- Switzerland

- /

- Life Sciences

- /

- SWX:SKAN

Undiscovered European Gems Including Gelsenwasser With Strong Fundamentals

Reviewed by Simply Wall St

As European markets experience a notable upswing, with the STOXX Europe 600 Index climbing 2.77% and major indices like Germany's DAX and France's CAC 40 showing significant gains, investors are increasingly turning their attention to smaller companies that might offer unique opportunities amid easing trade tensions. In this favorable environment, stocks with strong fundamentals—such as robust financial health and sustainable growth prospects—are particularly appealing, offering potential resilience against broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| BAUER | 78.29% | 4.31% | nan | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Gelsenwasser (DB:WWG)

Simply Wall St Value Rating: ★★★★☆☆

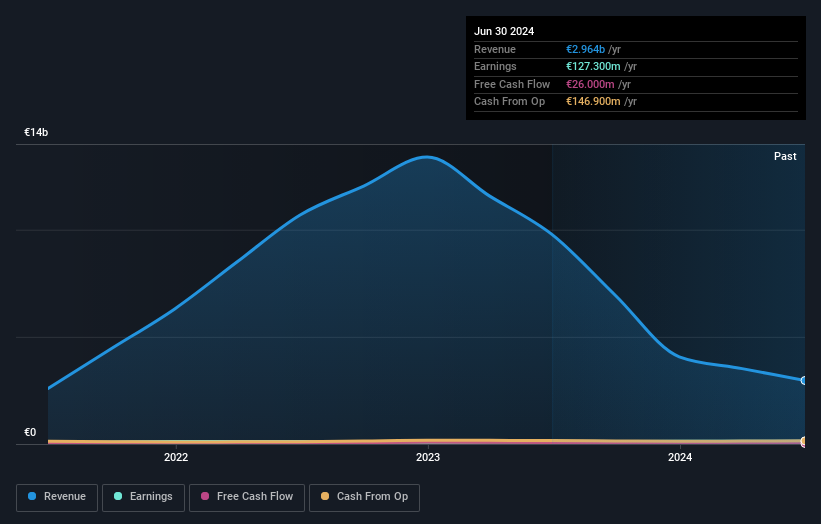

Overview: Gelsenwasser AG operates in the water, wastewater, gas supply, and electricity sectors across Germany, the Czech Republic, and Poland with a market capitalization of approximately €1.74 billion.

Operations: The primary revenue streams for Gelsenwasser AG are energy procurement and sales, generating €3.26 billion, and energy grids at €273.60 million. Water services contribute €293.20 million, while wastewater brings in €42.70 million, with investments and projects adding another €13.90 million to the total revenue mix.

Gelsenwasser, a smaller player in the utilities sector, shows a mixed financial picture. Despite trading 53% below its estimated fair value, recent earnings results reveal challenges. Sales dropped to €2.99 billion from €4.09 billion last year, while net income decreased to €117 million from €132 million. Earnings per share also saw a dip to €34 from the previous year's €39. The company's debt-to-equity ratio increased over five years from 8.9% to 17.9%, although this remains satisfactory at 15%. With high-quality past earnings and positive free cash flow, it still holds potential despite recent setbacks.

- Navigate through the intricacies of Gelsenwasser with our comprehensive health report here.

Assess Gelsenwasser's past performance with our detailed historical performance reports.

Sonaecom SGPS (ENXTLS:SNC)

Simply Wall St Value Rating: ★★★★★★

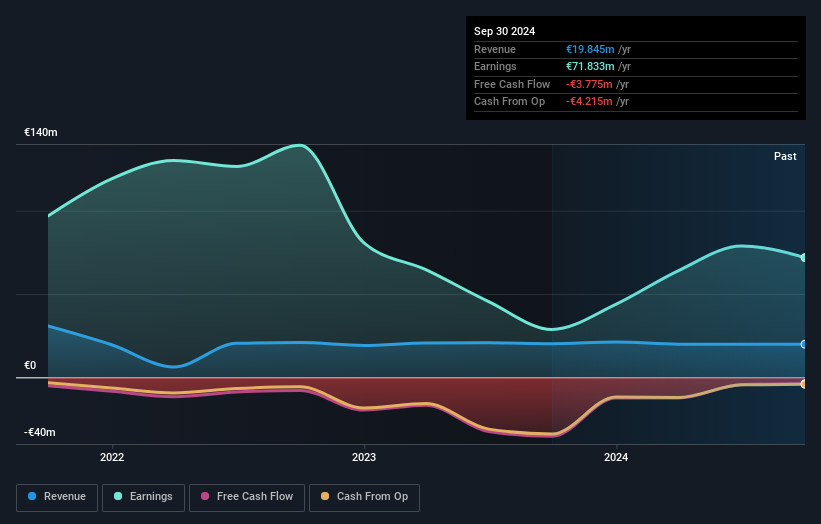

Overview: Sonaecom SGPS, S.A. is a company that, along with its subsidiaries, engages in the technology, media, and telecommunications sectors globally and has a market capitalization of approximately €770.54 million.

Operations: Sonaecom generates revenue primarily from its media and technology segments, with media contributing €16.38 million and technology €3.02 million. The company's market capitalization is approximately €770.54 million.

Sonaecom, a nimble player in the telecom sector, has shown resilience with its debt-free status, contrasting sharply with its earlier debt to equity ratio of 0.7%. Despite facing a significant one-off loss of €19M impacting recent financials, it boasts a robust earnings growth of 150% over the past year, outpacing the industry's 8.2%. The company's price-to-earnings ratio stands at 10.7x, offering better value compared to Portugal's market average of 11.8x. While free cash flow remains negative, Sonaecom's profitable operations suggest potential for future stability and growth within this dynamic industry landscape.

- Dive into the specifics of Sonaecom SGPS here with our thorough health report.

Gain insights into Sonaecom SGPS' past trends and performance with our Past report.

SKAN Group (SWX:SKAN)

Simply Wall St Value Rating: ★★★★★☆

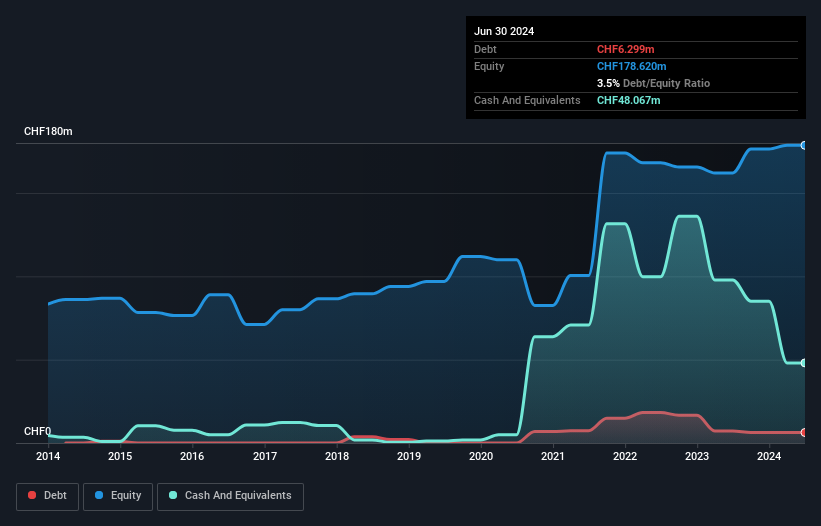

Overview: SKAN Group AG, along with its subsidiaries, specializes in offering isolators, cleanroom devices, and decontamination processes to the pharmaceutical and chemical industries globally, with a market capitalization of CHF1.50 billion.

Operations: SKAN Group generates revenue primarily from its Equipment & Solutions segment, amounting to CHF270.90 million, and the Services & Consumables segment, contributing CHF90.39 million.

SKAN Group, a player in the Life Sciences sector, has been making waves with its impressive earnings growth of 47.5% over the past year, outpacing the industry average of 24.7%. The company trades at a notable discount of 22.9% below its estimated fair value, suggesting potential upside for investors. SKAN's debt to equity ratio rose to 2.7% over five years but remains manageable with interest payments covered 108 times by EBIT. Despite not being free cash flow positive currently, SKAN's profitability and strategic international expansion into Brazil and Asia offer promising avenues for future revenue growth.

Seize The Opportunity

- Delve into our full catalog of 357 European Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SKAN Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SKAN

SKAN Group

Provides isolators, cleanroom devices, and decontamination processes for pharmaceutical and chemical industries in Europe, the Americas, Asia, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives