- Switzerland

- /

- Chemicals

- /

- SWX:CLN

Clariant (SWX:CLN) Is Down 5.0% After €2 Billion Legal Claims From BP and ExxonMobil – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Clariant recently announced it received two significant legal claims from BP Europe SE and ExxonMobil Petroleum & Chemical B.V., amounting to around €1.10 billion and €860 million respectively, following competition law infringement proceedings on the ethylene purchasing market in Germany that were sanctioned by the European Commission in 2020.

- This development highlights a substantial legal and financial risk for Clariant, as the company firmly rejects the claims and intends to contest the allegations, referencing its own economic evidence of no market impact from the conduct.

- We'll explore how these large-scale legal claims may alter Clariant's investment prospects and future risk profile.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Clariant Investment Narrative Recap

To be a Clariant shareholder today is to believe in the company's ability to deliver strong earnings growth from its specialty chemicals shift, margin improvements, and innovation pipeline, while withstanding challenges like legal disputes and persistent industrial production uncertainty. The recent claims from BP and ExxonMobil, together totaling nearly €2 billion, introduce significant legal and financial risks that could directly threaten Clariant’s near-term risk profile and potentially outweigh operating catalysts in the short term.

Relevant to this legal uncertainty, Clariant’s latest earnings showed a drop in net income and sales for the first half of 2025, coupled with lowered annual sales guidance. While the specialty focus and cost savings initiatives remain catalysts for future margin recovery, the sharp dip in profitability and added legal claims are likely to dominate investor attention as they assess Clariant's ability to defend its financial and market position.

On the other hand, beyond industrial headwinds, the outstanding scale of litigation claims is information investors should be aware of, especially as...

Read the full narrative on Clariant (it's free!)

Clariant's outlook anticipates CHF4.5 billion in revenue and CHF358.4 million in earnings by 2028. This is based on an annual revenue growth rate of 3.3% and a CHF245.4 million increase in earnings from the current CHF113.0 million.

Uncover how Clariant's forecasts yield a CHF10.58 fair value, a 51% upside to its current price.

Exploring Other Perspectives

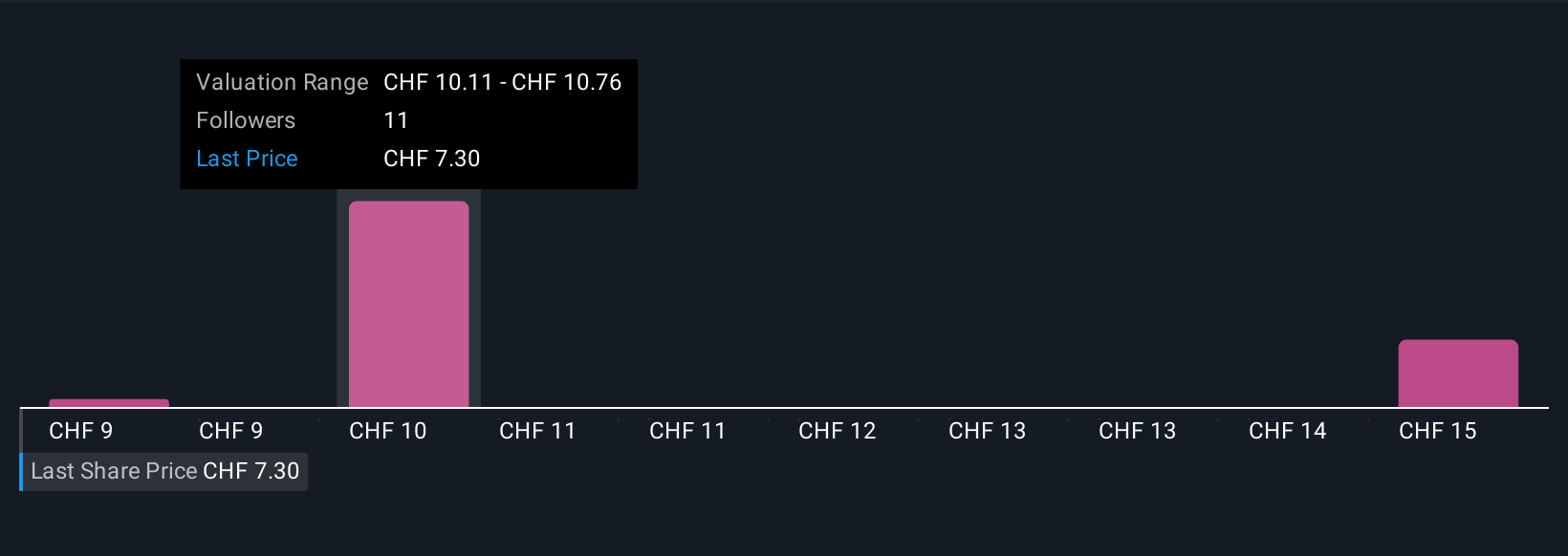

Simply Wall St Community members provided four fair value estimates for Clariant ranging from CHF8.80 to CHF15.29 per share. Against this broad spectrum of views, current legal risks threaten to challenge even optimistic earnings growth forecasts, offering plenty of alternative perspectives for you to consider.

Explore 4 other fair value estimates on Clariant - why the stock might be worth just CHF8.80!

Build Your Own Clariant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clariant research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Clariant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clariant's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CLN

Clariant

Develops, manufactures, distributes, and sells specialty chemicals in Switzerland, Europe, the Middle East, Africa, the United States, and the Asia Pacific.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives