- Switzerland

- /

- Real Estate

- /

- SWX:MOBN

Shareholders Will Probably Not Have Any Issues With Mobimo Holding AG's (VTX:MOBN) CEO Compensation

Key Insights

- Mobimo Holding will host its Annual General Meeting on 11th of April

- Total pay for CEO Daniel Ducrey includes CHF578.0k salary

- Total compensation is similar to the industry average

- Over the past three years, Mobimo Holding's EPS grew by 6.1% and over the past three years, the total shareholder return was 7.7%

Performance at Mobimo Holding AG (VTX:MOBN) has been reasonably good and CEO Daniel Ducrey has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 11th of April. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

Check out our latest analysis for Mobimo Holding

Comparing Mobimo Holding AG's CEO Compensation With The Industry

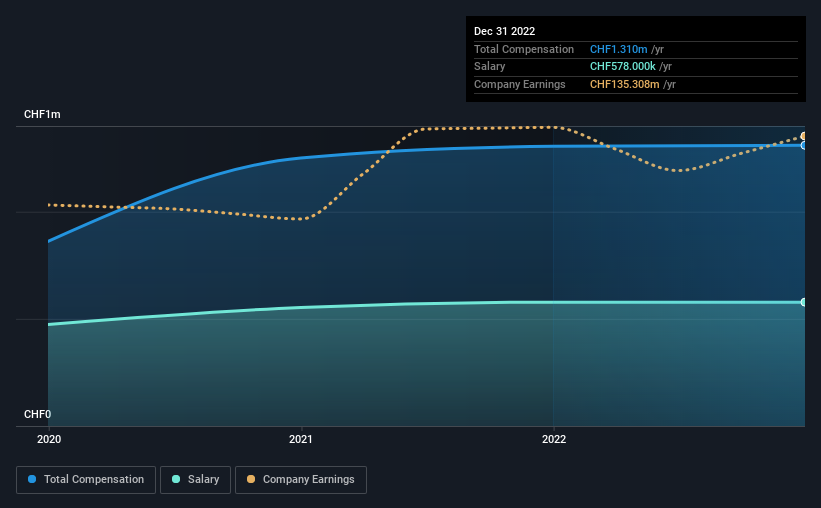

At the time of writing, our data shows that Mobimo Holding AG has a market capitalization of CHF1.8b, and reported total annual CEO compensation of CHF1.3m for the year to December 2022. This means that the compensation hasn't changed much from last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CHF578k.

For comparison, other companies in the Swiss Real Estate industry with market capitalizations ranging between CHF907m and CHF2.9b had a median total CEO compensation of CHF1.1m. So it looks like Mobimo Holding compensates Daniel Ducrey in line with the median for the industry. What's more, Daniel Ducrey holds CHF837k worth of shares in the company in their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CHF578k | CHF578k | 44% |

| Other | CHF732k | CHF727k | 56% |

| Total Compensation | CHF1.3m | CHF1.3m | 100% |

On an industry level, roughly 48% of total compensation represents salary and 52% is other remuneration. Our data reveals that Mobimo Holding allocates salary more or less in line with the wider market. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Mobimo Holding AG's Growth Numbers

Mobimo Holding AG has seen its earnings per share (EPS) increase by 6.1% a year over the past three years. Its revenue is down 1.8% over the previous year.

We generally like to see a little revenue growth, but the modest EPS growth gives us some relief. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Mobimo Holding AG Been A Good Investment?

Mobimo Holding AG has not done too badly by shareholders, with a total return of 7.7%, over three years. It would be nice to see that metric improve in the future. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO pay is simply one of the many factors that need to be considered while examining business performance. In our study, we found 5 warning signs for Mobimo Holding you should be aware of, and 2 of them are a bit concerning.

Switching gears from Mobimo Holding, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:MOBN

Mobimo Holding

Engages in the buying, planning, building, maintenance, and sale of real estate properties to private individuals, institutional investors, and companies in Switzerland.

Established dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)