- China

- /

- Auto Components

- /

- SHSE:600148

Subdued Growth No Barrier To Changchun Yidong Clutch CO.,LTD (SHSE:600148) With Shares Advancing 28%

Changchun Yidong Clutch CO.,LTD (SHSE:600148) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 15% over that time.

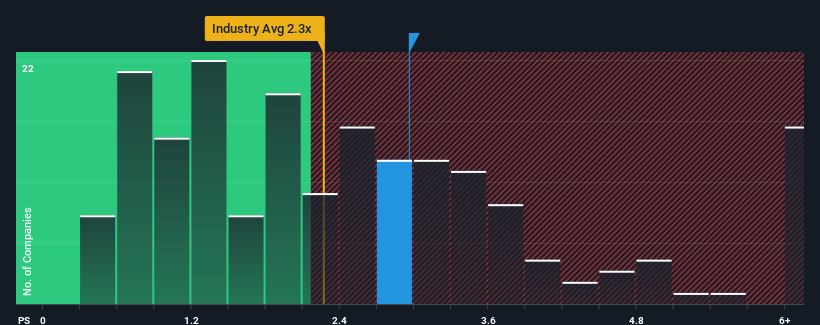

Since its price has surged higher, you could be forgiven for thinking Changchun Yidong ClutchLTD is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3x, considering almost half the companies in China's Auto Components industry have P/S ratios below 2.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Changchun Yidong ClutchLTD

How Changchun Yidong ClutchLTD Has Been Performing

It looks like revenue growth has deserted Changchun Yidong ClutchLTD recently, which is not something to boast about. It might be that many are expecting an improvement to the uninspiring revenue performance over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Changchun Yidong ClutchLTD, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Changchun Yidong ClutchLTD's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 48% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 25% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

In light of this, it's alarming that Changchun Yidong ClutchLTD's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Changchun Yidong ClutchLTD shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Changchun Yidong ClutchLTD currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Before you take the next step, you should know about the 1 warning sign for Changchun Yidong ClutchLTD that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600148

Changchun Yidong ClutchLTD

Engages in the development, production, and sales of automobile clutches in China and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)