- Switzerland

- /

- Medical Equipment

- /

- SWX:STMN

Swiss Growth Leaders With High Insider Stakes On SIX Swiss Exchange July 2024

Reviewed by Simply Wall St

The Swiss stock market recently displayed resilience, closing modestly higher as investors regained confidence, pushing the benchmark SMI to gain 0.38%. Amid these conditions, companies with substantial insider ownership often signal strong confidence in their future prospects, making them particularly interesting in such a recovering market environment.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.1% |

| Straumann Holding (SWX:STMN) | 32.7% | 20.8% |

| VAT Group (SWX:VACN) | 10.2% | 21% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.0% |

| Sonova Holding (SWX:SOON) | 17.7% | 9.9% |

| Partners Group Holding (SWX:PGHN) | 17.1% | 13.7% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 79.9% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Let's uncover some gems from our specialized screener.

INFICON Holding (SWX:IFCN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: INFICON Holding AG, based in Switzerland, specializes in developing instruments for gas analysis, measurement, and control across global markets, with a market capitalization of CHF 3.38 billion.

Operations: The company generates $673.71 million in revenue from its instrumentation for gas analysis, measurement, and control segment.

Insider Ownership: 10.3%

INFICON Holding, a Swiss company with high insider ownership, demonstrates promising growth in a niche market. With revenue and earnings forecast to outpace the Swiss market at 7.2% and 10.1% respectively, INFicon maintains robust projections despite not reaching the high growth threshold of 20%. The recent launch of their ELT Vmax leak detector for battery cells aligns with industry needs, suggesting potential for sustained demand and integration into mass production lines. This product development could enhance INFICON's competitive edge in precision instruments.

- Click here to discover the nuances of INFICON Holding with our detailed analytical future growth report.

- The analysis detailed in our INFICON Holding valuation report hints at an inflated share price compared to its estimated value.

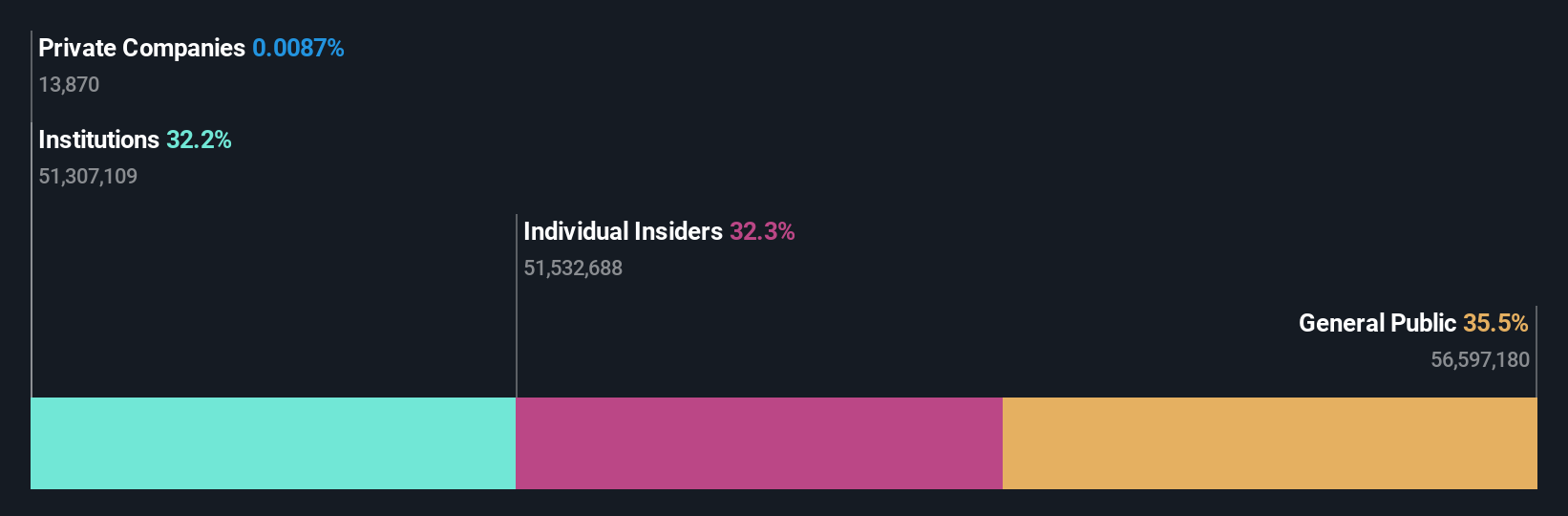

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Partners Group Holding AG is a global private equity firm that manages investments across multiple sectors including equity, real estate, infrastructure, and debt, with a market capitalization of CHF 31.35 billion.

Operations: The firm's revenue is segmented into CHF 1.17 billion from private equity, CHF 379.20 million from infrastructure, CHF 211.30 million from private credit, and CHF 186.90 million from real estate.

Insider Ownership: 17.1%

Partners Group Holding AG, a Swiss firm, shows moderate growth with forecasted annual earnings and revenue increases of 13.7% and 14.1%, respectively—both exceeding the Swiss market averages. Despite this, its high debt level and a dividend coverage issue reflect some financial strains. Recent activities include a CHF 300 million fixed-income offering and potential M&A discussions regarding the sale of Formosa Solar, indicating active strategic maneuvers in its business operations.

- Get an in-depth perspective on Partners Group Holding's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Partners Group Holding is priced higher than what may be justified by its financials.

Straumann Holding (SWX:STMN)

Simply Wall St Growth Rating: ★★★★★☆

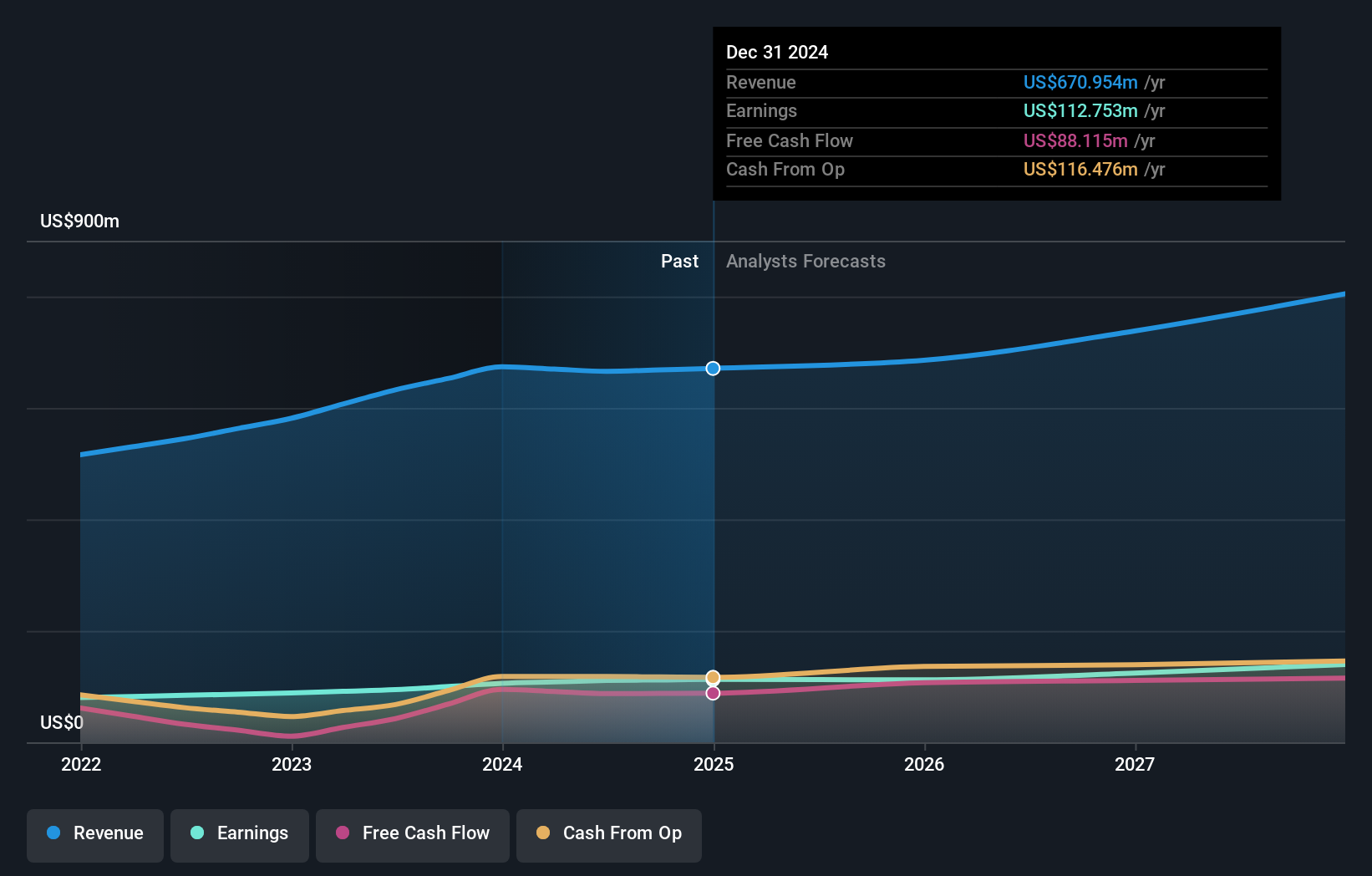

Overview: Straumann Holding AG operates globally, offering tooth replacement and orthodontic solutions with a market capitalization of CHF 18.81 billion.

Operations: The company's revenue is generated through sales in various regions: CHF 1.17 billion from Europe, Middle East, and Africa (EMEA), CHF 793.05 million from North America (NAM), CHF 451.27 million from Asia Pacific (APAC), and CHF 265.82 million from Latin America (LATAM).

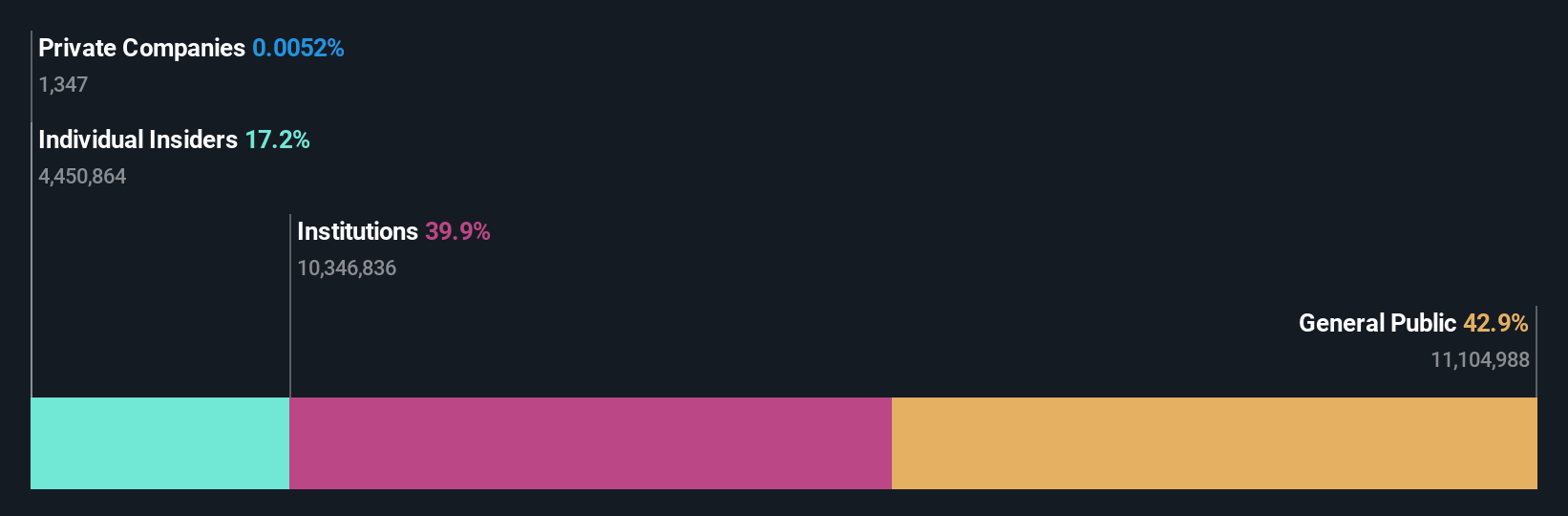

Insider Ownership: 32.7%

Straumann Holding AG, a Swiss growth company with high insider ownership, is trading at 5.3% below its estimated fair value. It anticipates a 20.84% annual earnings increase and revenue growth of 9.8% per year, outpacing the Swiss market's 4.5%. However, profit margins have declined from last year's 18.7% to 10.2%. Recent presentations at various global healthcare conferences underscore its active engagement in expanding market presence and investor relations despite financial fluctuations due to large one-off items.

- Navigate through the intricacies of Straumann Holding with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Straumann Holding's share price might be too optimistic.

Make It Happen

- Click here to access our complete index of 15 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:STMN

Straumann Holding

Provides tooth replacement and orthodontic solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)