- Switzerland

- /

- Specialty Stores

- /

- SWX:MOZN

Need To Know: The Consensus Just Cut Its mobilezone holding ag (VTX:MOZN) Estimates For 2021

The latest analyst coverage could presage a bad day for mobilezone holding ag (VTX:MOZN), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

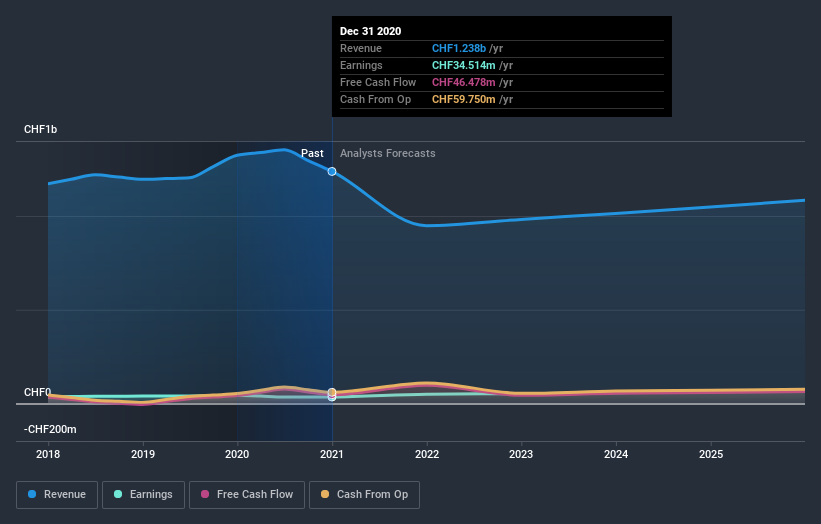

Following the latest downgrade, the three analysts covering mobilezone holding ag provided consensus estimates of CHF948m revenue in 2021, which would reflect a stressful 23% decline on its sales over the past 12 months. Statutory earnings per share are presumed to soar 44% to CHF1.12. Prior to this update, the analysts had been forecasting revenues of CHF1.1b and earnings per share (EPS) of CHF1.11 in 2021. So there's been a clear change in analyst sentiment in the recent update, with the analysts making a measurable cut to revenues and reconfirming their earnings per share estimates.

Check out our latest analysis for mobilezone holding ag

The consensus has reconfirmed its price target of CHF12.83, showing that the analysts don't expect weaker sales expectationsthis year to have a material impact on mobilezone holding ag's market value. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic mobilezone holding ag analyst has a price target of CHF13.50 per share, while the most pessimistic values it at CHF12.00. This is a very narrow spread of estimates, implying either that mobilezone holding ag is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 23% by the end of 2021. This indicates a significant reduction from annual growth of 6.1% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 8.9% per year. It's pretty clear that mobilezone holding ag's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with analysts reconfirming that earnings per share are expected to continue performing in line with their prior expectations. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on mobilezone holding ag after today.

Unfortunately, the earnings downgrade - if accurate - may also place pressure on mobilezone holding ag's mountain of debt, which could lead to some belt tightening for shareholders. To see more of our financial analysis, you can click through to our free platform to learn more about its balance sheet and specific concerns we've identified.

You can also see our analysis of mobilezone holding ag's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you’re looking to trade mobilezone holding ag, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:MOZN

mobilezone holding ag

Provides mobile and fixed-line telephony, television, and Internet services for various network operators in Germany and Switzerland.

Established dividend payer with moderate risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026