- Switzerland

- /

- Life Sciences

- /

- SWX:LONN

Lonza Group (SWX:LONN) Valuation in Focus Following Major Executive Appointments

Reviewed by Simply Wall St

Most Popular Narrative: 18% Undervalued

According to the most widely followed narrative, Lonza Group shares are trading at an attractive discount compared to the consensus estimate of their future worth. Analysts see the company as undervalued by 18% based on projected earnings growth and capital allocation efficiency, using a 4.37% discount rate.

"Lonza's strategic and diversified investments in cutting-edge manufacturing facilities (notably in mammalian, bioconjugate, cell & gene, and highly potent APIs) and automation upgrades (including the ongoing Vacaville and Visp expansions) are set to capture growing customer demand for next-generation therapies and support operating leverage. This points to higher-margin growth and improved group EBITDA margins."

Want to know what really powers this undervalued call? Uncover the ambitious growth story, bold profit margin forecasts, and fierce analyst debate set to reshape Lonza’s valuation future. Get ready to see which financial assumptions are making bulls optimistic about a major re-rating ahead.

Result: Fair Value of CHF665.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, changing foreign currency trends and high expansion risks in new manufacturing facilities could quickly challenge these upbeat analyst forecasts.

Find out about the key risks to this Lonza Group narrative.Another View: What Do Valuation Ratios Say?

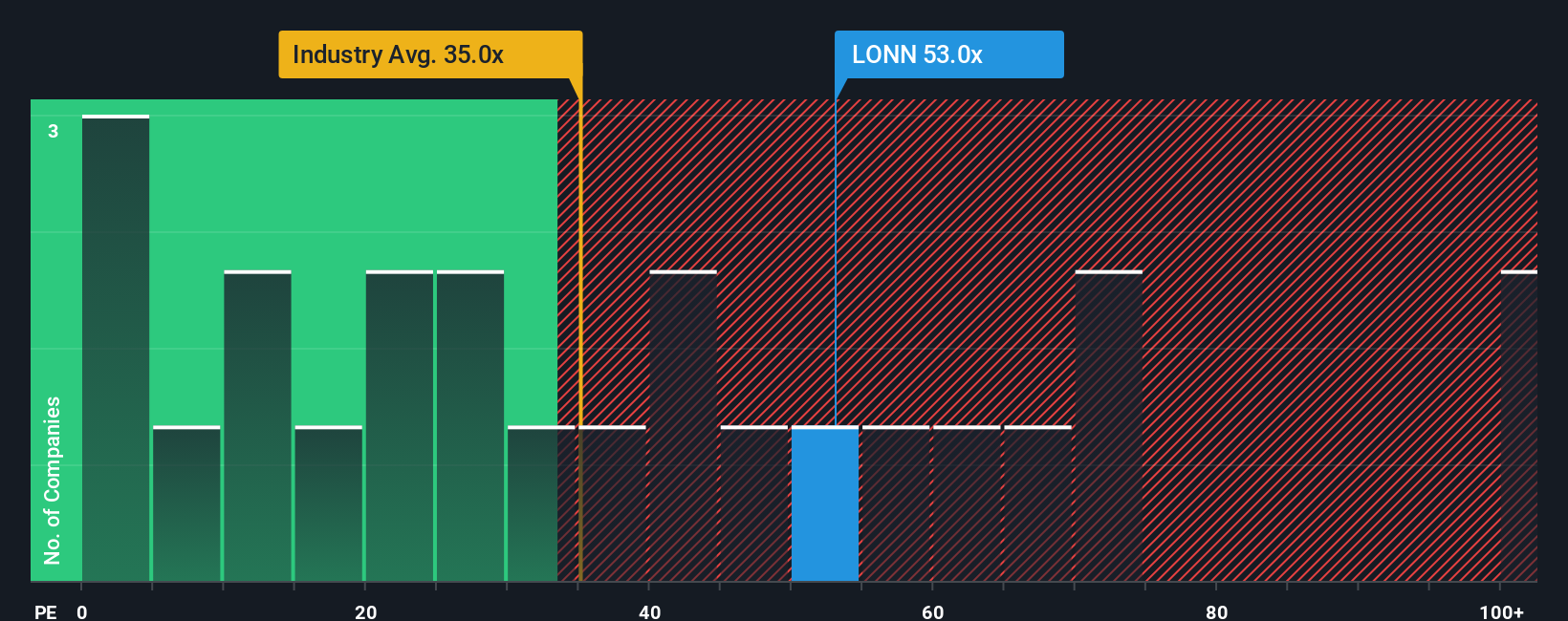

While analysts see upside based on future earnings and growth, current valuation ratios suggest Lonza's shares are expensive compared to the broader European Life Sciences industry. Could the market already be pricing in the optimism, or is there more potential left to unlock?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Lonza Group to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Lonza Group Narrative

If you see things differently or want to dive deeper, you can easily explore the numbers and shape your own perspective in just a few minutes. Do it your way

A great starting point for your Lonza Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities pass you by. Supercharge your research and find unique stocks tailored to your goals with these smart investment shortcuts:

- Unlock potential windfalls by targeting companies trading below their true worth with our list of undervalued stocks based on cash flows.

- Earn reliable income as you build wealth by zeroing in on dividend stocks with yields > 3% offering strong yields above 3%.

- Tap into rapid innovation and expansion by checking out breakthrough businesses in quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LONN

Lonza Group

Supplies various products and services for pharmaceutical, biotech, and nutrition markets in Europe, North and Central America, Latin America, Asia, Australia, New Zealand, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives