Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Carozzi S.A. (SNSE:CAROZZI) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Carozzi

What Is Carozzi's Debt?

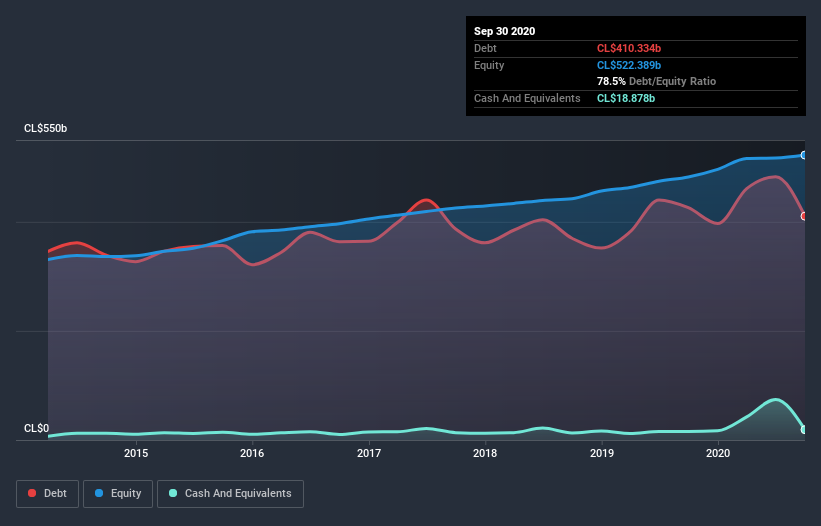

The chart below, which you can click on for greater detail, shows that Carozzi had CL$410.3b in debt in September 2020; about the same as the year before. However, because it has a cash reserve of CL$18.9b, its net debt is less, at about CL$391.5b.

A Look At Carozzi's Liabilities

According to the last reported balance sheet, Carozzi had liabilities of CL$241.6b due within 12 months, and liabilities of CL$412.5b due beyond 12 months. On the other hand, it had cash of CL$18.9b and CL$166.1b worth of receivables due within a year. So its liabilities total CL$469.2b more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's CL$347.6b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Carozzi's debt is 3.2 times its EBITDA, and its EBIT cover its interest expense 5.3 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. One way Carozzi could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 14%, as it did over the last year. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Carozzi will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, Carozzi recorded free cash flow worth 58% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Carozzi's struggle to handle its total liabilities had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. For example, its EBIT growth rate is relatively strong. Taking the abovementioned factors together we do think Carozzi's debt poses some risks to the business. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 3 warning signs we've spotted with Carozzi (including 1 which is a bit unpleasant) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Carozzi, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:CAROZZI

Solid track record with excellent balance sheet.

Market Insights

Community Narratives