- Switzerland

- /

- Pharma

- /

- SWX:NOVN

Assessing Novartis (SWX:NOVN) Valuation After a Steady 2024 Climb

Reviewed by Kshitija Bhandaru

Novartis (SWX:NOVN) shares have moved slightly over the past week, piquing investor interest in what has been a steady climb this year. The company’s year-to-date return now sits at 17%, reflecting solid performance in 2024.

See our latest analysis for Novartis.

Novartis’s steady climb has been supported by consistent demand for its key therapies and a handful of smaller pipeline updates, with momentum clearly building. While the 2024 share price return stands at 16.87%, longer-term investors have seen a robust 59% total return over three years, highlighting the value of staying the course with this stock.

If recent pharma gains have you interested, consider exploring more leading companies using our focused healthcare stocks screener: See the full list for free.

Given this history of growth and a steady run-up in recent months, the key question for investors now is whether Novartis remains undervalued or if the market has already accounted for its future prospects. Could there still be a buying opportunity?

Most Popular Narrative: 5% Overvalued

Novartis currently trades at CHF104.04, slightly above the fair value estimate of CHF99.08 set by the most widely followed narrative. This suggests the latest market price is factoring in optimistic expectations and limited upside in the near term.

"Novartis' robust pipeline and rapid regulatory progress in advanced therapies, including biologics, gene, and cell therapies, positions the company to benefit from emerging healthcare technologies. This could potentially accelerate future earnings and margin growth as new high-value products launch."

Curious how new medicines and expansion plans could shake up this valuation? Unlock the bold forecasts and contentious assumptions driving the consensus price target. Will Novartis execute on its ambitious margin and growth blueprint, or are investors overlooking key variables? The answer might surprise you.

Result: Fair Value of CHF99.08 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing patent expirations and intensifying pricing pressures in key markets could challenge Novartis’s ability to sustain its recent growth trajectory.

Find out about the key risks to this Novartis narrative.

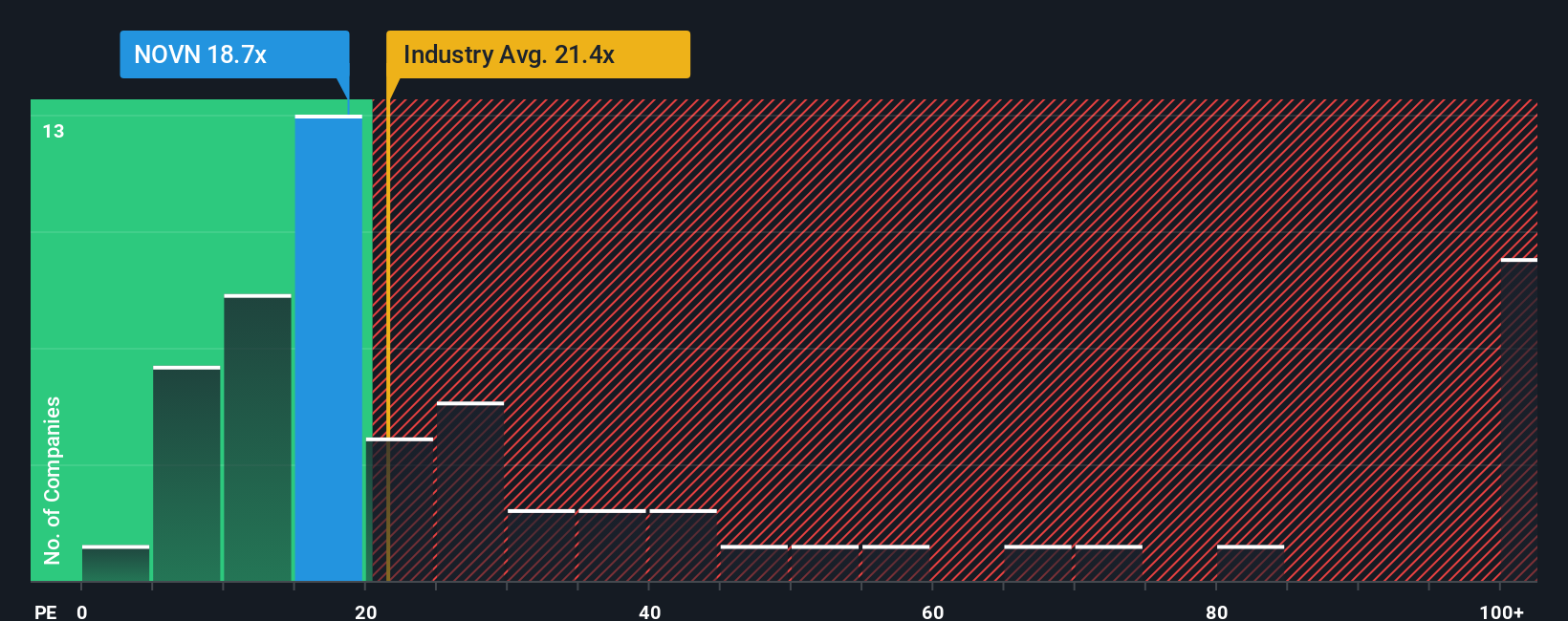

Another View: Multiples Suggest a Discount

Looking through the lens of earnings-based valuation, Novartis actually appears attractively priced versus both its industry and peers. Its price-to-earnings ratio is 18.3x, below the European pharmaceuticals industry’s 21.1x and peer average of 72.8x. The SWS fair ratio stands even higher at 29.3x. Does this present a hidden value opportunity, or is there more risk under the surface?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Novartis Narrative

If you’re keen to dig deeper or come to your own conclusions, you can easily build a personalised case for Novartis in just a few minutes, starting now: Do it your way

A great starting point for your Novartis research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Unmissable Investment Opportunities?

Broaden your portfolio with proven paths to growth. Don’t let today’s best ideas slip by. The right screener could spark your next big win.

- Capture steady returns by tapping into these 18 dividend stocks with yields > 3% that offer higher yields than the market average, benefiting from resilient business models and reliable cash flows.

- Accelerate your exposure to future-ready sectors with these 25 AI penny stocks driving innovation at the intersection of artificial intelligence and real-world business needs.

- Sharpen your edge by targeting these 26 quantum computing stocks leading the way in the rapidly evolving world of quantum computing and advanced technology applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novartis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NOVN

Novartis

Researches, develops, manufactures, distributes, markets, and sells pharmaceutical medicines in Switzerland and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives