- Switzerland

- /

- Pharma

- /

- SWX:GALD

3 Stocks That May Be Trading Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

In a week marked by volatility, global markets have been influenced by a mix of corporate earnings reports and geopolitical developments, with U.S. stocks experiencing fluctuations amid AI competition fears and tariff concerns. As investors navigate these complex market conditions, identifying stocks that may be trading below their estimated intrinsic value can offer potential opportunities for those looking to capitalize on discrepancies between market prices and underlying worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wistron (TWSE:3231) | NT$99.00 | NT$197.62 | 49.9% |

| Alltop Technology (TPEX:3526) | NT$265.00 | NT$528.78 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.90 | CA$11.79 | 50% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.17 | US$26.31 | 49.9% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.72 | €5.43 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.22 | SEK165.90 | 49.8% |

| Spin Master (TSX:TOY) | CA$30.23 | CA$60.17 | 49.8% |

| Coastal Financial (NasdaqGS:CCB) | US$86.74 | US$172.68 | 49.8% |

| Equifax (NYSE:EFX) | US$266.77 | US$531.78 | 49.8% |

| Facephi Biometria (BME:FACE) | €2.23 | €4.45 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

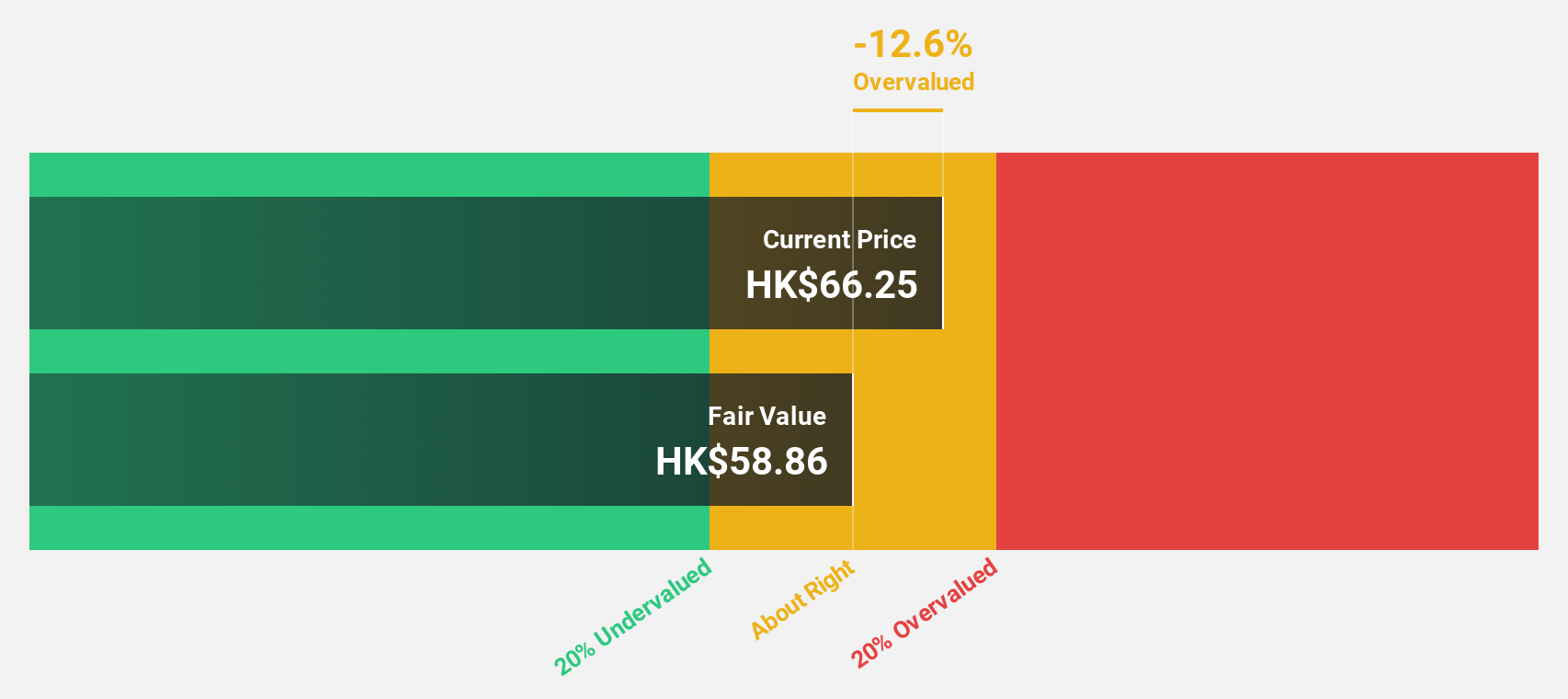

Kuaishou Technology (SEHK:1024)

Overview: Kuaishou Technology is an investment holding company that offers live streaming, online marketing, and other services in the People’s Republic of China, with a market cap of approximately HK$188.60 billion.

Operations: The company's revenue segments are comprised of Domestic operations generating CN¥119.83 billion and Overseas operations contributing CN¥4.25 billion.

Estimated Discount To Fair Value: 48.9%

Kuaishou Technology is trading at a significant discount to its estimated fair value, with shares priced 48.9% below this benchmark. The company's recent earnings report shows robust growth, with net income rising substantially year-over-year. Despite revenue growth projections being moderate at 8.7% annually, the company is expected to achieve higher profit growth compared to the Hong Kong market average. Recent product innovations and strategic buybacks further enhance its investment appeal based on cash flows.

- Insights from our recent growth report point to a promising forecast for Kuaishou Technology's business outlook.

- Navigate through the intricacies of Kuaishou Technology with our comprehensive financial health report here.

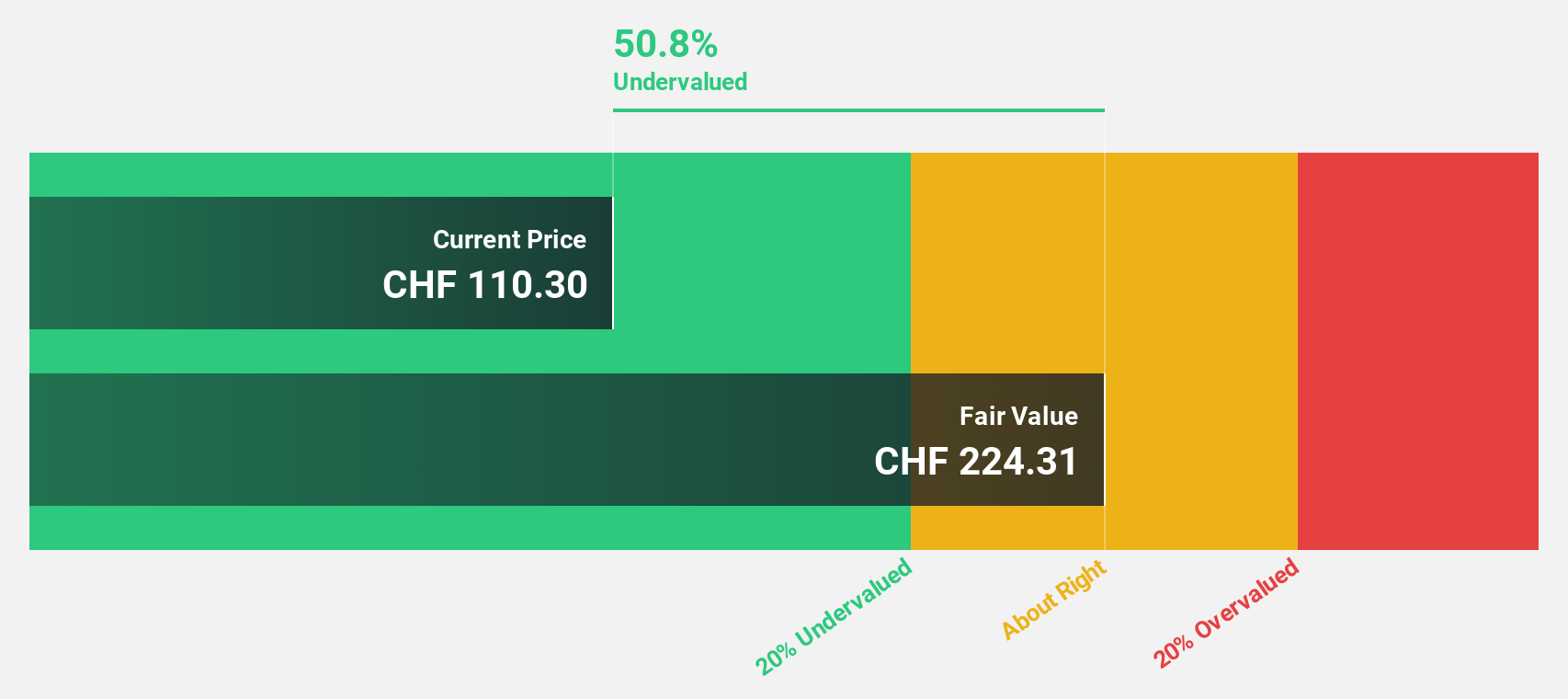

Galderma Group (SWX:GALD)

Overview: Galderma Group AG is a global dermatology company with a market capitalization of CHF26.90 billion.

Operations: The company's revenue segment includes Dermatology, generating $4.32 billion.

Estimated Discount To Fair Value: 48.9%

Galderma Group is trading at a significant discount, priced 48.9% below its estimated fair value of CHF227.38. Despite revenue growth being moderate at 11.1% annually, earnings are projected to grow by 36.57% per year, with profitability expected within three years—above the market average growth rate. Recent clinical trials and product innovations in their aesthetics portfolio highlight potential for sustained cash flow improvements, reinforcing its attractiveness as an undervalued stock based on cash flows.

- Our growth report here indicates Galderma Group may be poised for an improving outlook.

- Get an in-depth perspective on Galderma Group's balance sheet by reading our health report here.

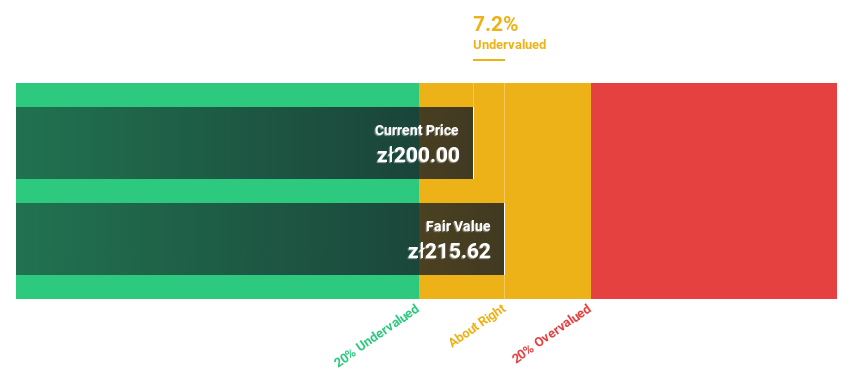

CCC (WSE:CCC)

Overview: CCC S.A. is a footwear company operating in Poland, Central and Eastern Europe, and Western Europe with a market cap of PLN11.76 billion.

Operations: The company's revenue segments include Dee Zee with PLN85.10 million, Eobuwie generating PLN3.01 billion, CCC Omnichannel contributing PLN4.31 billion, Modivo Omnichannel at PLN1.05 billion, and Halfprice Omnichannel with PLN1.68 billion.

Estimated Discount To Fair Value: 23.1%

CCC is trading at PLN176.3, significantly below its estimated fair value of PLN229.34, highlighting its undervaluation based on cash flows. The company recently became profitable, with third-quarter net income surging to PLN155.4 million from PLN5.1 million a year ago. Despite interest payment challenges, earnings are forecast to grow at 26.9% annually over three years—outpacing the Polish market—and revenue growth is expected at 11.7% per year, reflecting strong future prospects.

- Our comprehensive growth report raises the possibility that CCC is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of CCC stock in this financial health report.

Next Steps

- Unlock our comprehensive list of 930 Undervalued Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Galderma Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GALD

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives