- Switzerland

- /

- Life Sciences

- /

- SWX:SKAN

European Stocks Estimated To Be Trading Below Fair Value By Up To 42.4%

Reviewed by Simply Wall St

As European markets show signs of recovery, with the pan-European STOXX Europe 600 Index rising by 3.93% over a recent week, investor sentiment has been buoyed by the European Central Bank's rate cuts and easing trade tensions. In this context, identifying undervalued stocks becomes crucial as these opportunities may offer potential for growth when market conditions stabilize further.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK49.265 | SEK96.49 | 48.9% |

| LPP (WSE:LPP) | PLN15695.00 | PLN30654.82 | 48.8% |

| Pharma Mar (BME:PHM) | €80.80 | €158.16 | 48.9% |

| Lindab International (OM:LIAB) | SEK190.30 | SEK372.38 | 48.9% |

| TF Bank (OM:TFBANK) | SEK347.50 | SEK683.01 | 49.1% |

| Mo-BRUK (WSE:MBR) | PLN316.50 | PLN621.01 | 49% |

| LINK Mobility Group Holding (OB:LINK) | NOK22.70 | NOK44.01 | 48.4% |

| Jerónimo Martins SGPS (ENXTLS:JMT) | €21.40 | €42.22 | 49.3% |

| MedinCell (ENXTPA:MEDCL) | €14.70 | €28.62 | 48.6% |

| Longino & Cardenal (BIT:LON) | €1.36 | €2.71 | 49.8% |

Here's a peek at a few of the choices from the screener.

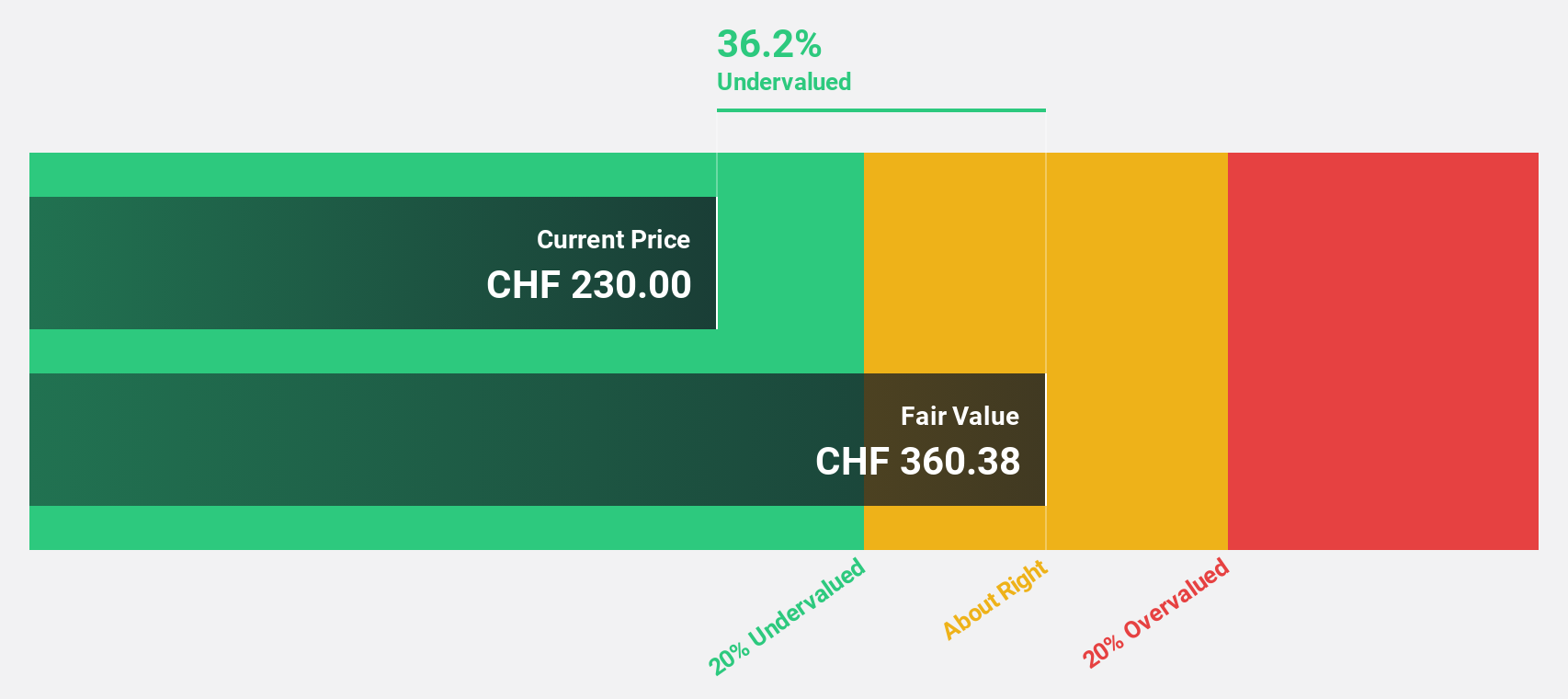

Comet Holding (SWX:COTN)

Overview: Comet Holding AG, with a market cap of CHF1.64 billion, offers X-ray and radio frequency power technology solutions across Europe, North America, Asia, and other international markets.

Operations: The company's revenue segments are comprised of X-Ray Systems (IXS) at CHF115.89 million, Industrial X-Ray Modules (IXM) at CHF94.57 million, and Plasma Control Technologies (PCT) at CHF247.39 million.

Estimated Discount To Fair Value: 42.4%

Comet Holding AG's stock appears undervalued, trading at CHF 211.6, significantly below the estimated fair value of CHF 367.44. The company's recent financial performance shows strong growth, with net income rising to CHF 35.12 million from CHF 15.39 million year-over-year and Q1 sales increasing by 37.5% to CHF 111.2 million compared to last year. Despite high share price volatility, Comet's earnings are expected to grow significantly faster than the Swiss market over the next three years.

- Our expertly prepared growth report on Comet Holding implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Comet Holding here with our thorough financial health report.

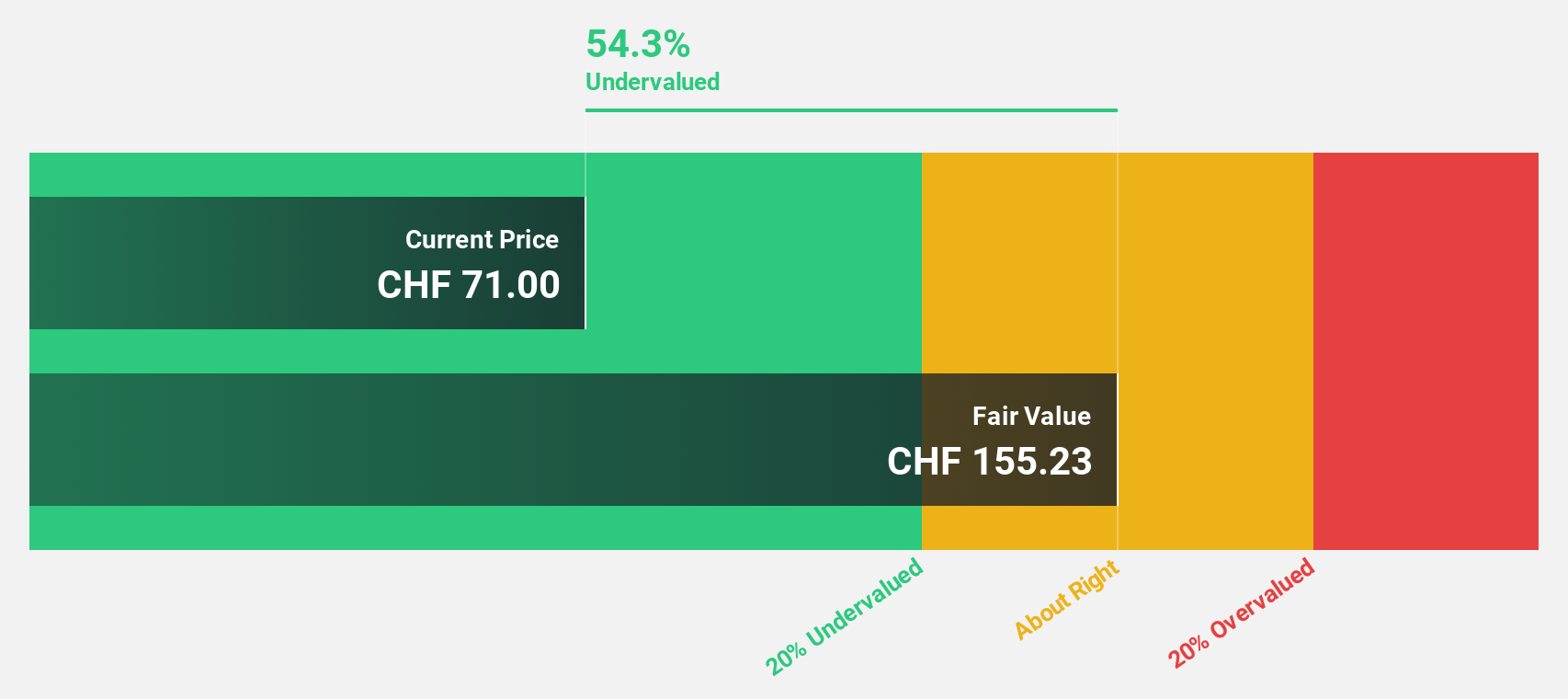

SKAN Group (SWX:SKAN)

Overview: SKAN Group AG, with a market cap of CHF1.45 billion, operates internationally providing isolators, cleanroom devices, and decontamination processes for the pharmaceutical and chemical industries.

Operations: The company's revenue is derived from two main segments: Equipment & Solutions, contributing CHF270.90 million, and Services & Consumables, accounting for CHF90.39 million.

Estimated Discount To Fair Value: 25.6%

SKAN Group is trading at CHF 64.4, significantly below its estimated fair value of CHF 86.53, suggesting a potential undervaluation based on cash flows. Analysts agree the stock price could rise by 40.8%. Recent earnings show net income increased to CHF 38.8 million from CHF 26.31 million year-over-year, with revenue growth expected in the mid-teens for 2025, outpacing the Swiss market's forecasted growth rate of 4.5% per year.

- The growth report we've compiled suggests that SKAN Group's future prospects could be on the up.

- Get an in-depth perspective on SKAN Group's balance sheet by reading our health report here.

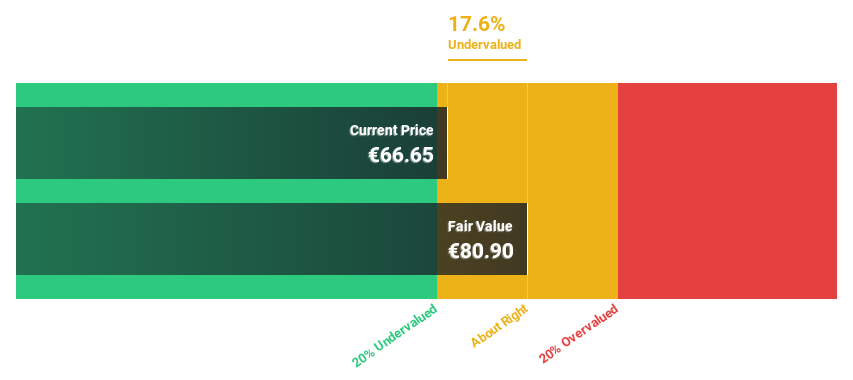

Nagarro (XTRA:NA9)

Overview: Nagarro SE, along with its subsidiaries, offers digital product engineering and technology solutions across North America, Central Europe, the rest of Europe, and internationally, with a market cap of €8.80 billion.

Operations: The company's revenue primarily comes from its Computer Services segment, totaling €947.15 million.

Estimated Discount To Fair Value: 17%

Nagarro, trading at €67.6, is priced below its estimated fair value of €81.49, indicating potential undervaluation based on cash flows. Analysts project a 60.9% price increase with earnings expected to grow faster than the German market at 19.7% annually. The strategic acquisition of Notion Edge France enhances Nagarro's CX offerings and market reach in Europe and Africa, despite the company's high debt levels potentially impacting financial flexibility.

- The analysis detailed in our Nagarro growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Nagarro stock in this financial health report.

Turning Ideas Into Actions

- Discover the full array of 177 Undervalued European Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SKAN

SKAN Group

Provides isolators, cleanroom devices, and decontamination processes for pharmaceutical and chemical industries in Europe, the Americas, Asia, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives