- Switzerland

- /

- Real Estate

- /

- SWX:SPSN

Swiss Prime Site (SWX:SPSN): Valuation Check After Fully Deploying CHF 300m Into Yield-Accretive Zurich Offices

Reviewed by Simply Wall St

Swiss Prime Site (SWX:SPSN) has just wrapped up its CHF 300 million growth push by buying a fully let, modern office property in Zurich West, locking in a 4% net yield with SIX Group as tenant.

See our latest analysis for Swiss Prime Site.

This latest Zurich West deal lands as the share price sits at CHF 117.9 and builds on solid momentum, with an 18.8% year to date share price return and a strong 3 year total shareholder return of 68.5%. This suggests investors are steadily rewarding the company’s disciplined, yield accretive growth strategy.

If this kind of steady compounding appeals, it is also worth exploring fast growing stocks with high insider ownership as a way to uncover other shareholder aligned growth stories beyond real estate.

With the capital raise fully deployed into higher yielding assets and returns already robust, the key question now is whether Swiss Prime Site’s shares still offer upside, or if the market has already priced in this next leg of growth.

Most Popular Narrative: 0.8% Undervalued

With Swiss Prime Site last closing at CHF 117.9 against a narrative fair value of roughly CHF 118.8, the story leans toward finely balanced optimism rather than deep value.

The analysts have a consensus price target of CHF114.417 for Swiss Prime Site based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF130.0, and the most bearish reporting a price target of just CHF102.0.

Want to see why modest revenue growth, rising margins, and a punchy future profit multiple still add up to this near fully priced fair value? The narrative walks through the exact earnings path, profitability shift, and valuation multiple that hold this projection together, step by step, without assuming runaway growth.

Result: Fair Value of $118.8 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this constructive outlook could be challenged if redevelopment costs escalate further or if structural office and retail weakness drives higher vacancies and softer rents.

Find out about the key risks to this Swiss Prime Site narrative.

Another Way To Look At Value

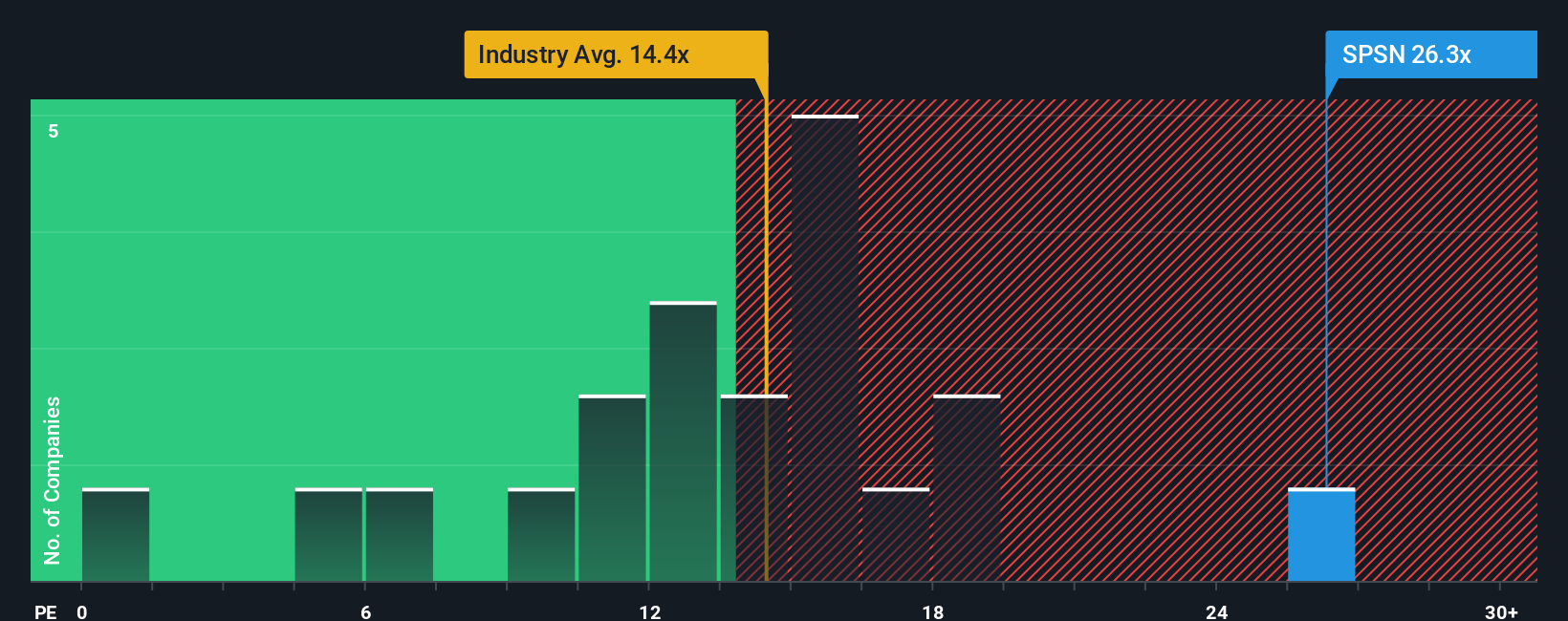

Fair value from the narrative workup looks tightly aligned with today’s price, but the earnings multiple tells a less comfortable story. Swiss Prime Site trades on 26.3 times earnings, far richer than both peers at 14.1 times and the sector at 14.4 times, even if that matches its fair ratio of 26.3 times. That premium leaves less room for disappointment if growth or margins slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Swiss Prime Site Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalised narrative in minutes, Do it your way.

A great starting point for your Swiss Prime Site research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more smart investment ideas?

Put your research momentum to work now by scanning powerful stock shortlists on Simply Wall St, before the next wave of opportunities moves without you.

- Target cash rich potential by reviewing these 908 undervalued stocks based on cash flows that may be trading below what their future cash flows truly justify.

- Capitalize on breakthrough innovation with these 26 AI penny stocks shaping the next generation of intelligent software, automation, and data driven platforms.

- Strengthen your income stream through these 13 dividend stocks with yields > 3% that pair reliable payouts with fundamentally resilient businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SPSN

Swiss Prime Site

Through its subsidiaries, operates as a real estate company in Switzerland.

Average dividend payer with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)