- Switzerland

- /

- Chemicals

- /

- SWX:SIKA

July 2024 Insights Into Three Stocks Estimated as Undervalued on SIX Swiss Exchange

Reviewed by Simply Wall St

Swiss stocks recently showcased robust performance, with the benchmark SMI index climbing 0.95% amid positive earnings expectations and favorable interest rate outlooks. This buoyant market environment underscores the potential for identifying undervalued stocks that could offer appealing opportunities for investors attentive to valuation metrics and market trends.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sulzer (SWX:SUN) | CHF132.80 | CHF221.74 | 40.1% |

| COLTENE Holding (SWX:CLTN) | CHF47.40 | CHF77.41 | 38.8% |

| Burckhardt Compression Holding (SWX:BCHN) | CHF595.00 | CHF858.78 | 30.7% |

| Temenos (SWX:TEMN) | CHF64.90 | CHF85.32 | 23.9% |

| Julius Bär Gruppe (SWX:BAER) | CHF51.30 | CHF95.50 | 46.3% |

| Sonova Holding (SWX:SOON) | CHF273.30 | CHF468.07 | 41.6% |

| SGS (SWX:SGSN) | CHF81.04 | CHF125.50 | 35.4% |

| Comet Holding (SWX:COTN) | CHF371.00 | CHF589.71 | 37.1% |

| Medartis Holding (SWX:MED) | CHF72.80 | CHF131.32 | 44.6% |

| Sika (SWX:SIKA) | CHF259.00 | CHF338.90 | 23.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

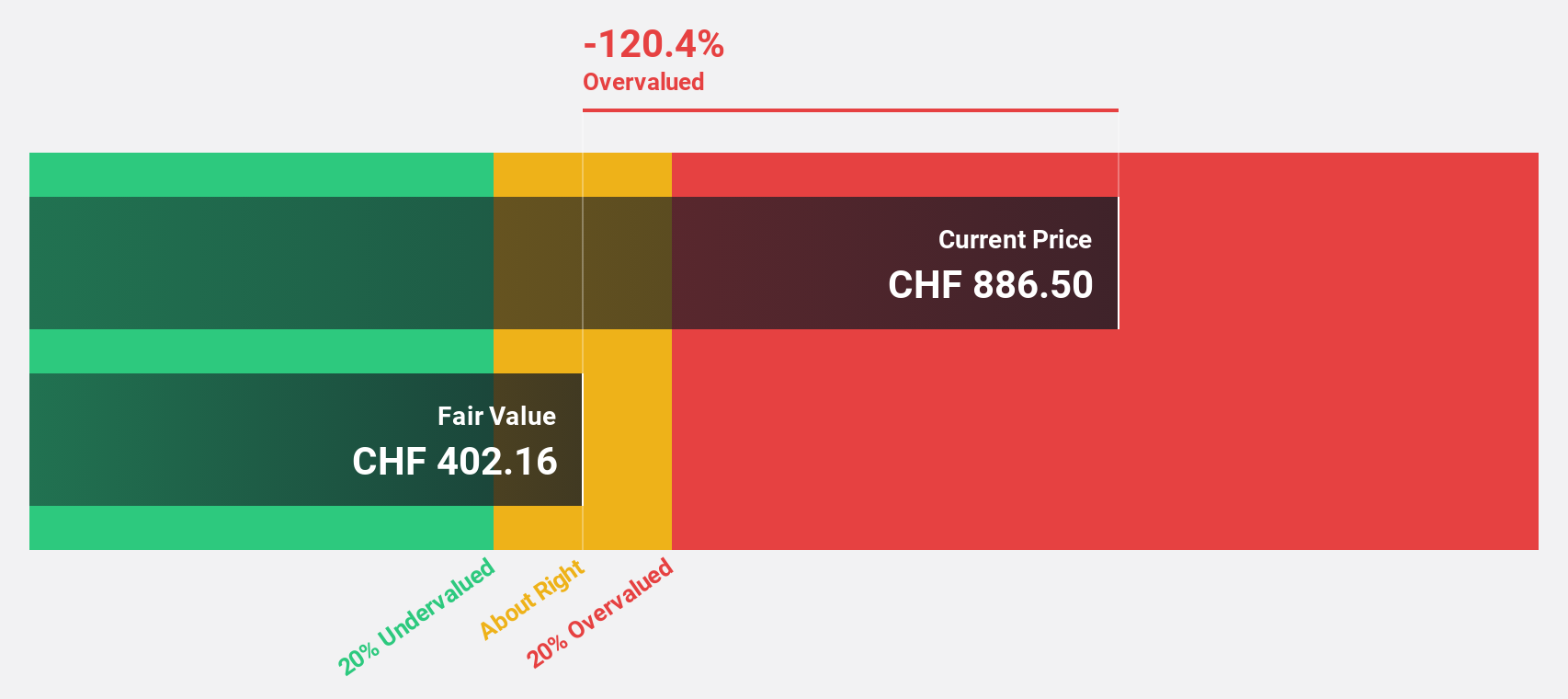

Barry Callebaut (SWX:BARN)

Overview: Barry Callebaut AG operates in the manufacturing and sale of chocolate and cocoa products, with a market capitalization of approximately CHF 8.75 billion.

Operations: The company's revenue is derived from its Global Cocoa segment, which generated CHF 5.31 billion.

Estimated Discount To Fair Value: 12.5%

Barry Callebaut, priced at CHF1599, trades below our fair value estimate of CHF1827.66, reflecting a modest undervaluation. Despite this, the company's revenue and earnings growth are forecasted to outpace the Swiss market at 7.4% and 25.2% per year respectively. However, its debt is not well covered by operating cash flows, introducing some financial risk. The recent sales trading statement on May 2nd indicates sustained operational activity but does not significantly alter the financial outlook.

- Our earnings growth report unveils the potential for significant increases in Barry Callebaut's future results.

- Take a closer look at Barry Callebaut's balance sheet health here in our report.

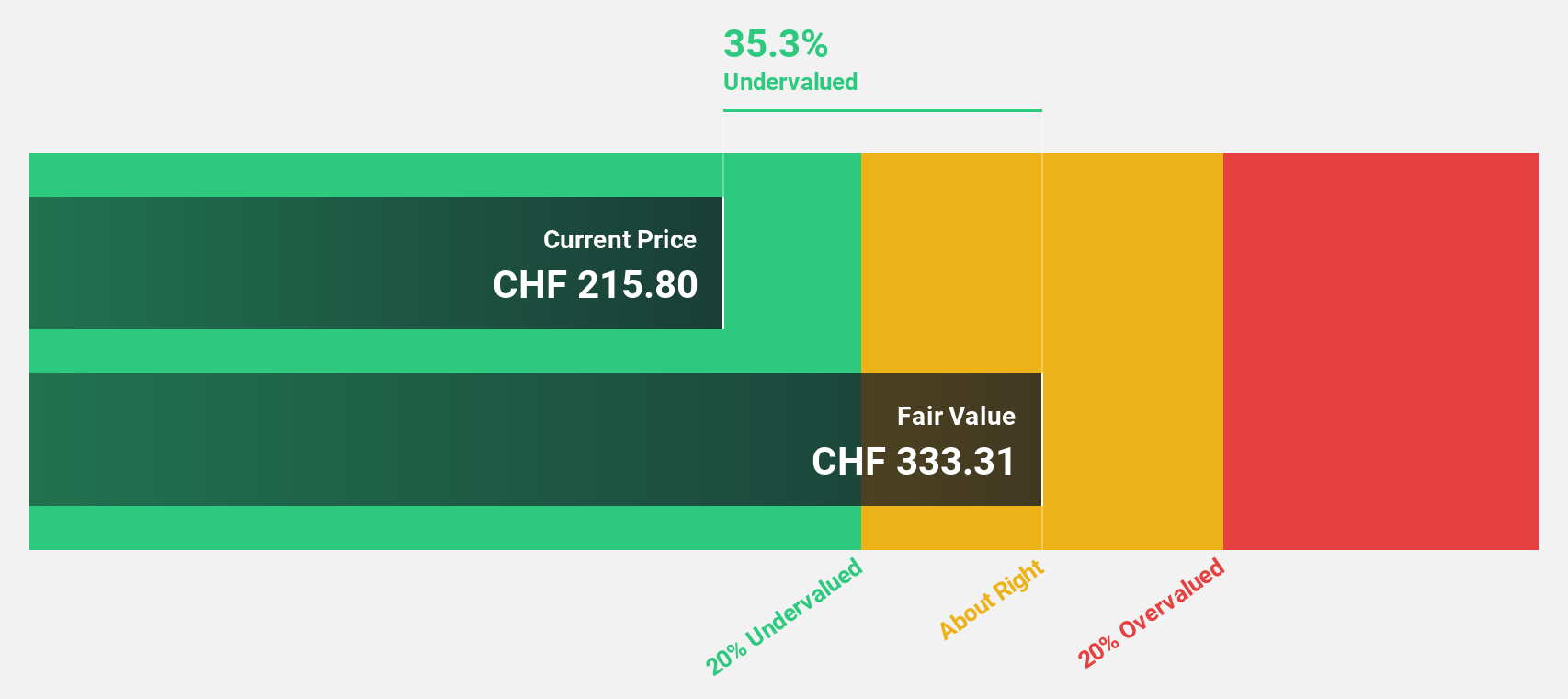

Sika (SWX:SIKA)

Overview: Sika AG is a specialty chemicals company that offers products and systems for bonding, sealing, damping, reinforcing, and protecting in the construction and automotive industries globally, with a market capitalization of approximately CHF 41.55 billion.

Operations: Sika's revenue is derived mainly from two segments: CHF 9.45 billion from construction industry products and CHF 1.78 billion from industrial manufacturing products.

Estimated Discount To Fair Value: 23.6%

Sika, valued at CHF259, is perceived as undervalued with a fair value estimate of CHF338.9, trading 23.6% below this mark. Its revenue and earnings growth forecasts of 6.1% and 12.7% respectively outstrip the Swiss market predictions, though the company's high debt levels pose some financial concerns. Recent expansions in China and Peru highlight strategic growth initiatives aimed at meeting increasing market demands and enhancing sustainability in construction materials.

- According our earnings growth report, there's an indication that Sika might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Sika.

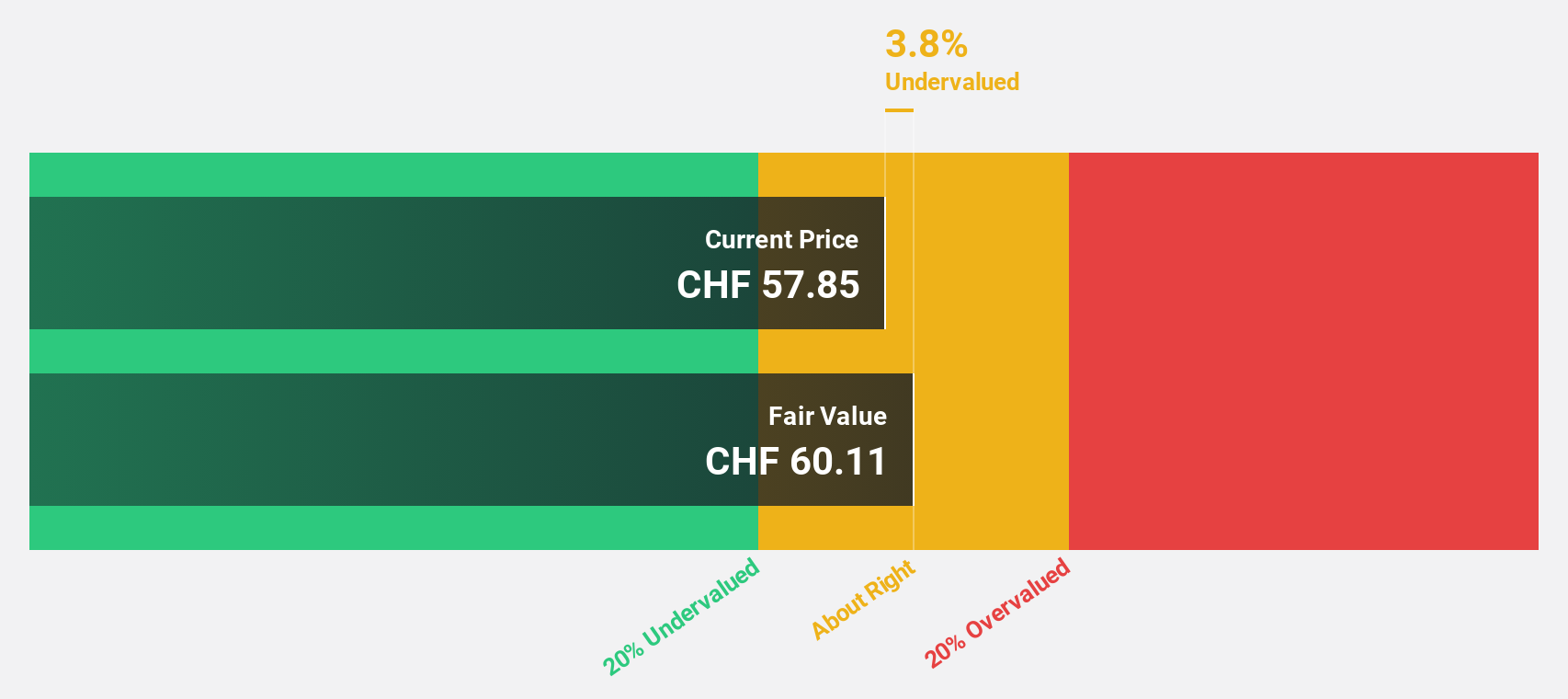

Temenos (SWX:TEMN)

Overview: Temenos AG is a global company that develops, markets, and sells integrated banking software systems to financial institutions, with a market capitalization of approximately CHF 4.70 billion.

Operations: The company generates its revenue by providing integrated banking software systems to financial institutions globally.

Estimated Discount To Fair Value: 23.9%

Temenos, priced at CHF64.9, is considered undervalued with a fair value estimate of CHF85.32, reflecting a significant discount. While its revenue growth at 7.6% annually is modest compared to some market benchmarks, earnings are expected to increase by 14.7% yearly, outpacing the Swiss market's 8.3%. However, high debt levels and share price volatility present challenges. Recent strategic moves include a share buyback program and partnerships for digital transformations with Haventree Bank and PC Financial®, enhancing its business agility and market reach through scalable SaaS solutions.

- Our comprehensive growth report raises the possibility that Temenos is poised for substantial financial growth.

- Get an in-depth perspective on Temenos' balance sheet by reading our health report here.

Next Steps

- Click here to access our complete index of 14 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SIKA

Sika

A specialty chemicals company, develops, produces, and sells systems and products for bonding, sealing, damping, reinforcing, and protecting in the building sector and motor vehicle industry worldwide.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion