- Chile

- /

- Wireless Telecom

- /

- SNSE:ENTEL

Empresa Nacional de Telecomunicaciones S.A.'s (SNSE:ENTEL) Subdued P/S Might Signal An Opportunity

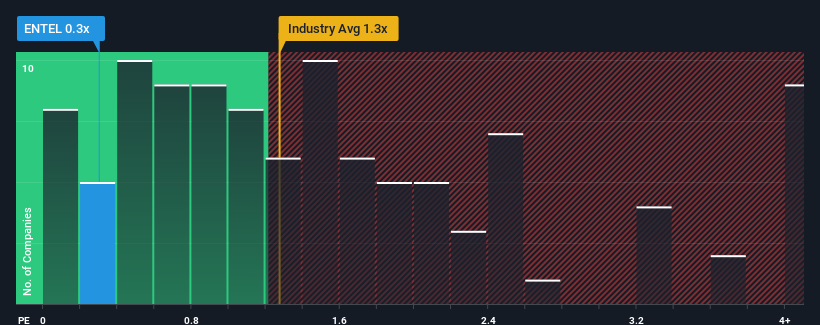

When you see that almost half of the companies in the Wireless Telecom industry in Chile have price-to-sales ratios (or "P/S") above 1.3x, Empresa Nacional de Telecomunicaciones S.A. (SNSE:ENTEL) looks to be giving off some buy signals with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Empresa Nacional de Telecomunicaciones

How Empresa Nacional de Telecomunicaciones Has Been Performing

Empresa Nacional de Telecomunicaciones could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Empresa Nacional de Telecomunicaciones.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Empresa Nacional de Telecomunicaciones' is when the company's growth is on track to lag the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Regardless, revenue has managed to lift by a handy 18% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 4.7% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 5.4% per annum, which is not materially different.

With this in consideration, we find it intriguing that Empresa Nacional de Telecomunicaciones' P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Empresa Nacional de Telecomunicaciones' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Empresa Nacional de Telecomunicaciones' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Empresa Nacional de Telecomunicaciones, and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Empresa Nacional de Telecomunicaciones might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SNSE:ENTEL

Empresa Nacional de Telecomunicaciones

Empresa Nacional de Telecomunicaciones S.A.

Good value with moderate growth potential.

Market Insights

Community Narratives