SAIC Motor Corporation Limited's (SHSE:600104) Low P/E No Reason For Excitement

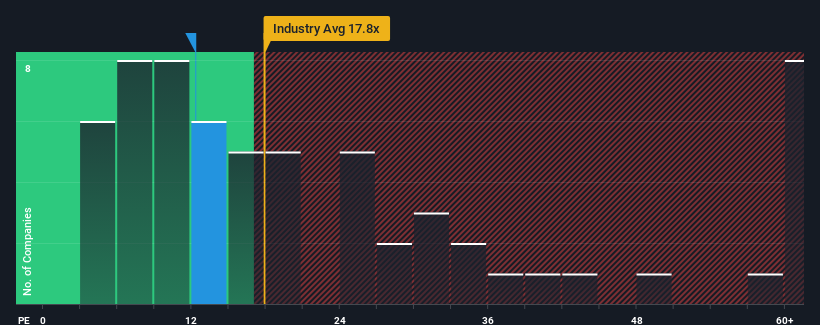

With a price-to-earnings (or "P/E") ratio of 12.3x SAIC Motor Corporation Limited (SHSE:600104) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 31x and even P/E's higher than 58x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

SAIC Motor hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for SAIC Motor

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like SAIC Motor's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 12%. As a result, earnings from three years ago have also fallen 29% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 4.8% each year during the coming three years according to the analysts following the company. That's shaping up to be materially lower than the 20% per year growth forecast for the broader market.

In light of this, it's understandable that SAIC Motor's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From SAIC Motor's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of SAIC Motor's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with SAIC Motor, and understanding should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600104

SAIC Motor

Researches and develops, produces, and sells vehicles and their parts in the People’s Republic of China and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives