- Chile

- /

- Renewable Energy

- /

- SNSE:COLBUN

Could Colbún S.A.'s (SNSE:COLBUN) Weak Financials Mean That The Market Could Correct Its Share Price?

Colbún's (SNSE:COLBUN) stock up by 8.7% over the past three months. However, its weak financial performance indicators makes us a bit doubtful if that trend could continue. Specifically, we decided to study Colbún's ROE in this article.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Colbún

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Colbún is:

4.6% = US$172m ÷ US$3.7b (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. So, this means that for every CLP1 of its shareholder's investments, the company generates a profit of CLP0.05.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Colbún's Earnings Growth And 4.6% ROE

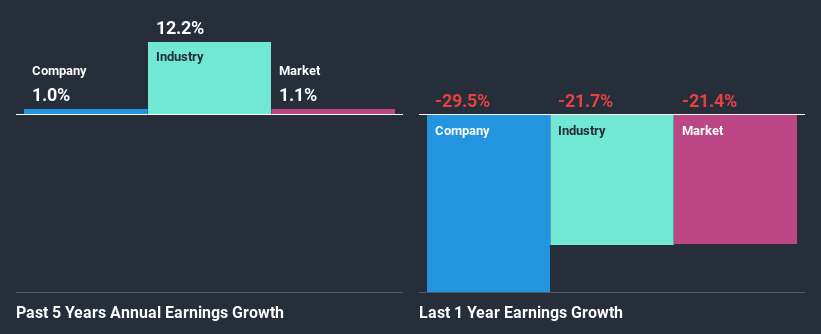

It is quite clear that Colbún's ROE is rather low. Even compared to the average industry ROE of 11%, the company's ROE is quite dismal. As a result, Colbún's flat earnings over the past five years doesn't come as a surprise given its lower ROE.

As a next step, we compared Colbún's net income growth with the industry and found that the company has a similar growth figure when compared with the industry average growth rate of 1.0% in the same period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Colbún is trading on a high P/E or a low P/E, relative to its industry.

Is Colbún Efficiently Re-investing Its Profits?

With a high three-year median payout ratio of 100% (implying that the company keeps only 0.04% of its income) of its business to reinvest into its business), most of Colbún's profits are being paid to shareholders, which explains the absence of growth in earnings.

Additionally, Colbún has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 59% over the next three years. The fact that the company's ROE is expected to rise to 5.8% over the same period is explained by the drop in the payout ratio.

Conclusion

On the whole, Colbún's performance is quite a big let-down. Although the company has shown a fair bit of growth in earnings, yet the low ROE and the low rate of reinvestment makes us skeptical about the continuity of that growth, especially when or if the business comes to face any threats. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you decide to trade Colbún, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:COLBUN

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)