- Switzerland

- /

- Pharma

- /

- SWX:NOVN

Is Novartis Set for Growth After Three-Year 60% Share Price Surge?

Reviewed by Bailey Pemberton

If you are debating what to do with your Novartis shares or considering jumping in, you are not alone. The stock has been a topic of conversation among investors thanks to its impressive mix of stability and recent upward momentum. Just look at the numbers, and you will see Novartis is up 16.9% for the year to date and a striking 60.2% over three years. Shorter-term movement can be choppier, as seen in the last week’s modest 2.3% dip. This is hardly surprising given some pockets of cautious sentiment across the pharmaceutical sector. Still, the 6.5% rise over the past month hints that optimism has not gone anywhere, especially as the market continues to reward companies with strong pipelines and resilient cash flows amid broader industry developments.

But is Novartis actually undervalued, or is the market simply catching up to its true worth? Our valuation score for Novartis, based on six different checks, lands at 5 out of 6. This is a strong initial signal that the stock could still offer upside by several key measures. Each point in that score means Novartis passed another rigorous test that analysts use to hunt for bargains. In the next section, I will run through each method, explaining where Novartis shines and where there might still be room for skepticism. Afterward, we will get into what I believe is the best way to judge whether Novartis is genuinely undervalued right now.

Why Novartis is lagging behind its peers

Approach 1: Novartis Discounted Cash Flow (DCF) Analysis

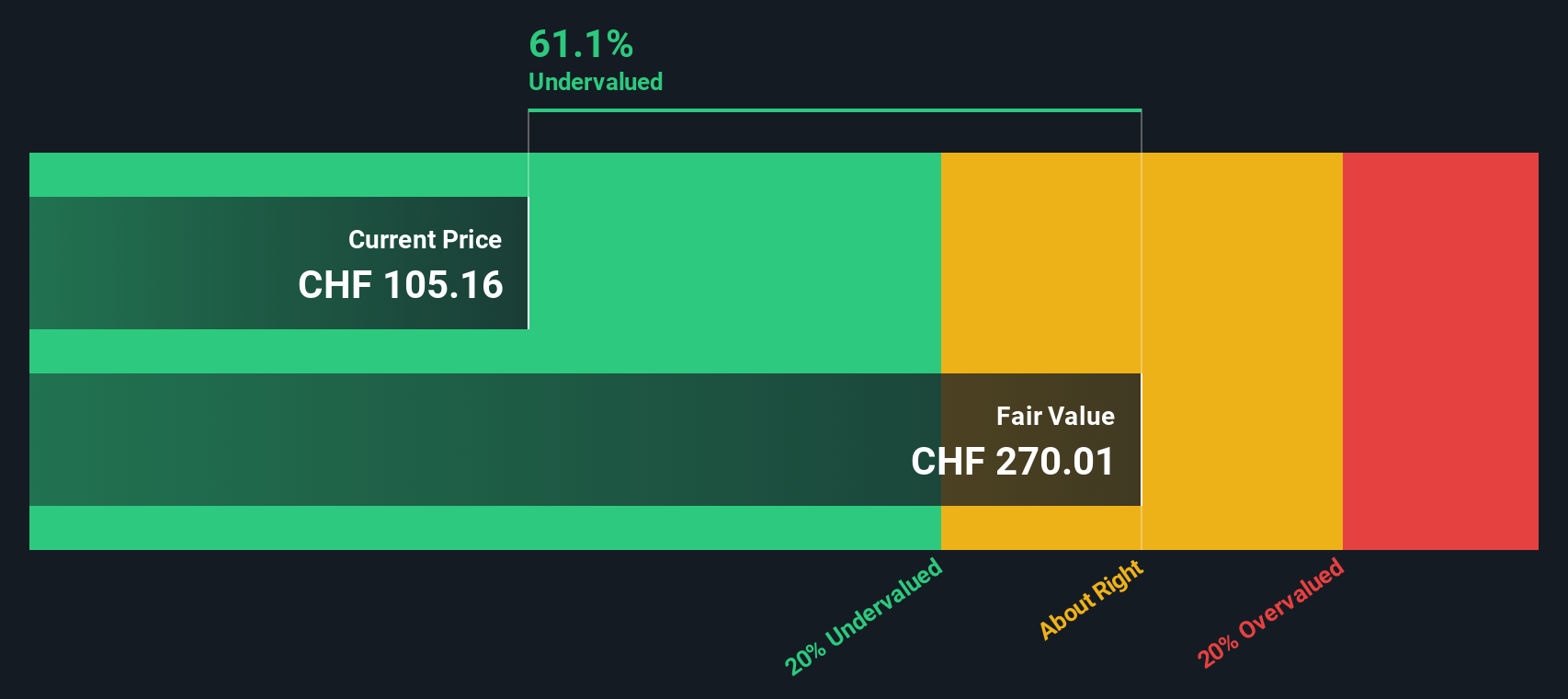

The Discounted Cash Flow (DCF) model estimates what a company is really worth by projecting its future free cash flows and then discounting those figures back to today’s value. In Novartis's case, the model captures expected cash generation and provides a data-driven estimate of intrinsic value.

Currently, Novartis generates free cash flow of about $18.0 billion. Analysts forecast this to grow steadily, reaching $20.9 billion by 2029. While direct analyst estimates go out five years, further projections up to ten years are extrapolated by Simply Wall St to map out longer-term performance. This trajectory assumes the company continues delivering robust cash flows, marking Novartis as a consistent generator of value.

According to this DCF model, Novartis’s intrinsic value lands at $269.89 per share. With the model showing the stock trades at a 61.5% discount to this value, the implication is that Novartis shares look significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Novartis is undervalued by 61.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Novartis Price vs Earnings

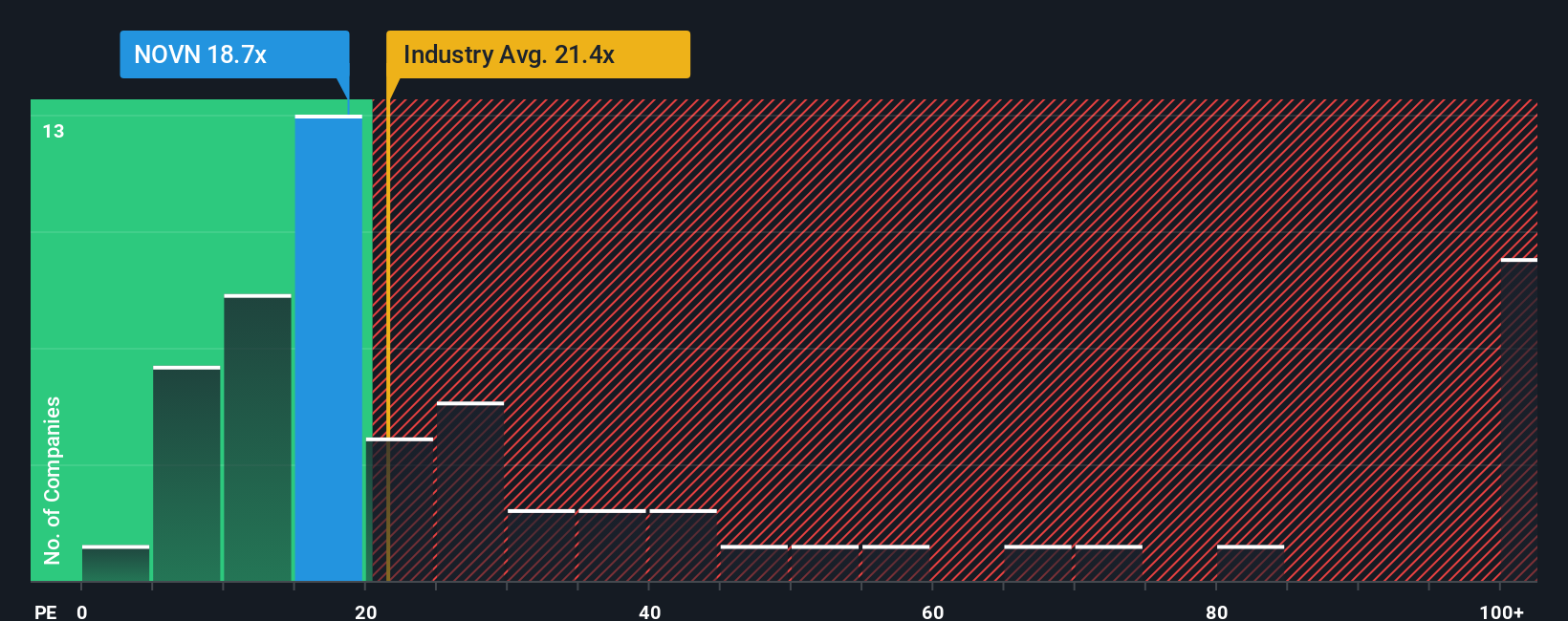

For established, profitable companies like Novartis, the Price-to-Earnings (PE) ratio is a widely used metric for valuation. It shows how much investors are willing to pay for each dollar of earnings, making it a useful yardstick for comparing companies with steady profits.

The "normal" or "fair" PE ratio for any stock is not a fixed number. It is influenced by growth expectations and the perceived risk of the business. Companies with stronger growth prospects or lower risk often justify higher PE multiples, while the reverse is true for slower growth or riskier firms.

