- Switzerland

- /

- Biotech

- /

- SWX:RLF

Despite currently being unprofitable, Relief Therapeutics Holding (VTX:RLF) has delivered a 566% return to shareholders over 3 years

Relief Therapeutics Holding AG (VTX:RLF) shareholders might be concerned after seeing the share price drop 17% in the last quarter. But over three years the performance has been really wonderful. In fact, the share price has taken off in that time, up 566%. As long term investors the recent fall doesn't detract all that much from the longer term story. The thing to consider is whether there is still too much elation around the company's prospects. We love happy stories like this one. The company should be really proud of that performance!

In light of the stock dropping 12% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

View our latest analysis for Relief Therapeutics Holding

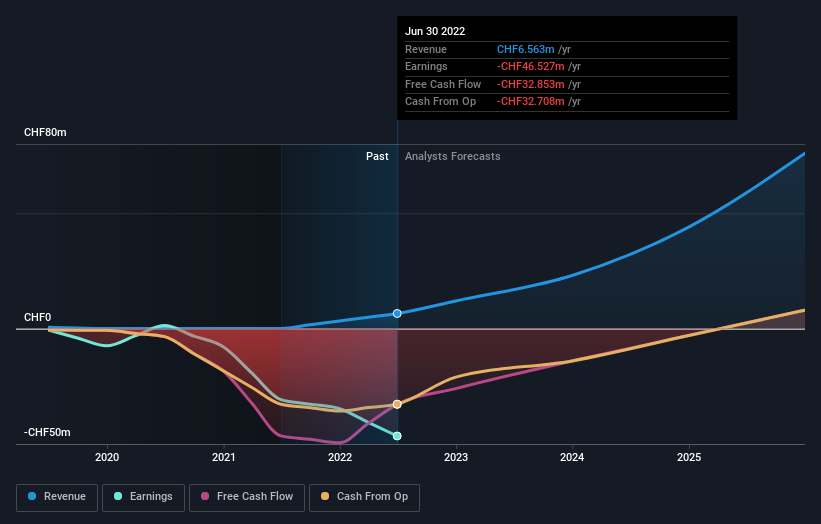

Relief Therapeutics Holding wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Relief Therapeutics Holding's revenue trended up 128% each year over three years. That's well above most pre-profit companies. And it's not just the revenue that is taking off. The share price is up 88% per year in that time. Despite the strong run, top performers like Relief Therapeutics Holding have been known to go on winning for decades. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Relief Therapeutics Holding stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 6.5% in the twelve months, Relief Therapeutics Holding shareholders did even worse, losing 64%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 19%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Relief Therapeutics Holding (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:RLF

Relief Therapeutics Holding

A biopharmaceutical company, focuses on identification, development, and commercialization of novel, patent protected products for the treatment of rare metabolic, dermatological, and pulmonary diseases in Switzerland, Europe, North America, and internationally.

Adequate balance sheet slight.

Market Insights

Community Narratives