agricultural machinery sectors.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)