- Switzerland

- /

- Marine and Shipping

- /

- SWX:KNIN

Will New Board Appointments at Kuehne + Nagel (SWX:KNIN) Reshape Its Leadership Continuity and Strategy?

Reviewed by Simply Wall St

- Kuehne + Nagel International AG announced that Eduardo Razuck and Søren Schmidt will join its Management Board, taking over leadership of the Contract Logistics and Road Logistics business units, respectively, as part of upcoming board changes spanning from October 2025 through May 2026.

- The appointment of Søren Schmidt, who brings decades of global road logistics leadership, and the internal promotion of Eduardo Razuck signal an emphasis on both industry expertise and leadership continuity at a critical time for the company.

- We'll examine how the addition of deep industry expertise to Kuehne + Nagel’s board could influence its long-term investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Kuehne + Nagel International Investment Narrative Recap

For shareholders, the primary investment case in Kuehne + Nagel hinges on continued resilience in global logistics volume growth, underpinned by efficiency gains and market share wins in high-growth sectors. The recent appointments to the Management Board, Eduardo Razuck for Contract Logistics and Søren Schmidt for Road Logistics, signal an emphasis on experienced operational leadership, but do not materially alter the most pressing near-term catalyst: margin recovery amid operational cost pressures and ongoing rate volatility. The biggest risk remains persistent margin compression due to higher OpEx and integration costs, particularly if volume gains do not offset pressure from weaker conversion rates and sluggish demand in key segments.

Among recent company announcements, the upcoming leadership change for the Road Logistics business, with the onboarding of Søren Schmidt, a recognized expert in global road logistics, aligns closely with efforts to broaden service offerings, a relevant strategic pillar amid industry overcapacity. This move could support Kuehne + Nagel’s efforts to stabilize earnings by reducing sensitivity to volatile international freight markets, a factor that investors are tracking as the integration of key acquisitions and cost management initiatives play out.

Yet, what investors may overlook is the contrasting risk that even strong leadership cannot fully offset the drag from persistently declining conversion rates and...

Read the full narrative on Kuehne + Nagel International (it's free!)

Kuehne + Nagel International's outlook projects CHF27.4 billion in revenue and CHF1.4 billion in earnings by 2028. This is based on analysts' assumptions of 2.1% annual revenue growth and an increase in earnings of CHF200 million from the current CHF1.2 billion.

Uncover how Kuehne + Nagel International's forecasts yield a CHF180.88 fair value, a 9% upside to its current price.

Exploring Other Perspectives

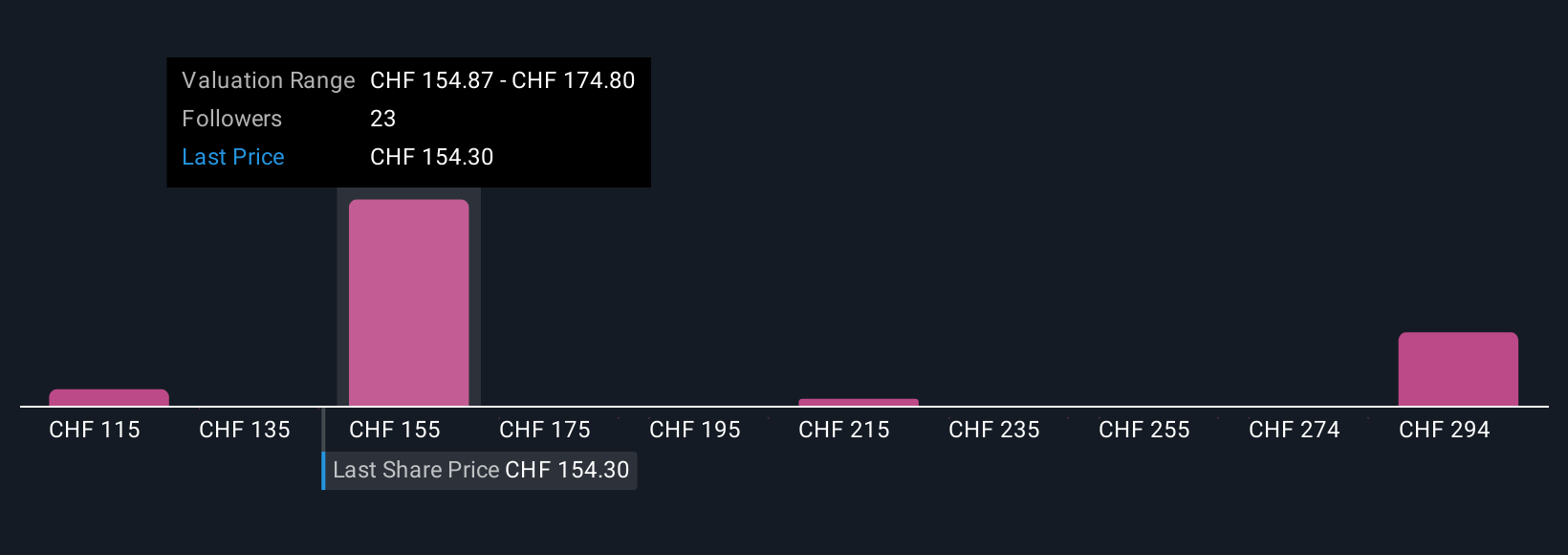

Community fair value estimates for Kuehne + Nagel vary widely, from CHF115 to CHF309.82, based on 7 different Simply Wall St Community analyses. With opinions split and margin pressures ongoing, you may want to explore how broader market uncertainty is shaping individual expectations.

Explore 7 other fair value estimates on Kuehne + Nagel International - why the stock might be worth 30% less than the current price!

Build Your Own Kuehne + Nagel International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kuehne + Nagel International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kuehne + Nagel International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kuehne + Nagel International's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuehne + Nagel International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:KNIN

Kuehne + Nagel International

Provides integrated logistics services in Europe, the Middle East, Africa, the Americas, the Asia-Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives