- Switzerland

- /

- Chemicals

- /

- SWX:SIKA

Sika (SWX:SIKA) Forecasts 10% Annual Earnings Growth, Reinforcing Bullish Narratives Ahead of Earnings

Reviewed by Simply Wall St

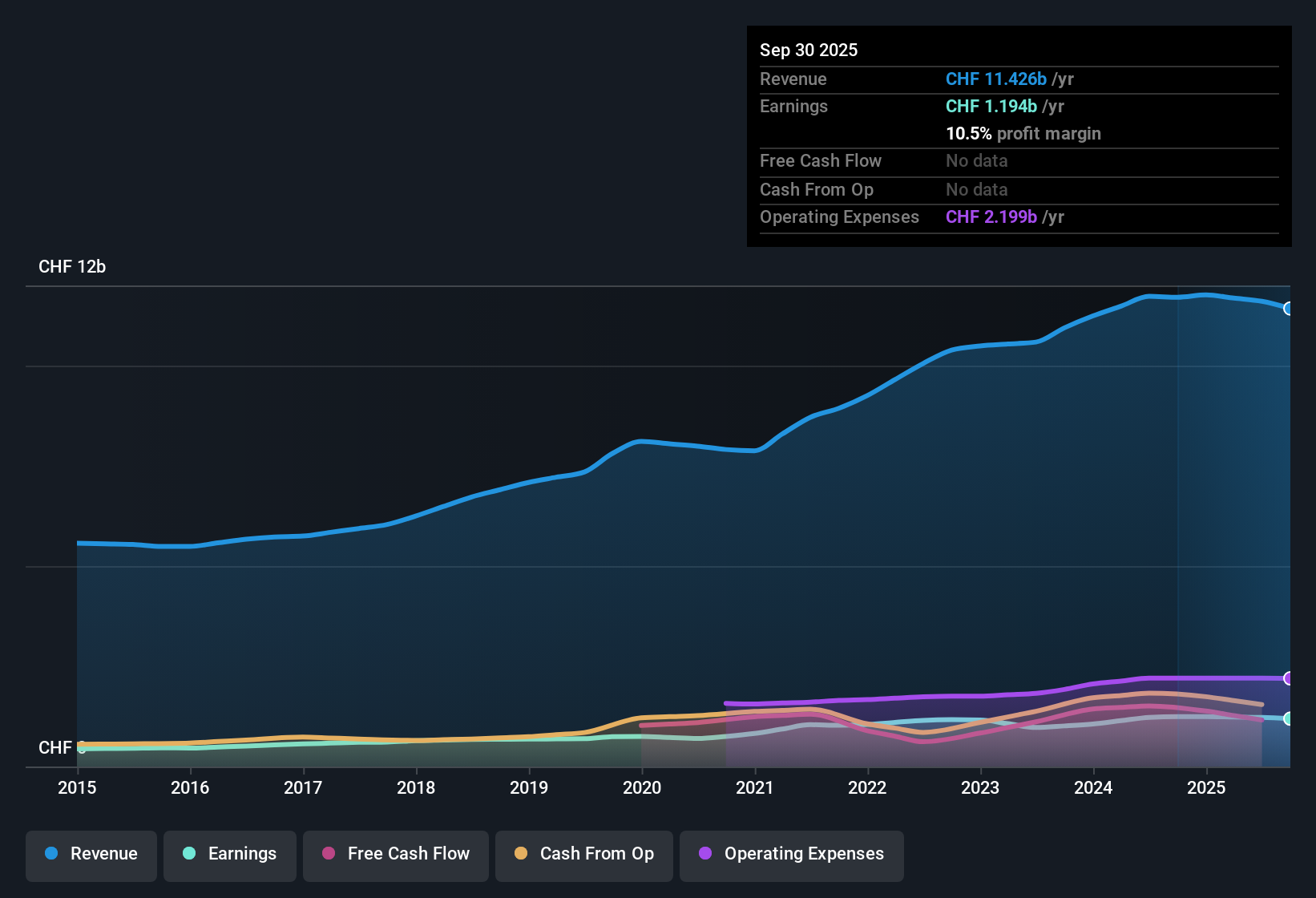

Sika (SWX:SIKA) delivered earnings forecast to grow at 10% per year, with revenue set to rise by 4.7% annually, outpacing the broader Swiss market’s projected 4% growth rate. Over the past five years, earnings have climbed by 6.9% each year, and the company has maintained a net profit margin of 10.5%, matching the prior period. These numbers, paired with Sika’s high-quality earnings profile and only minor risk concerns, provide investors with a constructive outlook anchored by continued profit growth and attractive relative value.

See our full analysis for Sika.Next up, we’ll see how these latest figures compare to the market narratives investors follow, and whether the numbers reinforce or challenge consensus views.

See what the community is saying about Sika

Profit Margin Expansion in Sight

- Analysts expect Sika’s profit margin to climb from 10.5% today to 12.3% by 2028, marking a material step up in earnings quality and efficiency derived from operational improvements and synergies.

- Consensus narrative notes that digitalization initiatives and ongoing acquisition integration are set to drive steady EBITDA margin improvement,

- Industry-wide moves toward high-margin solutions are already reflected in Sika’s ability to match the prior year’s 10.5% net margin while growing earnings per year at 6.9% over five years.

- The long-term shift to energy-efficient, low-carbon materials is helping Sika expand pricing power and protect margin gains against short-term market turbulence.

Analyst Price Target Sits 31% Above Market

- With Sika’s current share price at CHF176.00, the latest analyst price target of CHF230.83 stands 31% higher, reflecting optimism about multi-year profit and revenue growth.

- According to the consensus narrative, this target assumes Sika delivers CHF13.2 billion in revenue and CHF1.6 billion in earnings by 2028,

- To reach the target, Sika would need to trade on a forward PE of 28.5x, above today’s 23.1x, and higher than the industry at 26.5x. This implies the market sees further “rerating” potential if targets are hit.

- Bears highlight that analyst forecasts do differ, with some as low as CHF185.00, underlining the importance of testing these scenarios against your own expectations.

Valuation: Peer Discount Yet DCF Implies Large Upside

- Sika’s PE ratio of 23.1x is below its peer group average of 25.8x, but above the broader European Chemicals sector at 17.2x. Its share price trades at a sharp discount to a DCF fair value of CHF325.70.

- Consensus narrative makes clear that investors are weighing Sika’s higher valuation against structural growth drivers and low risk profile,

- The sizable 46% gap between the current price and DCF fair value is a key argument for upside, provided revenue and margin trajectories stay on track.

- Meanwhile, limited flagged risks, mostly related to integration and currency headwinds, lend some confidence to the constructive valuation outlook grounded in the underlying business fundamentals.

If you want to see how all sides stack up, including the full range of community narratives and the numbers behind each perspective, dive into the details with the consensus view for Sika. 📊 Read the full Sika Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sika on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these figures? In just a few minutes, you can shape your perspective into a fresh narrative by using Do it your way.

A great starting point for your Sika research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Sika’s valuation looks compelling, some investors remain cautious about the risk that higher future earnings expectations may not materialize. This could leave shares looking expensive relative to the industry.

If overpaying is a concern for you, quickly compare with these 881 undervalued stocks based on cash flows to target stocks backed by strong cash flow and attractive entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SIKA

Sika

A specialty chemicals company, develops, produces, and sells systems and products for bonding, sealing, damping, reinforcing, and protecting in the building sector and motor vehicle industry worldwide.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)