The Switzerland market recently experienced a modest gain, with the benchmark SMI rising slightly as investors anticipate further interest rate cuts from central banks following the European Central Bank's third rate cut this year. In such an environment, identifying high-growth tech stocks in Switzerland involves looking for companies that demonstrate resilience and adaptability amid fluctuating economic conditions and potential monetary policy shifts.

Top 10 High Growth Tech Companies In Switzerland

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| LEM Holding | 8.81% | 20.48% | ★★★★★☆ |

| Santhera Pharmaceuticals Holding | 26.80% | 35.40% | ★★★★★★ |

| ALSO Holding | 12.58% | 26.76% | ★★★★☆☆ |

| Comet Holding | 19.94% | 48.36% | ★★★★★☆ |

| Temenos | 7.58% | 14.39% | ★★★★☆☆ |

| SoftwareONE Holding | 8.55% | 52.33% | ★★★★★☆ |

| Addex Therapeutics | 26.51% | 33.31% | ★★★★★☆ |

| Basilea Pharmaceutica | 9.24% | 33.25% | ★★★★★☆ |

| Sensirion Holding | 13.86% | 102.68% | ★★★★☆☆ |

| MCH Group | 4.41% | 100.62% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Basilea Pharmaceutica (SWX:BSLN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basilea Pharmaceutica AG is a commercial-stage biopharmaceutical company that develops products for oncology and anti-infectives, with a market cap of CHF552.72 million.

Operations: The company generates revenue primarily from the discovery, development, and commercialization of innovative pharmaceutical products, amounting to CHF149.02 million. Its focus is on addressing medical needs in oncology and anti-infectives.

Amidst a challenging backdrop, Basilea Pharmaceutica has demonstrated resilience and strategic agility. Recently, the company raised its 2024 revenue forecast to CHF 203 million and net profit expectations to CHF 60 million, reflecting a robust upward adjustment from earlier projections. This revision followed significant regulatory advancements, including the European Commission’s extension of market exclusivity for its antifungal Cresemba®, now also approved for pediatric use. These developments not only underscore Basilea's capacity to navigate regulatory landscapes but also enhance its competitive edge in the biotech sector. Furthermore, with R&D expenses aligned closely with industry innovation demands, Basilea invests wisely in future growth areas, maintaining a balance that supports sustained development while managing fiscal prudence effectively.

- Click here to discover the nuances of Basilea Pharmaceutica with our detailed analytical health report.

Understand Basilea Pharmaceutica's track record by examining our Past report.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America with a market capitalization of CHF1.43 billion.

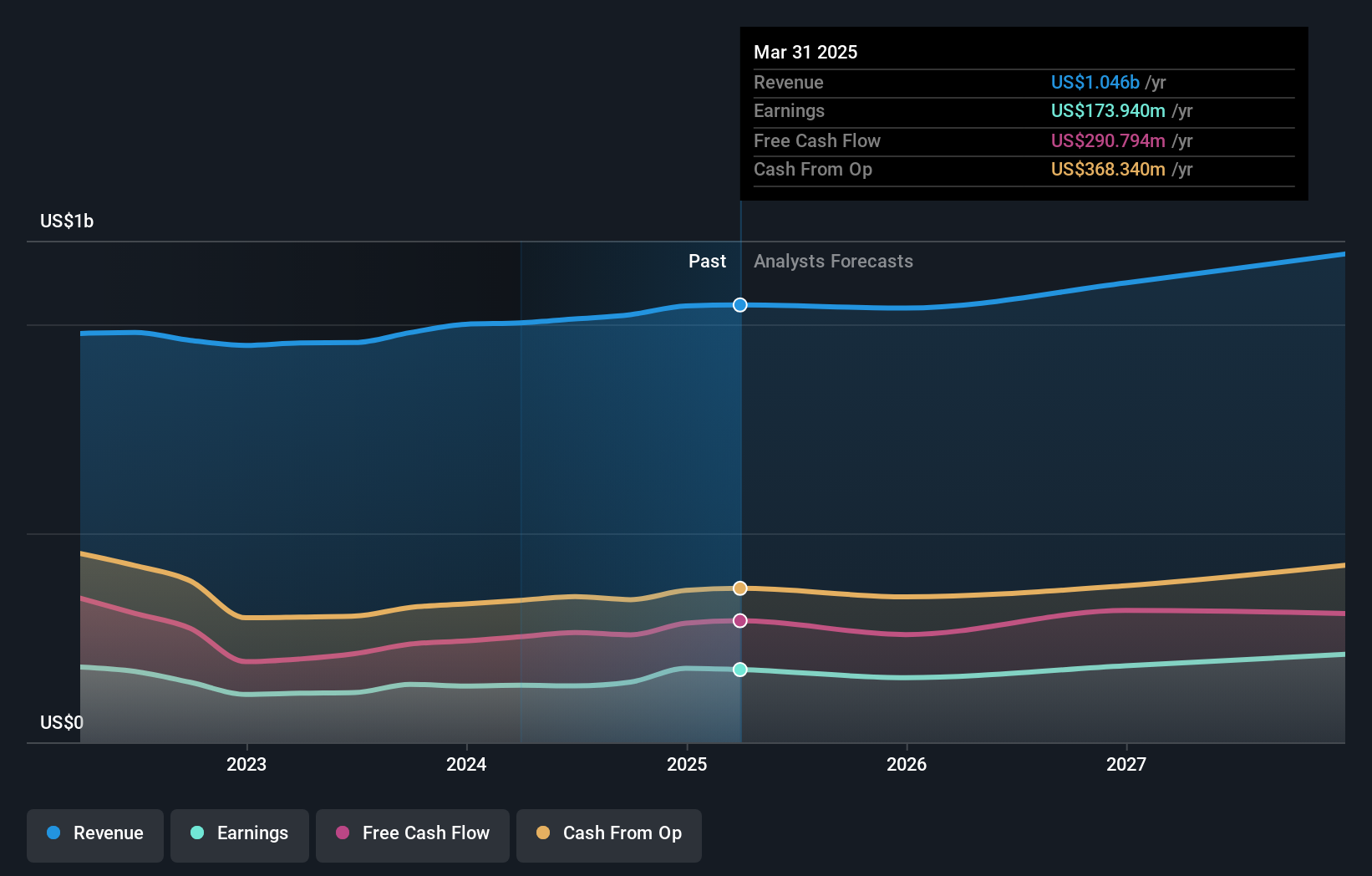

Operations: LEM Holding focuses on providing electrical measurement solutions across multiple global markets, including Asia, Europe, and the Americas. The company generates revenue primarily from its diverse range of products designed for industrial and automotive applications.

Amid a tech landscape where innovation fuels growth, LEM Holding stands out with its strategic R&D investments, which have notably increased to enhance competitive edge and product development. With an R&D expense ratio that has escalated to 8.8% of revenue, the company is poised above many Swiss peers, underscoring a commitment to advancing technological capabilities. Additionally, LEM's projected annual revenue growth rate of 20.5% reflects an optimistic outlook in electronics amidst challenging market conditions. However, recent financials reveal a dip in quarterly earnings year-over-year, necessitating careful monitoring of operational efficiency moving forward.

Temenos (SWX:TEMN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temenos AG specializes in developing, marketing, and selling integrated banking software systems to financial institutions globally, with a market cap of CHF4.66 billion.

Operations: Temenos AG generates revenue primarily through its Product segment, which accounted for approximately $880 million, while its Services segment contributed around $133 million. The company focuses on providing software solutions tailored to the needs of banking and financial institutions worldwide.

Temenos is capitalizing on the shift towards cloud-based solutions and AI-driven platforms, evident from its recent executive appointments aimed at enhancing product innovation and market reach. The company's R&D spending has been robust, aligning with its strategic focus, as reflected in a 7.6% annual revenue growth forecast—outpacing the Swiss market average of 4.2%. Furthermore, Temenos has demonstrated financial agility through a significant share repurchase program, buying back shares worth CHF 200 million. This move underscores confidence in its operational strategy and future growth prospects amidst evolving financial technology landscapes.

- Get an in-depth perspective on Temenos' performance by reading our health report here.

Assess Temenos' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Investigate our full lineup of 12 SIX Swiss Exchange High Growth Tech and AI Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LEHN

LEM Holding

Provides solutions for measuring electrical parameters in China, Japan, South Korea, India, Southeast Asia, Europe, Middle East, Africa, NAFTA and Latin America.

Undervalued with high growth potential and pays a dividend.