- Switzerland

- /

- Chemicals

- /

- SWX:GIVN

Givaudan (SWX:GIVN): Reassessing Valuation After Cautious Outlook and Softer Q4 Performance

Reviewed by Simply Wall St

Givaudan (SWX:GIVN) is back in focus after its shares slid more than 5% when management stopped short of reaffirming full year sales growth guidance and flagged tougher market conditions alongside softer than expected Q4 growth.

See our latest analysis for Givaudan.

That cautious tone has landed on a stock that was already under pressure, with a 1 month share price return of minus 9.63% and a 1 year total shareholder return of minus 22.53%, even though the 3 year total shareholder return is still positive at 13.85%.

If Givaudan’s reset has you rethinking your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership for other compelling stories with strong backing from insiders.

With the shares trading at a sizeable discount to analyst targets, but growth expectations clearly moderating, the real question now is whether Givaudan is quietly undervalued or if the market is already pricing in its next chapter of growth.

Most Popular Narrative: 23.7% Undervalued

With Givaudan last closing at CHF 3,070 against a narrative fair value of around CHF 4,021, the valuation debate is shifting from premium to potential mispricing.

The company continues to outpace industry peers, in part due to its innovation pipeline. Launches of sustainable, natural ingredients (e.g., FDA-approved color solutions, algae-derived beauty actives) directly align with consumer shifts toward health, wellness, and clean label products, supporting both top-line growth and potential margin expansion.

Curious how steady mid single digit growth, rising margins and a richer earnings multiple combine to justify that upside gap? The full narrative unpacks the revenue trajectory, profitability lift and future valuation multiple that underpin this higher fair value, all discounted at just under 4.5%.

Result: Fair Value of $4021.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could be challenged if margin pressure from higher input costs persists, or if antitrust investigations result in material fines and reputational damage.

Find out about the key risks to this Givaudan narrative.

Another View: Rich Multiples, Different Story

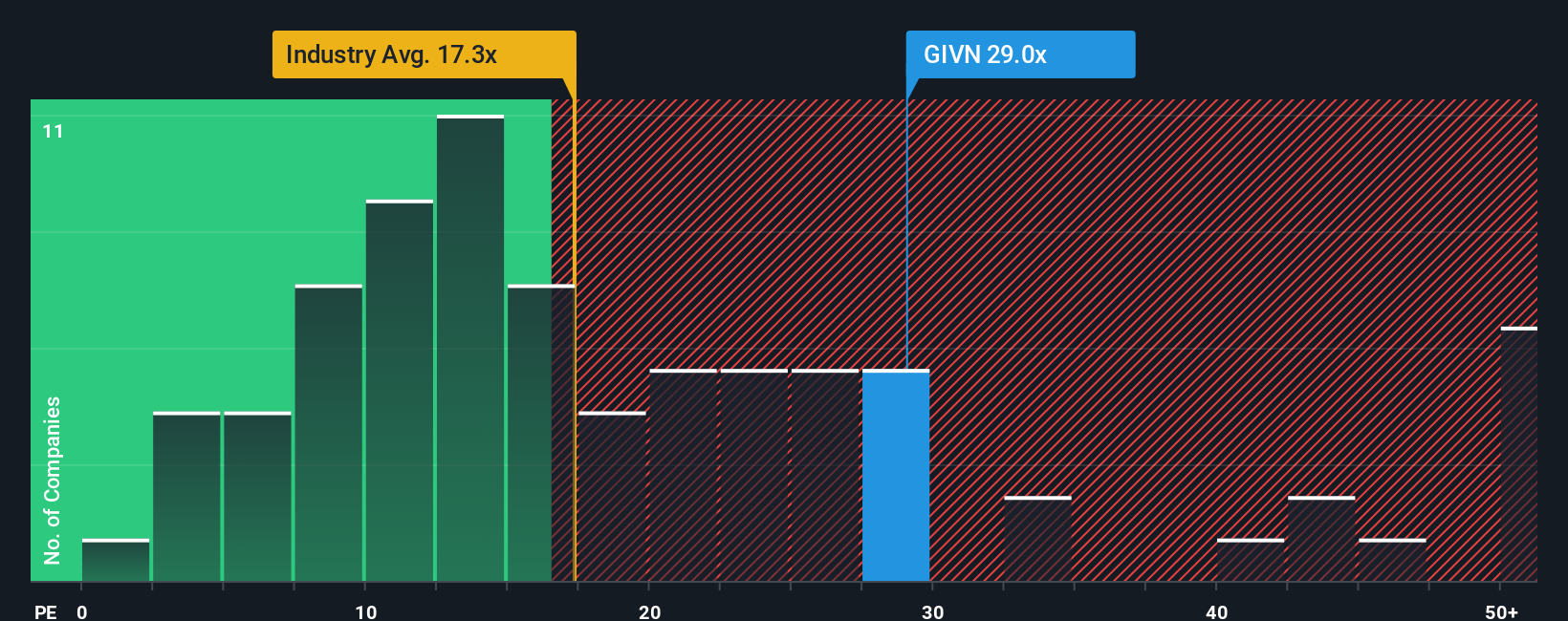

Step away from narratives and the price to earnings ratio paints a tougher picture. Givaudan trades on 25.9 times earnings versus a fair ratio of 19.2 times, the European chemicals average of 17.2 times and a 24.2 times peer average. This suggests valuation risk if sentiment sours.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Givaudan Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Givaudan research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investing ideas?

Before you move on, lock in your next opportunity by using the Simply Wall St Screener to uncover fresh, data backed stocks that match your strategy.

- Capture early stage growth by scanning these 3613 penny stocks with strong financials that already show stronger fundamentals than most of their small cap peers.

- Capitalize on transformational trends by targeting these 26 AI penny stocks poised to benefit from accelerating adoption of intelligent automation and machine learning.

- Strengthen your portfolio’s value core with these 903 undervalued stocks based on cash flows that still look cheap on cash flow projections despite solid operating performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GIVN

Givaudan

Manufactures, supplies, and sells fragrance, beauty, taste, and wellbeing products to the consumer goods industry.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)