- Chile

- /

- Real Estate

- /

- SNSE:MALLPLAZA

Be Sure To Check Out Plaza S.A. (SNSE:MALLPLAZA) Before It Goes Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Plaza S.A. (SNSE:MALLPLAZA) is about to go ex-dividend in just four days. The ex-dividend date is two business days before a company's record date in most cases, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. In other words, investors can purchase Plaza's shares before the 25th of April in order to be eligible for the dividend, which will be paid on the 30th of April.

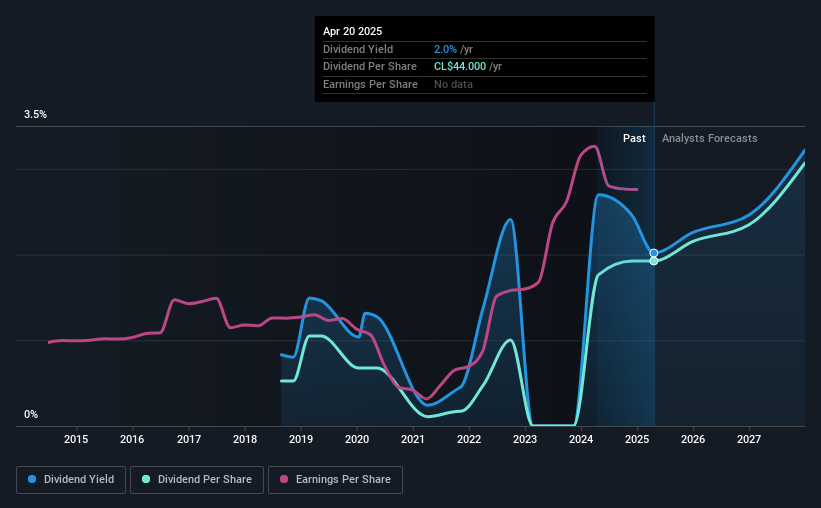

The company's next dividend payment will be CL$21.53 per share, and in the last 12 months, the company paid a total of CL$44.00 per share. Based on the last year's worth of payments, Plaza stock has a trailing yield of around 2.0% on the current share price of CL$2179.90. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

We've discovered 3 warning signs about Plaza. View them for free.Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately Plaza's payout ratio is modest, at just 40% of profit. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It distributed 42% of its free cash flow as dividends, a comfortable payout level for most companies.

It's positive to see that Plaza's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Check out our latest analysis for Plaza

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That's why it's comforting to see Plaza's earnings have been skyrocketing, up 25% per annum for the past five years. Plaza is paying out less than half its earnings and cash flow, while simultaneously growing earnings per share at a rapid clip. This is a very favourable combination that can often lead to the dividend multiplying over the long term, if earnings grow and the company pays out a higher percentage of its earnings.

Plaza also issued more than 5% of its market cap in new stock during the past year, which we feel is likely to hurt its dividend prospects in the long run. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Plaza has delivered 20% dividend growth per year on average over the past seven years. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

Final Takeaway

Should investors buy Plaza for the upcoming dividend? It's great that Plaza is growing earnings per share while simultaneously paying out a low percentage of both its earnings and cash flow. It's disappointing to see the dividend has been cut at least once in the past, but as things stand now, the low payout ratio suggests a conservative approach to dividends, which we like. It's a promising combination that should mark this company worthy of closer attention.

While it's tempting to invest in Plaza for the dividends alone, you should always be mindful of the risks involved. We've identified 3 warning signs with Plaza (at least 1 which makes us a bit uncomfortable), and understanding these should be part of your investment process.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:MALLPLAZA

Plaza

Develops, builds, administers, manages, exploits, leases, and sublets premises and spaces in shopping centers in Chile, Colombia, and Peru.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)