- Chile

- /

- Electric Utilities

- /

- SNSE:ENELDXCH

Know This Before Buying Enel Distribucion Chile S.A. (SNSE:ENELDXCH) For Its Dividend

Dividend paying stocks like Enel Distribucion Chile S.A. (SNSE:ENELDXCH) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

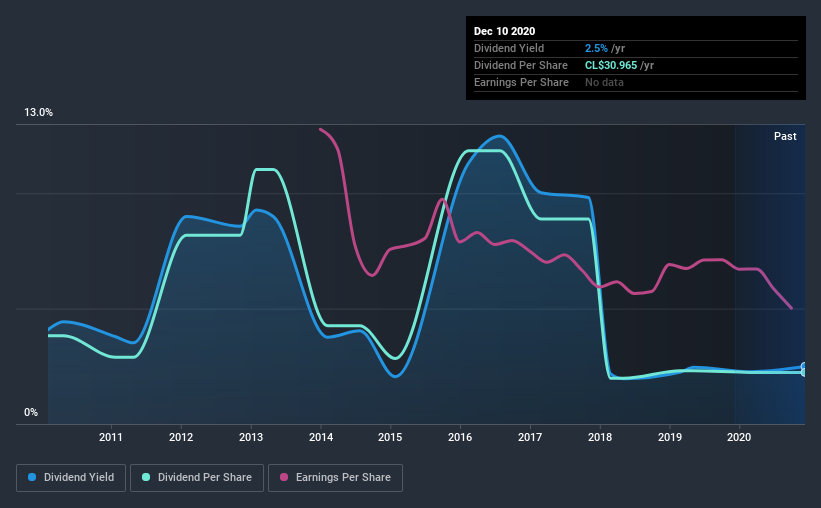

While Enel Distribucion Chile's 2.5% dividend yield is not the highest, we think its lengthy payment history is quite interesting. Some simple research can reduce the risk of buying Enel Distribucion Chile for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on Enel Distribucion Chile!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Enel Distribucion Chile paid out 26% of its profit as dividends. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. Plus, there is room to increase the payout ratio over time.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Last year, Enel Distribucion Chile paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

While the above analysis focuses on dividends relative to a company's earnings, we do note Enel Distribucion Chile's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Enel Distribucion Chile's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of Enel Distribucion Chile's dividend payments. This dividend has been unstable, which we define as having been cut one or more times over this time. During the past 10-year period, the first annual payment was CL$53.0 in 2010, compared to CL$31.0 last year. The dividend has shrunk at around 5.2% a year during that period. Enel Distribucion Chile's dividend hasn't shrunk linearly at 5.2% per annum, but the CAGR is a useful estimate of the historical rate of change.

We struggle to make a case for buying Enel Distribucion Chile for its dividend, given that payments have shrunk over the past 10 years.

Dividend Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS are growing. Over the past five years, it looks as though Enel Distribucion Chile's EPS have declined at around 7.9% a year. Declining earnings per share over a number of years is not a great sign for the dividend investor. Without some improvement, this does not bode well for the long term value of a company's dividend.

Conclusion

To summarise, shareholders should always check that Enel Distribucion Chile's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Enel Distribucion Chile has a low payout ratio, which we like, although it paid out virtually all of its generated cash. Earnings per share have been falling, and the company has cut its dividend at least once in the past. From a dividend perspective, this is a cause for concern. Overall, Enel Distribucion Chile falls short in several key areas here. Unless the investor has strong grounds for an alternative conclusion, we find it hard to get interested in a dividend stock with these characteristics.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come accross 3 warning signs for Enel Distribucion Chile you should be aware of, and 1 of them makes us a bit uncomfortable.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you decide to trade Enel Distribucion Chile, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Enel Distribucion Chile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SNSE:ENELDXCH

Slightly overvalued with very low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)