- Switzerland

- /

- Biotech

- /

- SWX:IDIA

Assessing Idorsia (SWX:IDIA) Valuation Following Recent Surge in Investor Attention

Reviewed by Kshitija Bhandaru

See our latest analysis for Idorsia.

Idorsia’s momentum this year has been remarkable, with its share price up 290% year-to-date and a 177% total shareholder return over the past twelve months, even as volatility picked up in recent weeks. Recent sharp swings suggest that investor confidence is rising on growth prospects; however, longer-term returns remain deeply negative for those holding since before the rally.

If this pharma rebound has you thinking broadly about what's next, you might discover some interesting opportunities via our See the full list for free.

The surge in Idorsia’s stock raises a key question for investors: is there still value to be unlocked here, or has the recent rally already incorporated all of the company’s expected future growth?

Most Popular Narrative: 4.5% Undervalued

According to the most widely followed narrative, Idorsia’s fair value has now climbed just above its last close price. After a period of significant optimism and upgraded expectations, this analysis marks a measured shift in outlook compared to previous forecasts.

Optimism regarding the accelerated advancement and eventual commercialization of a broad pipeline (including Fabry disease, chemokine antagonists, and the C. diff vaccine) may be inflating valuation through expectations of long-term multi-asset revenue streams. However, increased cost controls and funding needs persist until 2027 profitability.

Curious about the blockbuster product launches and strategic assumptions fueling this price target? Behind the headline value, there is a tug-of-war between future market expansion and margin breakthroughs. Unlock the narrative to see which big expectations and bold pipeline moves tip the scales.

Result: Fair Value of $4.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong commercial momentum for QUVIVIQ or major regulatory wins, such as U.S. descheduling, could quickly change expectations and drive upside for Idorsia’s outlook.

Find out about the key risks to this Idorsia narrative.

Another View: What Multiples Reveal

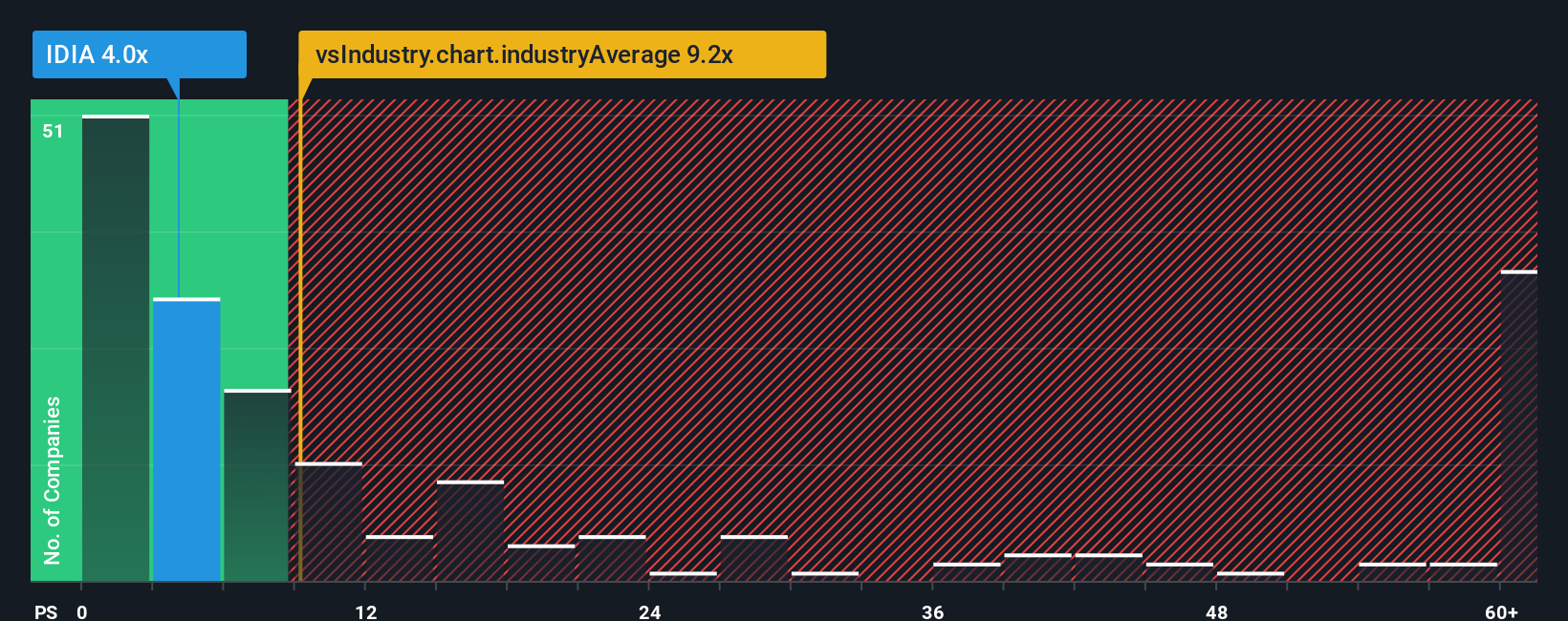

Looking through a different lens, Idorsia trades at a sales ratio of 3.8x, which is well below both its peer average of 6.5x and the broader European Biotechs sector at 9.3x. However, it still sits above its own fair ratio of 2.8x, highlighting both value relative to rivals and some downside risk if expectations cool. Do investors believe the rally is sustainable, or could sentiment shift if the story changes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Idorsia Narrative

If you see things differently or want to dive deeper into the numbers, you can craft your own perspective and shape a narrative in just a few minutes: Do it your way

A great starting point for your Idorsia research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors broaden their horizons and seize new opportunities before the crowd. Don’t let your next game-changing investment pass you by. These unique stock ideas are just a click away with Simply Wall Street’s powerful screener tools:

- Capture income potential from companies with strong, reliable yields when you start with these 18 dividend stocks with yields > 3%.

- Tap into digital transformation by sizing up leading innovators inside these 25 AI penny stocks that are reshaping tomorrow’s markets today.

- Uncover tomorrow’s market leaders at attractive valuations by scanning these 897 undervalued stocks based on cash flows and get ahead of the next big opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:IDIA

Idorsia

A biopharmaceutical company, engages in the discovery, development, and commercialization of drugs for unmet medical needs in Switzerland, the United States, Japan, Europe, China, and Canada.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives