- Switzerland

- /

- Life Sciences

- /

- SWX:SKAN

A Look at SKAN Group's (SWX:SKAN) Valuation Following CEO Succession Announcement

Reviewed by Simply Wall St

SKAN Group (SWX:SKAN) surprised the market with news that its Board has wrapped up a key piece of strategic planning and appointed Jonas Greutert as the next CEO, with the transition set for January 2026. After eight years of growth under Thomas Huber, the company is now preparing to hand the reins to someone with a track record at Mettler-Toledo and Dätwyler Group. Investors often pay close attention to leadership changes like this, as they wonder whether new management will continue building on past success or introduce a shift in focus.

The backdrop for this announcement is a year that has tested SKAN Group holders with a share price decline of 25% over the past twelve months. However, the company’s impressive multi-year growth and substantial increases in both revenue and net income suggest the underlying business remains sound. Momentum has clearly cooled off lately, and this CEO transition provides another consideration for investors evaluating the company’s next phase.

After a challenging stretch in the market and with new leadership on the horizon, investors may be weighing whether this is the moment to consider SKAN Group shares or if the market is already accounting for the company’s future growth potential.

Most Popular Narrative: 30.8% Undervalued

The current most widely followed narrative suggests SKAN Group's shares offer significant upside, as analysts see them trading well below their estimated fair value.

The significant increase in order intake (20% YoY) and a record-high order backlog reflect robust underlying pharmaceutical market growth, especially for oncology-related ADC filling lines and the ongoing shift towards injectable drugs. As backlog converts to sales in coming quarters, this supports forward revenue growth and improved earnings visibility.

Want to know what’s driving this bullish fair value? This narrative depends on bold growth assumptions and a future profit multiple that outpaces the market. Uncover which specific financial forecasts and margin improvements support this substantial target. Curious which numbers could redefine SKAN's value story? The hidden details may surprise you.

Result: Fair Value of $84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, delays in major projects or instability in consumable demand could quickly challenge this optimistic outlook for SKAN Group’s growth story.

Find out about the key risks to this SKAN Group narrative.Another View: Market Ratios Show a Different Picture

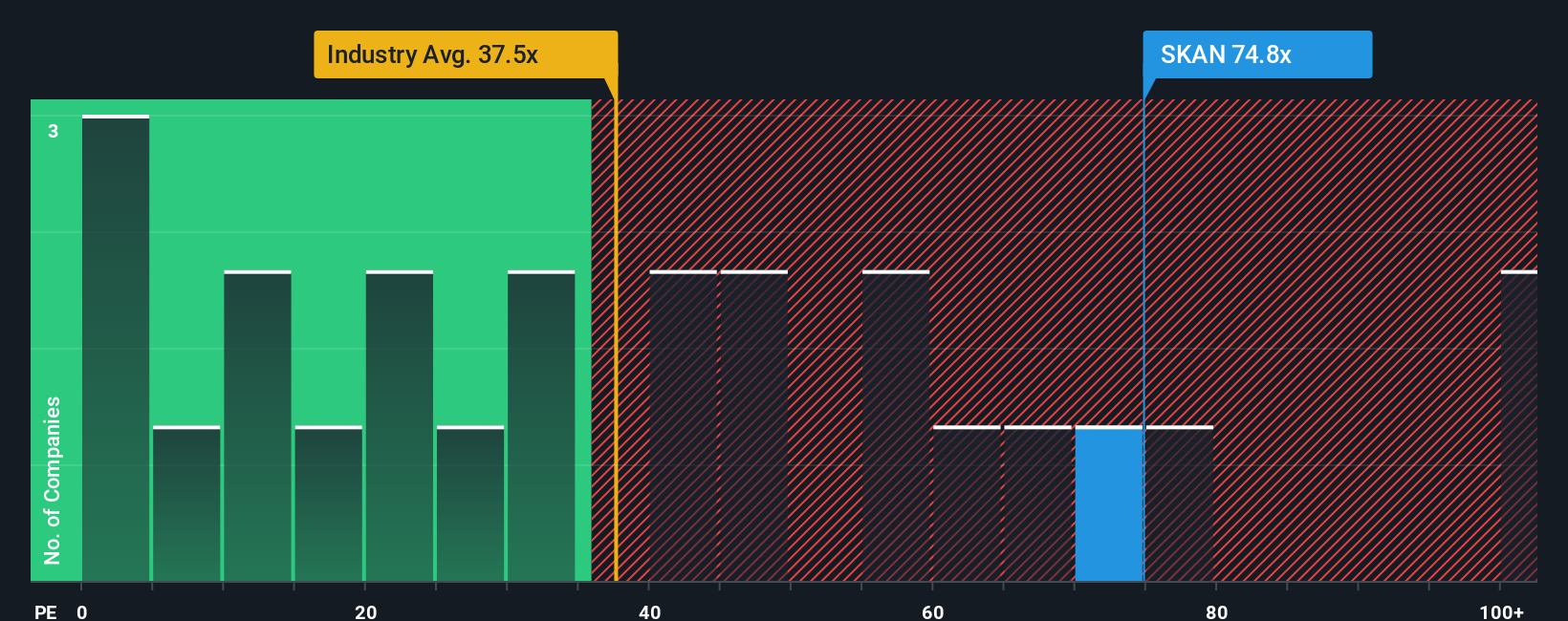

While one approach sees SKAN Group as significantly undervalued, market ratios suggest its shares are actually expensive compared to industry standards. This raises an important question: are the optimistic forecasts priced in already?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SKAN Group Narrative

If you want to take a different perspective or explore your own findings from the available data, you can easily construct a custom narrative in just a few minutes. Then, share your view – Do it your way.

A great starting point for your SKAN Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let new opportunities pass you by. Use these powerful tools to spot unique stocks that align with your goals and keep your portfolio ahead of the curve.

- Tap into high-potential tech by using AI penny stocks to find companies pioneering the next wave of artificial intelligence applications.

- Capture hidden value as you seek undervalued stocks based on cash flows, flagging stocks trading well below their true worth based on solid cash flows.

- Supercharge your income strategy by searching for dividend stocks with yields > 3%, which deliver strong yields alongside financial stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SWX:SKAN

SKAN Group

Provides isolators, cleanroom devices, and decontamination processes for pharmaceutical and chemical industries in Europe, the Americas, Asia, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026