- Switzerland

- /

- Pharma

- /

- SWX:ROG

Is FDA Approval for Tecentriq-Zepzelca Revolutionizing the Investment Case for Roche (SWX:ROG)?

Reviewed by Sasha Jovanovic

- In October 2025, Roche received FDA approval for Tecentriq in combination with Zepzelca as a first-of-its-kind maintenance therapy for extensive-stage small cell lung cancer, and secured a CE-mark for an AI-powered risk stratification tool for chronic kidney disease in partnership with KlinRisk Inc. These milestones signal Roche's continued expansion into digital health and reinforce its leadership in high-impact oncology solutions.

- We'll now explore how the FDA approval for Tecentriq-Zepzelca could influence Roche's investment outlook and growth priorities.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Roche Holding Investment Narrative Recap

Roche Holding’s investment case rests on confidence in its innovation engine to maintain leadership in diagnostics and oncology amid looming biosimilar threats and changing global healthcare policies. The recent FDA approval for Tecentriq-Zepzelca provides a boost to Roche's oncology portfolio, yet the biggest immediate catalyst remains the company’s ability to defend and extend its core franchises, while ongoing pricing headwinds in China pose a significant risk to overall revenue and margin resilience. The net impact of this approval is positive for Roche’s value proposition but does not fully offset the structural challenge from biosimilar competition, especially with key patents expiring after 2026.

Among Roche’s latest announcements, the CE-mark for its AI-based chronic kidney disease risk stratification tool stands out. This digital health initiative highlights Roche’s ambitions to expand beyond traditional diagnostics and supports the thesis that investment in AI and digital solutions could help diversify revenue streams and defend margins as legacy products face mounting competition. Investors tracking near-term catalysts should note the interplay between successful new launches and the potential drag from geographic and product-specific pricing pressures.

However, investors should also keep in mind that as biosimilar competition accelerates in the EU and US, the risk to Roche’s medium-term earnings power and dividend track record could grow…

Read the full narrative on Roche Holding (it's free!)

Roche Holding's outlook anticipates revenues of CHF67.3 billion and earnings of CHF16.8 billion by 2028. This scenario assumes annual revenue growth of 1.9% and an earnings increase of CHF7.4 billion from the current CHF9.4 billion.

Uncover how Roche Holding's forecasts yield a CHF298.64 fair value, in line with its current price.

Exploring Other Perspectives

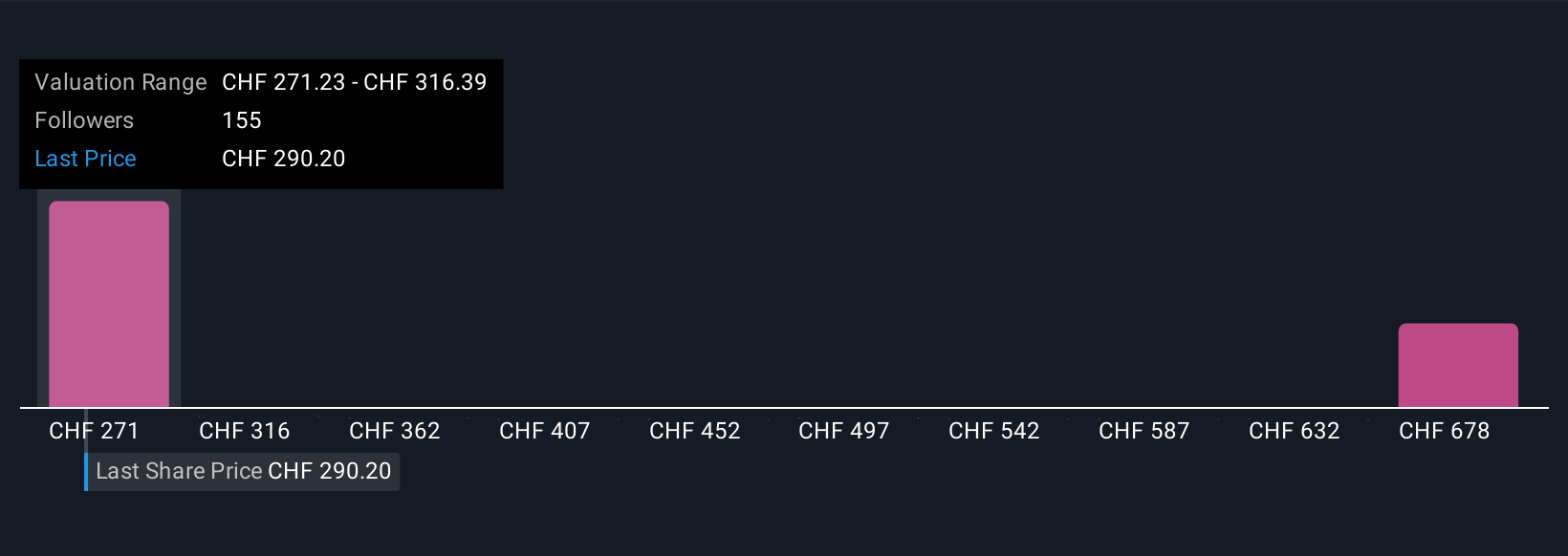

Twelve individual fair value estimates from the Simply Wall St Community span CHF271 to over CHF723 per share. Many highlight the risk that biosimilar entry and expiring patents may test Roche’s ability to sustain earnings and defend its historical strengths; differing opinions make it essential to examine a range of outlooks.

Explore 12 other fair value estimates on Roche Holding - why the stock might be worth over 2x more than the current price!

Build Your Own Roche Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roche Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Roche Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roche Holding's overall financial health at a glance.

No Opportunity In Roche Holding?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and New Zealand.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives