- Sweden

- /

- Electrical

- /

- NGM:PLEJD

3 Growth Companies With High Insider Ownership Growing Revenues Up To 38%

Reviewed by Simply Wall St

As global markets navigate the challenges of rising U.S. Treasury yields and tepid economic growth, investors are closely watching how these factors influence equity performance, particularly in the context of growth stocks that have recently outperformed value stocks. In such a volatile environment, companies with high insider ownership can be appealing as they often signal strong alignment between management and shareholders, potentially driving robust revenue growth even amidst broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.5% | 24.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We'll examine a selection from our screener results.

Plejd (NGM:PLEJD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Plejd AB (publ) is a technology company that develops products and services for smart lighting control in Sweden, with a market cap of SEK4.42 billion.

Operations: The company's revenue segment is primarily from Electronic Security Devices, amounting to SEK726.23 million.

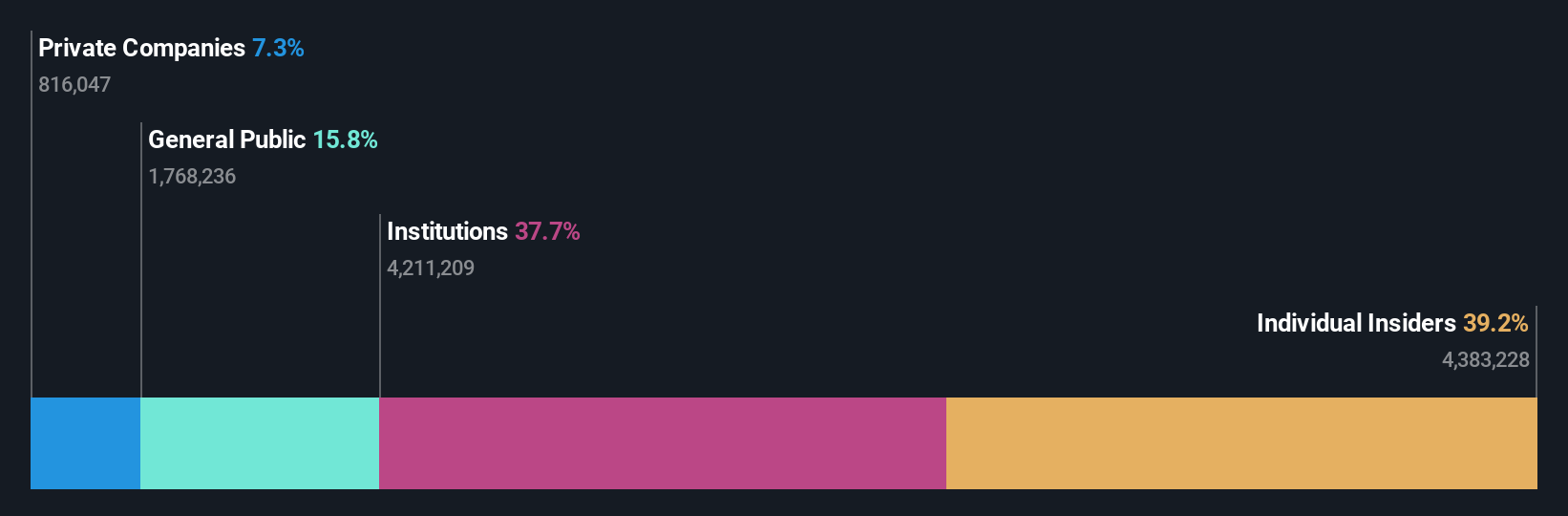

Insider Ownership: 38.1%

Revenue Growth Forecast: 17.9% p.a.

Plejd AB demonstrates strong growth potential with high insider ownership, as evidenced by recent earnings results showing significant profit increases. For Q3 2024, net income rose to SEK 20.32 million from SEK 4.38 million the previous year, with basic earnings per share increasing to SEK 1.82 from SEK 0.39. Forecasts suggest Plejd's earnings will grow significantly at 37.7% annually, outpacing the Swedish market's expected growth of 15.8%. Insider activity shows more buying than selling recently, supporting confidence in future performance.

- Take a closer look at Plejd's potential here in our earnings growth report.

- The analysis detailed in our Plejd valuation report hints at an inflated share price compared to its estimated value.

IKD (SHSE:600933)

Simply Wall St Growth Rating: ★★★★☆☆

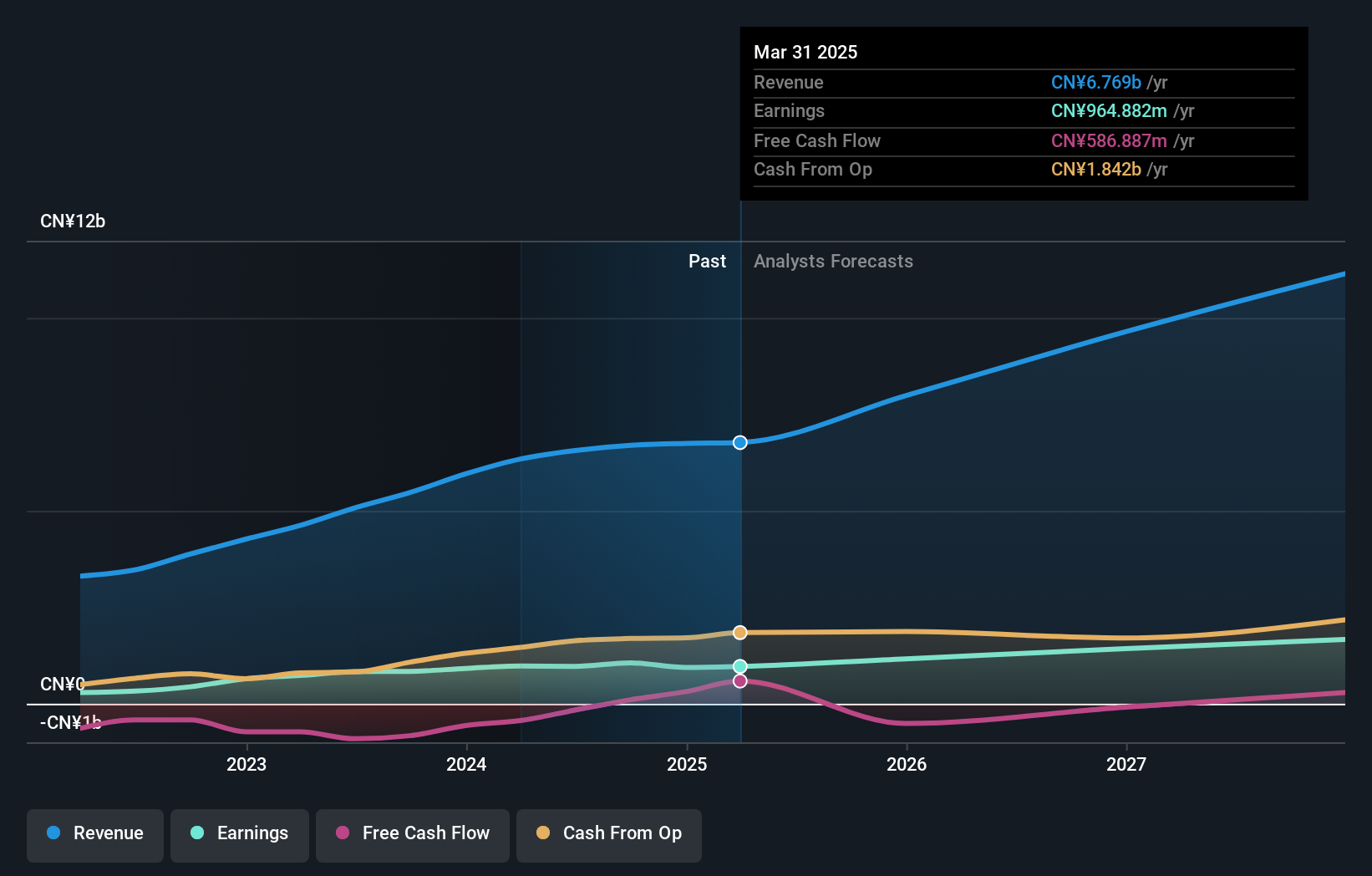

Overview: IKD Co., Ltd. is involved in the research, development, production, and sale of automotive aluminum alloy precision die castings across the United States, Europe, and Asia with a market cap of CN¥15.13 billion.

Operations: The company generates revenue from the research, development, manufacturing, and sales of automotive aluminum alloy precision die castings in the United States, Europe, and Asia.

Insider Ownership: 12.2%

Revenue Growth Forecast: 23% p.a.

IKD Co., Ltd. has shown robust growth, with sales reaching CNY 4.97 billion for the first nine months of 2024, up from CNY 4.23 billion a year earlier, and net income rising to CNY 741.79 million from CNY 597.61 million. Despite past shareholder dilution and a dividend not well-covered by free cash flows, earnings are expected to grow significantly at over 20% annually, outpacing the broader Chinese market's revenue growth forecast of 13.7%.

- Click here and access our complete growth analysis report to understand the dynamics of IKD.

- In light of our recent valuation report, it seems possible that IKD is trading behind its estimated value.

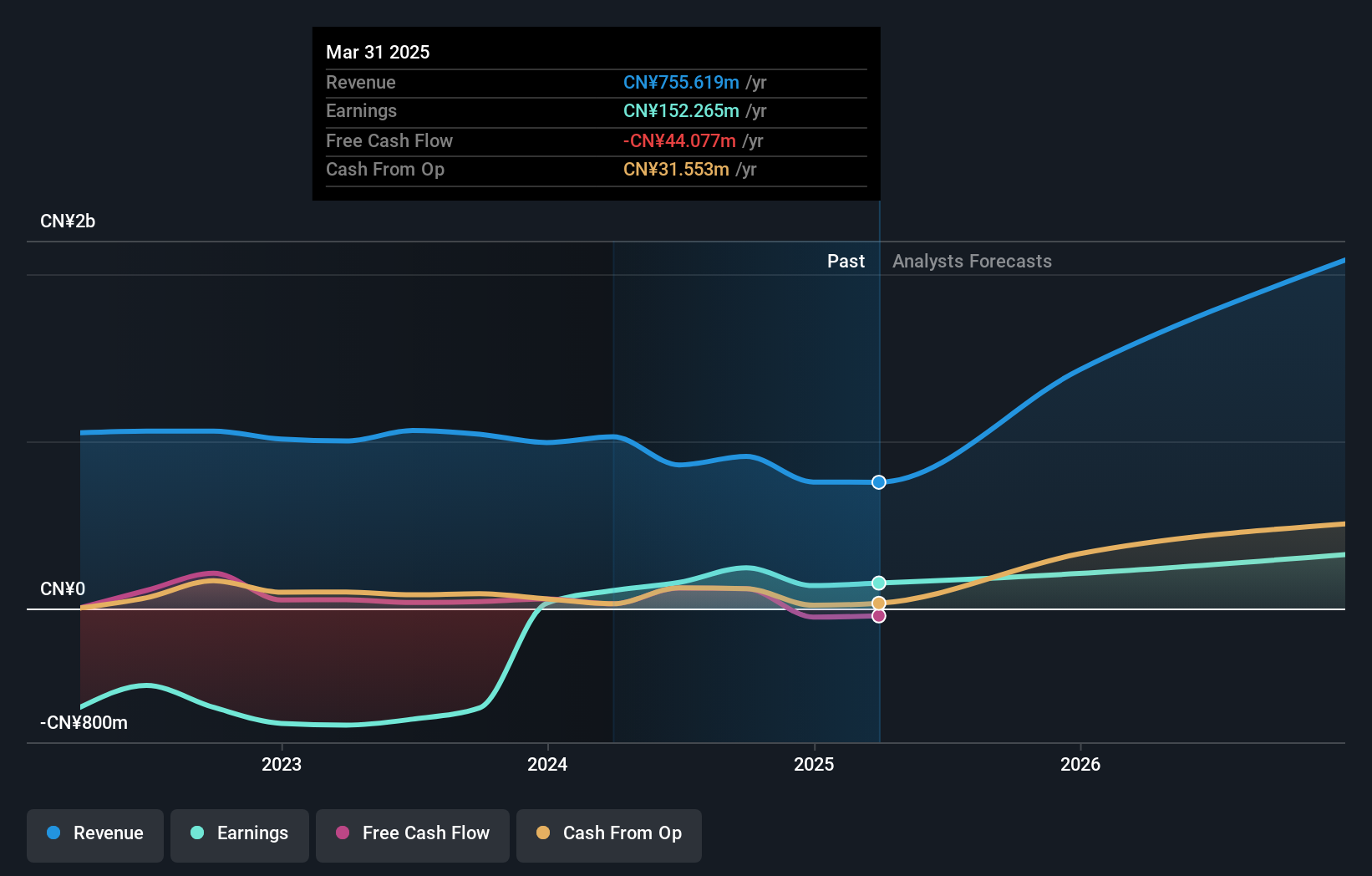

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doushen (Beijing) Education & Technology operates in the education and technology sector with a market capitalization of CN¥19.82 billion.

Operations: I'm sorry, but it seems that the revenue segments information is missing from the text provided. If you can provide the specific details or figures for each revenue segment, I can help summarize them into one sentence.

Insider Ownership: 25.4%

Revenue Growth Forecast: 38.4% p.a.

Doushen (Beijing) Education & Technology is projected to see revenue growth of 38.4% annually, surpassing the Chinese market's average. Despite past shareholder dilution and high volatility in share price, the company turned profitable this year with a net income of CNY 110.87 million for the first nine months of 2024, compared to a loss last year. However, its earnings growth forecast lags slightly behind the broader market at 23.8% per year.

- Delve into the full analysis future growth report here for a deeper understanding of Doushen (Beijing) Education & Technology.

- Our valuation report here indicates Doushen (Beijing) Education & Technology may be overvalued.

Taking Advantage

- Click here to access our complete index of 1522 Fast Growing Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NGM:PLEJD

Plejd

A technology company, develops products and services for smart lighting control in Sweden, Norway, Finland, the Netherlands, Germany, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives