- Chile

- /

- Metals and Mining

- /

- SNSE:CAP

CAP S.A. Just Missed Earnings; Here's What Analysts Are Forecasting Now

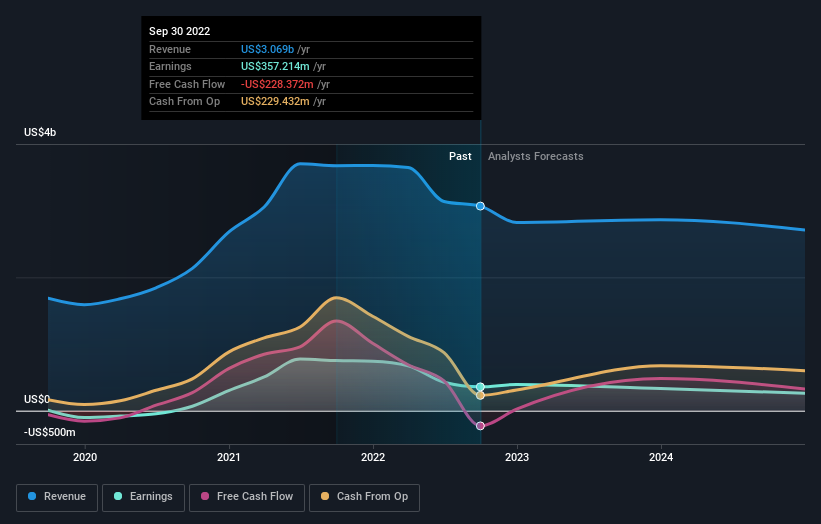

It's been a pretty great week for CAP S.A. (SNSE:CAP) shareholders, with its shares surging 11% to CL$5,600 in the week since its latest third-quarter results. It looks like a pretty bad result, given that revenues fell 15% short of analyst estimates at US$614m, and the company reported a statutory loss of US$0.048 per share instead of the profit that the analysts had been forecasting. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Our analysis indicates that CAP is potentially undervalued!

Following the recent earnings report, the consensus from five analysts covering CAP is for revenues of US$2.87b in 2023, implying a measurable 6.6% decline in sales compared to the last 12 months. Statutory earnings per share are expected to fall 11% to US$2.13 in the same period. Yet prior to the latest earnings, the analysts had been anticipated revenues of US$3.01b and earnings per share (EPS) of US$2.88 in 2023. From this we can that sentiment has definitely become more bearish after the latest results, leading to lower revenue forecasts and a large cut to earnings per share estimates.

It'll come as no surprise then, to learn that the analysts have cut their price target 18% to CL$9,500. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic CAP analyst has a price target of CL$10,391 per share, while the most pessimistic values it at CL$8,431. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely different views on what kind of performance this business can generate. As a result it might not be a great idea to make decisions based on the consensus price target, which is after all just an average of this wide range of estimates.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 5.3% by the end of 2023. This indicates a significant reduction from annual growth of 16% over the last five years. Yet aggregate analyst estimates for other companies in the industry suggest that industry revenues are forecast to decline 2.3% per year. So it's pretty clear that CAP's revenues are expected to shrink faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Unfortunately they also downgraded their revenue estimates, and our analysts estimates suggest that CAP is still expected to perform worse than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of CAP's future valuation.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for CAP going out to 2024, and you can see them free on our platform here.

It is also worth noting that we have found 4 warning signs for CAP (2 are significant!) that you need to take into consideration.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:CAP

CAP

Engages in iron ore mining, steel production, steel processing, and infrastructure businesses in Chile and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)