- Switzerland

- /

- Banks

- /

- SWX:LLBN

3 Dividend Stocks To Consider With Up To 3.7% Yield

Reviewed by Simply Wall St

As global markets navigate a tumultuous start to the year, with U.S. equities experiencing declines amid inflation concerns and political uncertainty, investors are increasingly seeking stability through dividend stocks. In such a volatile environment, selecting stocks that offer consistent dividend yields can provide a cushion against market fluctuations while potentially enhancing portfolio income.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.27% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.51% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.77% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.10% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.61% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.17% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.14% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1996 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

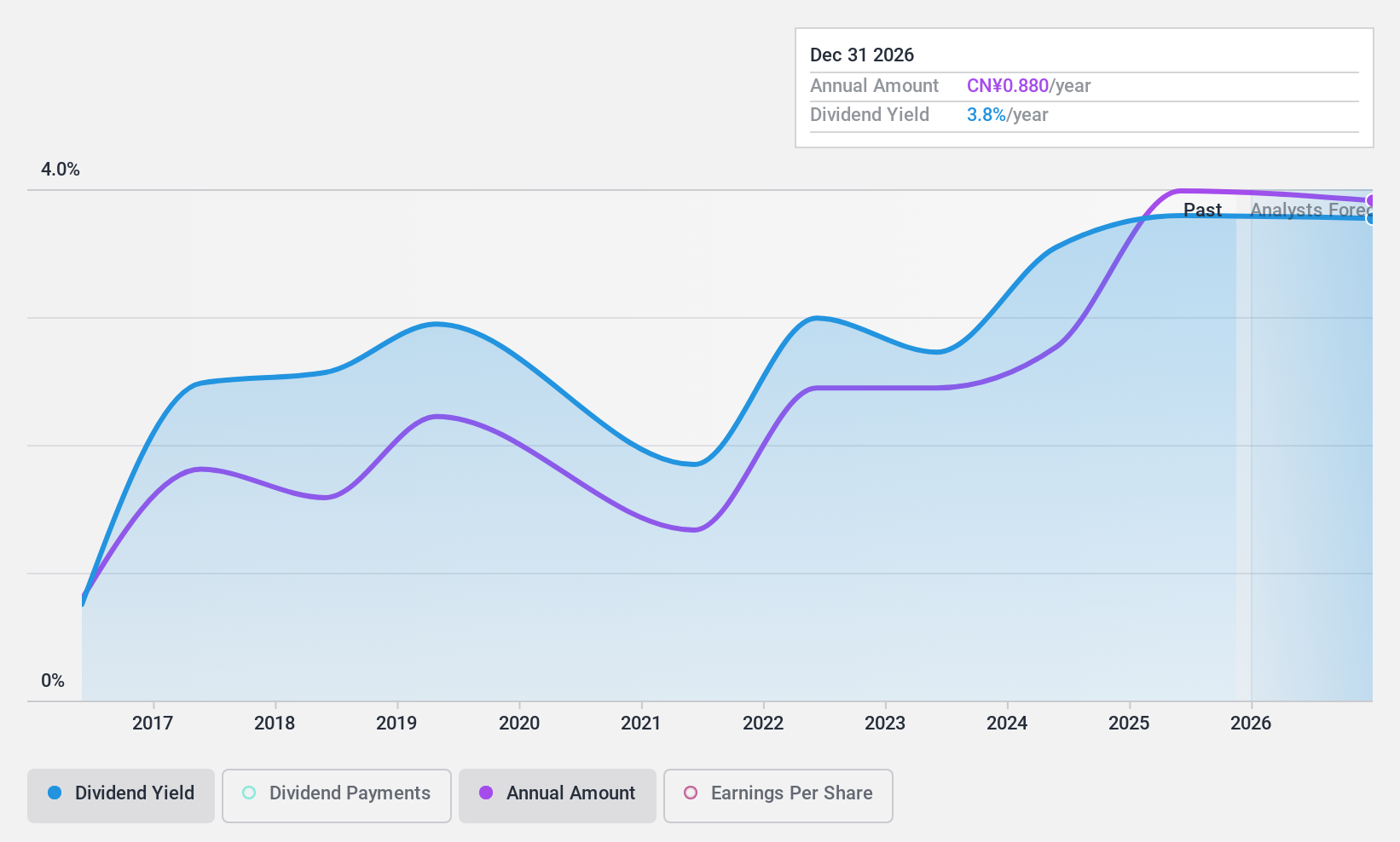

Noblelift Intelligent EquipmentLtd (SHSE:603611)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Noblelift Intelligent Equipment Co., Ltd. operates in the intelligent manufacturing equipment and smart logistics system sectors both in China and internationally, with a market cap of CN¥4.50 billion.

Operations: Noblelift Intelligent Equipment Co., Ltd. generates revenue through its operations in intelligent manufacturing equipment and smart logistics systems, serving both domestic and international markets.

Dividend Yield: 3.6%

Noblelift Intelligent Equipment Ltd. offers a dividend yield of 3.56%, ranking in the top 25% of CN market payers, but its sustainability is questionable as dividends are not covered by free cash flows and have been volatile over the past decade. Despite this, the payout ratio remains low at 34.6%, indicating coverage by earnings. The stock trades at a favorable price-to-earnings ratio of 9.8x compared to the market average of 31.8x, suggesting good relative value.

- Get an in-depth perspective on Noblelift Intelligent EquipmentLtd's performance by reading our dividend report here.

- Our valuation report here indicates Noblelift Intelligent EquipmentLtd may be undervalued.

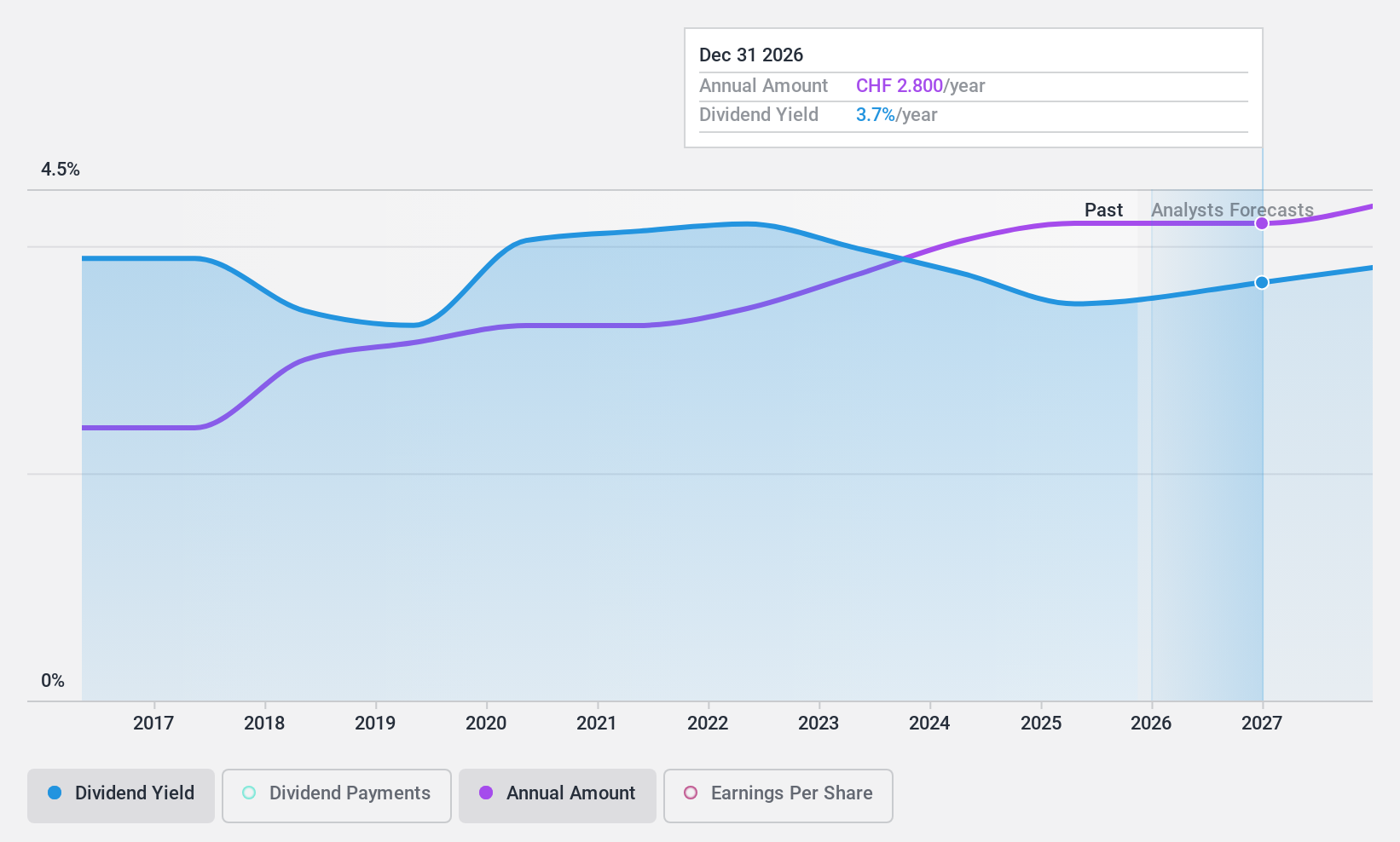

Liechtensteinische Landesbank (SWX:LLBN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liechtensteinische Landesbank Aktiengesellschaft offers banking products and services across Liechtenstein, Switzerland, Germany, Austria, and internationally with a market cap of CHF2.19 billion.

Operations: Liechtensteinische Landesbank's revenue segments include Retail & Corporate Banking with CHF313.30 million and International Wealth Management with CHF241.83 million.

Dividend Yield: 3.7%

Liechtensteinische Landesbank's dividend yield of 3.71% is below the top quartile for Swiss dividend payers. Despite a low payout ratio of 49.7%, indicating dividends are covered by earnings, its track record is marked by volatility and unreliability over the past decade. Earnings growth has been robust at 11.3% annually over five years, supporting future payouts. The stock trades at a discount to its estimated fair value, enhancing its appeal as a potential investment opportunity.

- Dive into the specifics of Liechtensteinische Landesbank here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Liechtensteinische Landesbank shares in the market.

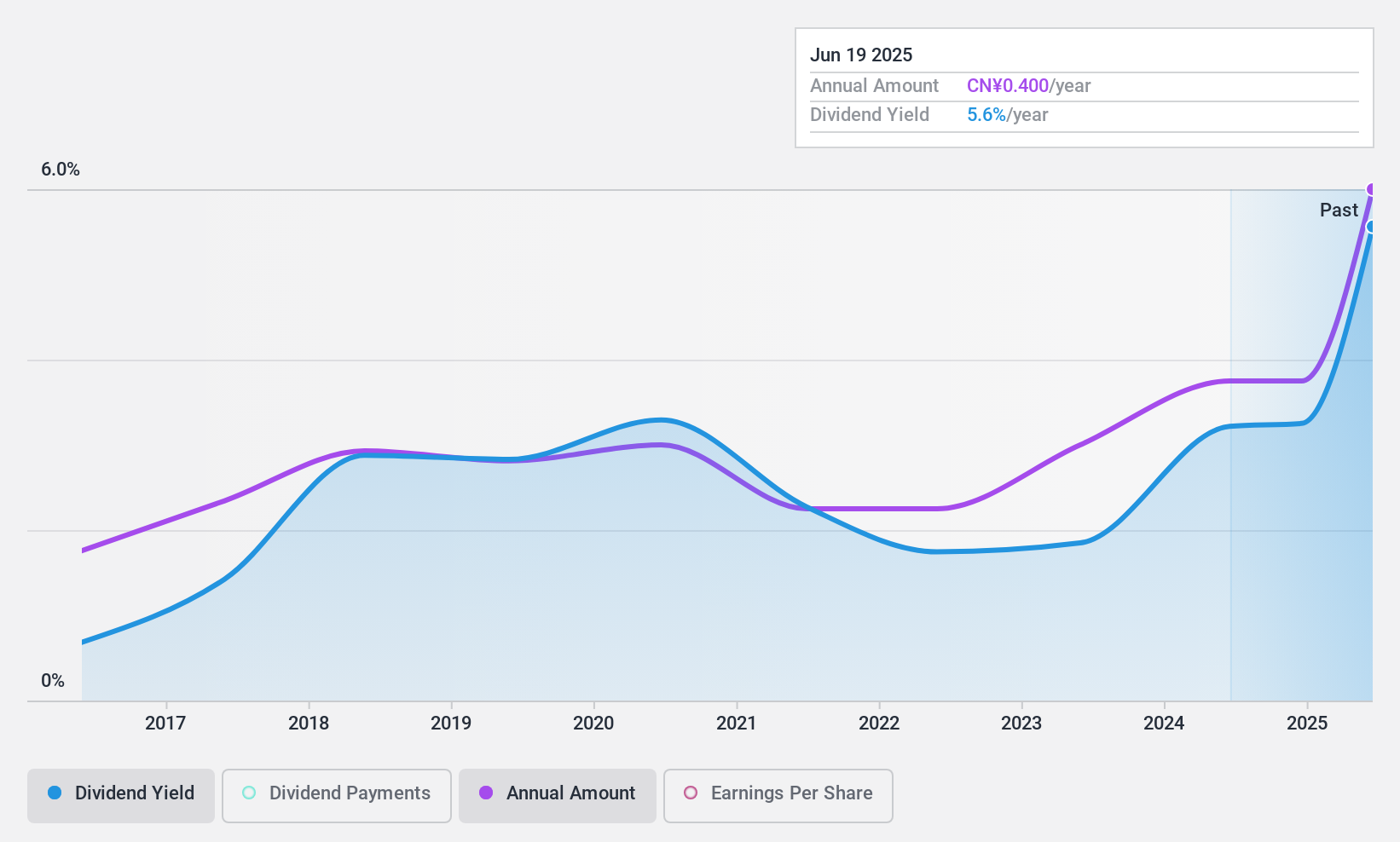

Xiamen R&T Plumbing TechnologyLtd (SZSE:002790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen R&T Plumbing Technology Co., Ltd. is involved in the research, development, production, and sale of bathroom products and accessories globally, with a market cap of CN¥3.01 billion.

Operations: Xiamen R&T Plumbing Technology Co., Ltd.'s revenue primarily derives from its global operations in the research, development, production, and sale of bathroom products and accessories.

Dividend Yield: 3.5%

Xiamen R&T Plumbing Technology's dividend yield of 3.47% ranks in the top 25% among Chinese dividend payers, yet its nine-year history is marked by volatility. With a payout ratio of 70.7%, dividends are covered by earnings, and cash flows also support payouts at a 78.9% cash payout ratio. Despite recent earnings decline, with net income dropping to CNY 126.34 million from CNY 175.85 million, the stock remains attractively priced with a P/E below market average.

- Click here and access our complete dividend analysis report to understand the dynamics of Xiamen R&T Plumbing TechnologyLtd.

- In light of our recent valuation report, it seems possible that Xiamen R&T Plumbing TechnologyLtd is trading behind its estimated value.

Summing It All Up

- Delve into our full catalog of 1996 Top Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LLBN

Liechtensteinische Landesbank

Provides banking products and services in Liechtenstein, Switzerland, Germany, and Austria.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives