While Flughafen Zürich AG (VTX:FHZN) might not be the most widely known stock at the moment, it saw a double-digit share price rise of over 10% in the past couple of months on the SWX. As a mid-cap stock with high coverage by analysts, you could assume any recent changes in the company’s outlook is already priced into the stock. But what if there is still an opportunity to buy? Let’s take a look at Flughafen Zürich’s outlook and value based on the most recent financial data to see if the opportunity still exists.

View our latest analysis for Flughafen Zürich

Is Flughafen Zürich Still Cheap?

The stock seems fairly valued at the moment according to my valuation model. It’s trading around 3.1% below my intrinsic value, which means if you buy Flughafen Zürich today, you’d be paying a fair price for it. And if you believe that the stock is really worth CHF172.93, then there isn’t much room for the share price grow beyond what it’s currently trading. Is there another opportunity to buy low in the future? Since Flughafen Zürich’s share price is quite volatile, we could potentially see it sink lower (or rise higher) in the future, giving us another chance to buy. This is based on its high beta, which is a good indicator for how much the stock moves relative to the rest of the market.

Can we expect growth from Flughafen Zürich?

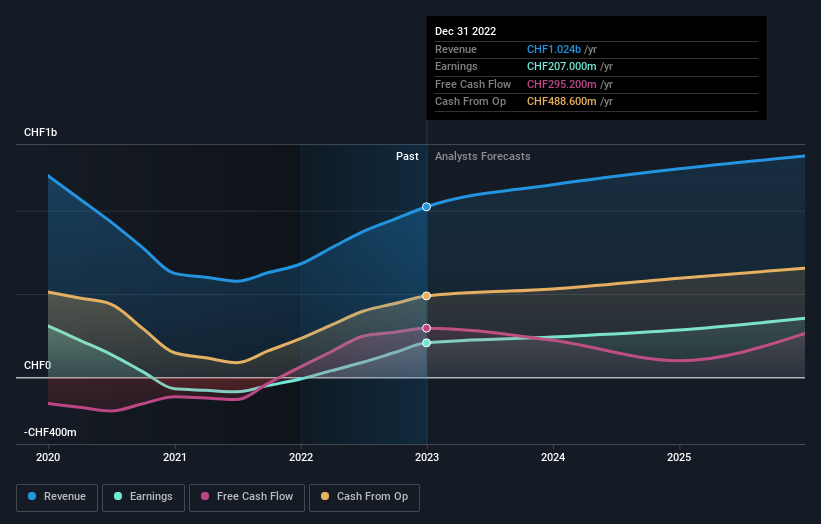

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. With profit expected to grow by 71% over the next couple of years, the future seems bright for Flughafen Zürich. It looks like higher cash flow is on the cards for the stock, which should feed into a higher share valuation.

What This Means For You

Are you a shareholder? It seems like the market has already priced in FHZN’s positive outlook, with shares trading around its fair value. However, there are also other important factors which we haven’t considered today, such as the track record of its management team. Have these factors changed since the last time you looked at the stock? Will you have enough conviction to buy should the price fluctuates below the true value?

Are you a potential investor? If you’ve been keeping tabs on FHZN, now may not be the most advantageous time to buy, given it is trading around its fair value. However, the optimistic prospect is encouraging for the company, which means it’s worth diving deeper into other factors such as the strength of its balance sheet, in order to take advantage of the next price drop.

Since timing is quite important when it comes to individual stock picking, it's worth taking a look at what those latest analysts forecasts are. At Simply Wall St, we have the analysts estimates which you can view by clicking here.

If you are no longer interested in Flughafen Zürich, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:FHZN

Excellent balance sheet with proven track record.