Currently, Novartis trades at a PE ratio of 18.5x. This is well below the average for global pharmaceutical peers, which sits at 73.5x, and below the broader industry average of 24.3x. While these benchmarks provide context, they do not tell the full story, since peer and industry averages can be skewed by outliers or change rapidly with sector sentiment shifts.

This is why Simply Wall St’s "Fair Ratio" offers a more targeted measure. The Fair Ratio for Novartis is 29.4x, reflecting a multiple adjusted for the company’s earnings outlook, profit margin, scale, and sector risks. Unlike generic comparables, this proprietary metric helps filter out the noise and focuses on what really matters to a company of this quality and market position.

Comparing Novartis’s current PE of 18.5x to the Fair Ratio of 29.4x, there is a considerable gap. This suggests the stock is undervalued from an earnings perspective, especially considering its stable growth and solid fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Novartis Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, a simple tool that lets you put a story behind the numbers by aligning your own perspective on Novartis’s future growth, margins, and risks with a transparent financial forecast and calculated fair value.

Narratives connect the dots between what is happening in the real world and what might happen in Novartis’s earnings, cash flow, and share price, helping you clearly see how changing assumptions or new information can instantly affect your best estimate of fair value. On Simply Wall St’s Community page, millions of investors use Narratives to easily share their own views, compare with others, and make decisions based on logic rather than headlines.

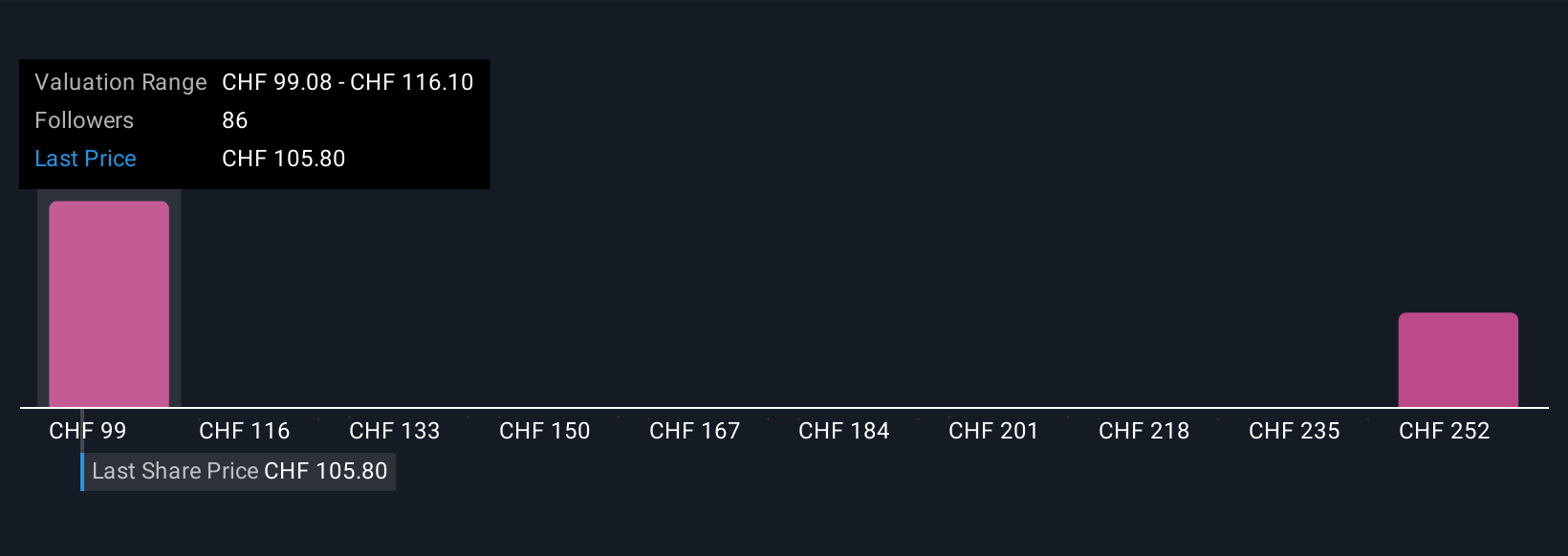

With Narratives, you can react quickly as news, earnings reports, or industry trends update the numbers behind each fair value estimate, giving you a dynamic view of where the stock stands. For example, some Novartis Narratives are highly optimistic, targeting a fair value above CHF120 based on emerging market expansion and breakthrough therapies. More conservative views point to CHF79, factoring in risks like patent expirations and pricing pressures. This range can be used to judge your own decision more confidently.

Do you think there's more to the story for Novartis? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novartis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NOVN

Novartis

Researches, develops, manufactures, distributes, markets, and sells pharmaceutical medicines in Switzerland and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives