- Switzerland

- /

- Insurance

- /

- SWX:SREN

Top Dividend Stocks On SIX Swiss Exchange For September 2024

Reviewed by Simply Wall St

The Switzerland market ended on a firm note on Thursday after staying positive right through the day's trading session, reacting to ECB's rate decision and U.S. economic data, and on hopes more central banks will lower their interest rates in the coming months. The benchmark SMI closed with a gain of 59.43 points or 0.5% at 11,982.34. In this environment of cautious optimism, dividend stocks can offer investors stability and income potential amid fluctuating economic conditions. Here are three top dividend stocks listed on the SIX Swiss Exchange that stand out for September 2024.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.22% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.79% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.67% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.86% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.82% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.58% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.56% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 4.05% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.68% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.40% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

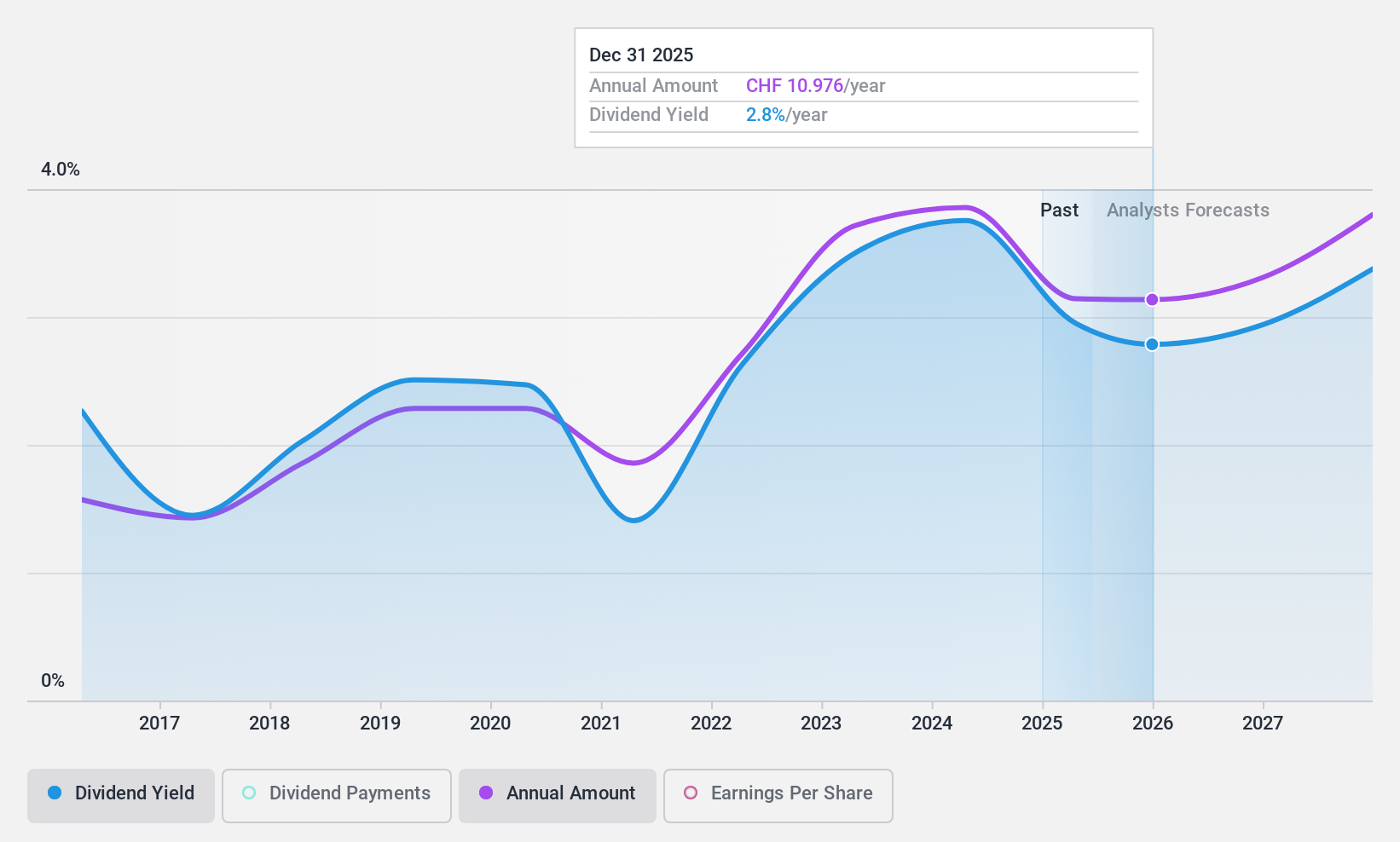

Bucher Industries (SWX:BUCN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bucher Industries AG manufactures and sells machinery, systems, and hydraulic components for various sectors including agriculture, food production, and public space maintenance with a market cap of CHF3.58 billion.

Operations: Bucher Industries AG's revenue segments include Kuhn Group (CHF1.27 billion), Bucher Specials (CHF373.90 million), Bucher Municipal (CHF593.40 million), Bucher Hydraulics (CHF699.20 million), and Bucher Emhart Glass (CHF502.10 million).

Dividend Yield: 3.9%

Bucher Industries' dividends have been stable and reliable over the past decade, with a low payout ratio of 46.4%, indicating earnings cover the dividend payments well. However, its high cash payout ratio of 102.5% suggests dividends are not well covered by free cash flows. The dividend yield of 3.86% is below the top tier in Switzerland, and recent earnings showed a decline in sales and net income for H1 2024 compared to the previous year.

- Click to explore a detailed breakdown of our findings in Bucher Industries' dividend report.

- In light of our recent valuation report, it seems possible that Bucher Industries is trading behind its estimated value.

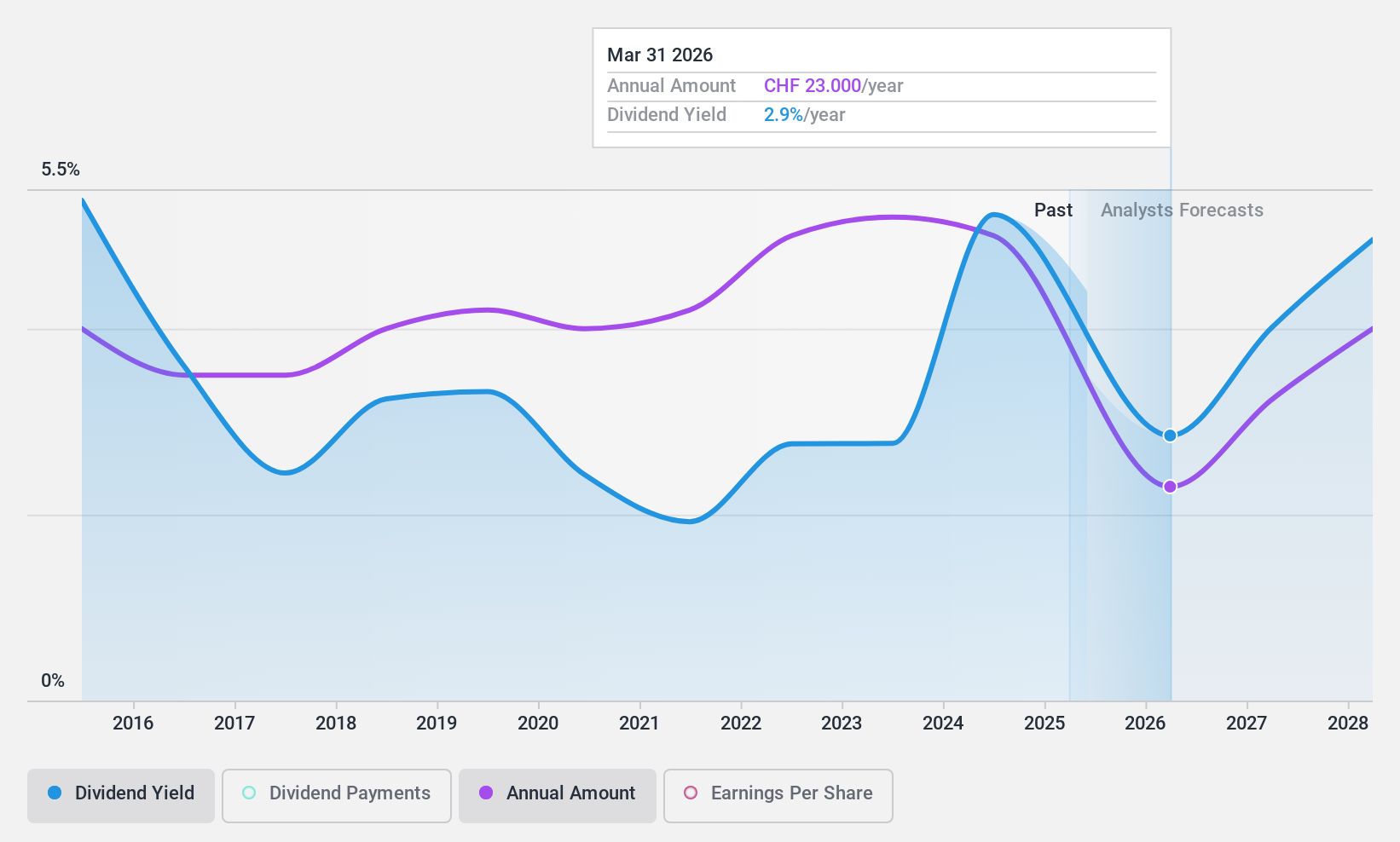

LEM Holding (SWX:LEHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LEM Holding SA, with a market cap of CHF1.45 billion, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Operations: LEM Holding SA generates revenue by providing solutions for measuring electrical parameters across regions such as China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Dividend Yield: 3.9%

LEM Holding's dividends have been reliable and stable over the past decade, yet the current payout ratio of 87.2% indicates earnings cover the payments, but a high cash payout ratio of 125.8% suggests they are not well covered by free cash flows. Trading at 30.6% below estimated fair value, LEM has a dividend yield of 3.92%, which is lower than top-tier Swiss dividend payers. Recent earnings showed significant declines in sales (CHF 80.96 million) and net income (CHF 4.78 million).

- Unlock comprehensive insights into our analysis of LEM Holding stock in this dividend report.

- Upon reviewing our latest valuation report, LEM Holding's share price might be too pessimistic.

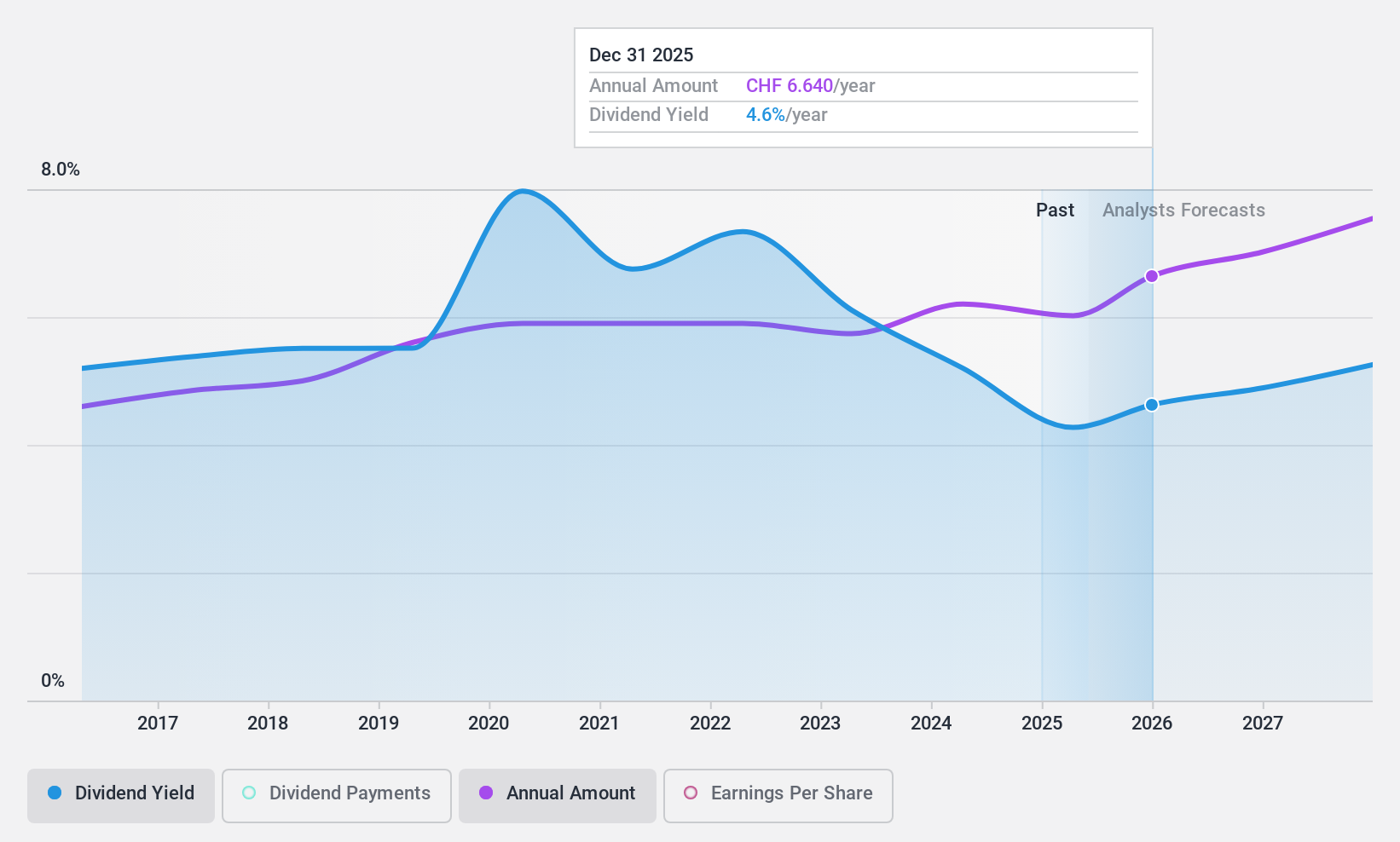

Swiss Re (SWX:SREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swiss Re AG, with a market cap of CHF33.45 billion, offers wholesale reinsurance, insurance, risk transfer solutions, and related services globally through its subsidiaries.

Operations: Swiss Re AG's revenue segments include Property & Casualty Reinsurance ($25.39 billion), Life & Health Reinsurance ($18.71 billion), Corporate Solutions ($6.10 billion), and Group Items ($2.09 billion).

Dividend Yield: 5%

Swiss Re's dividend payments are covered by both earnings (payout ratio: 55.8%) and cash flows (cash payout ratio: 50%). Despite a significant increase in net income to US$2.09 billion for H1 2024, its dividend history has been volatile over the past decade. Trading at approximately 69.4% below estimated fair value, Swiss Re offers a competitive dividend yield of 5.02%, placing it in the top quartile of Swiss dividend payers.

- Click here and access our complete dividend analysis report to understand the dynamics of Swiss Re.

- Our expertly prepared valuation report Swiss Re implies its share price may be lower than expected.

Seize The Opportunity

- Dive into all 25 of the Top SIX Swiss Exchange Dividend Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SREN

Swiss Re

Provides wholesale reinsurance, insurance, other insurance-based forms of risk transfer, and other insurance-related services worldwide.

Excellent balance sheet, good value and pays a dividend.