- Switzerland

- /

- Real Estate

- /

- BRSE:ADMI

The Market Lifts Admicasa Holding AG (BRN:ADMI) Shares 98% But It Can Do More

Admicasa Holding AG (BRN:ADMI) shares have had a really impressive month, gaining 98% after a shaky period beforehand. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

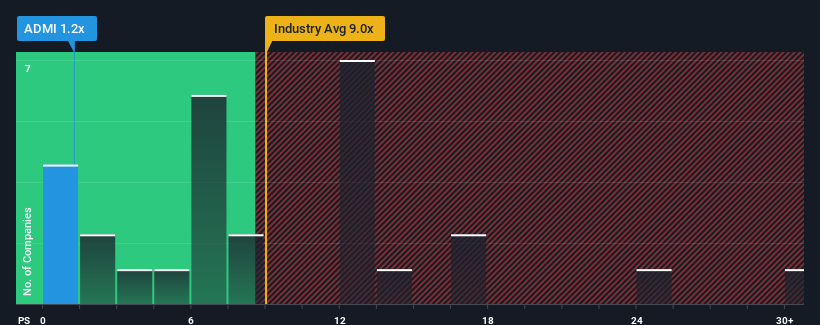

Even after such a large jump in price, considering about half the companies operating in Switzerland's Real Estate industry have price-to-sales ratios (or "P/S") above 9x, you may still consider Admicasa Holding as an great investment opportunity with its 1.2x P/S ratio. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Admicasa Holding

What Does Admicasa Holding's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Admicasa Holding has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. Those who are bullish on Admicasa Holding will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Admicasa Holding's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Admicasa Holding?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Admicasa Holding's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 100% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 14% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to decline by 10% over the next year, even worse than the company's recent medium-term annualised revenue decline.

With this information, it's perhaps strange but not a major surprise that Admicasa Holding is trading at a lower P/S in comparison. Even if the company's recent growth rates continue outperforming the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. There is still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Key Takeaway

Shares in Admicasa Holding have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look into numbers has shown it's somewhat unexpected that Admicasa Holding has a lower P/S than the industry average, given its recent three-year revenue performance which was better than anticipated for an industry facing challenges. When we see better than average revenue growth but a lower than average P/S, we must assume that potential risks are what might be placing significant pressure on the P/S ratio. We'd hazard a guess that some investors are concerned about the company's revenue performance tailing off amidst these tough industry conditions. While recent medium-term revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

Plus, you should also learn about these 3 warning signs we've spotted with Admicasa Holding.

If these risks are making you reconsider your opinion on Admicasa Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BRSE:ADMI

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)