- Switzerland

- /

- Chemicals

- /

- SWX:CLN

3 Dividend Stocks To Consider With Up To 4.1% Yield

Reviewed by Simply Wall St

As global markets continue to respond positively to political developments and AI-related investments, major indices like the S&P 500 have reached record highs, reflecting investor optimism. In this buoyant environment, dividend stocks can offer a blend of income and potential capital appreciation, making them an attractive consideration for those looking to benefit from stable returns amidst evolving market dynamics.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.24% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.57% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.51% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1959 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

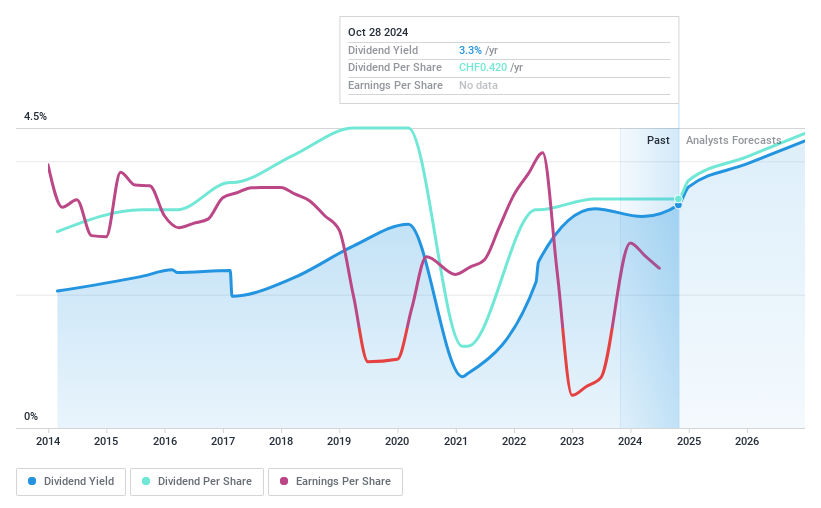

Clariant (SWX:CLN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clariant AG develops, manufactures, distributes, and sells specialty chemicals globally with a market cap of CHF3.39 billion.

Operations: Clariant AG's revenue is derived from three main segments: Catalysis (CHF927 million), Care Chemicals (CHF2.22 billion), and Adsorbents & Additives (CHF1.02 billion).

Dividend Yield: 4.1%

Clariant's dividend yield of 4.07% ranks in the top 25% of Swiss dividend payers, but its sustainability is questionable with a high payout ratio of 117.1%, indicating dividends are not well covered by earnings. Despite a reasonable cash payout ratio of 55%, past dividend payments have been volatile and unreliable over the last decade. Recent legal issues, including a €1.4 billion lawsuit from BASF, could further impact financial stability and future payouts.

- Unlock comprehensive insights into our analysis of Clariant stock in this dividend report.

- According our valuation report, there's an indication that Clariant's share price might be on the cheaper side.

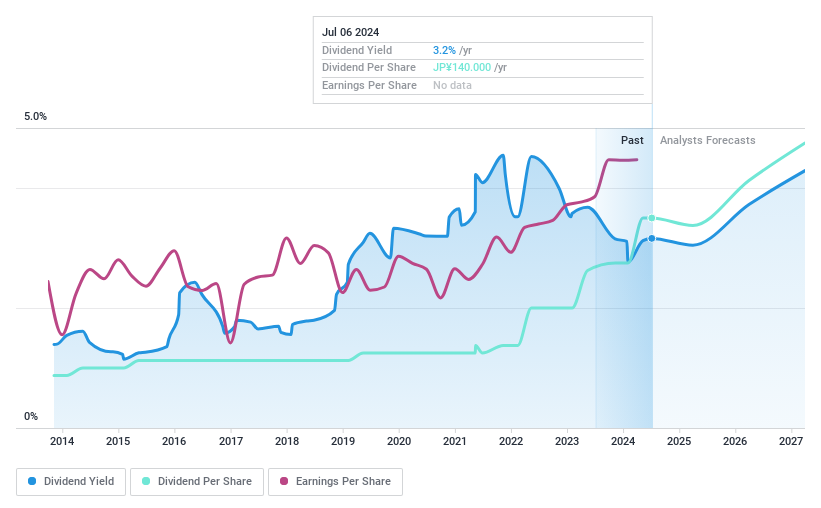

Rix (TSE:7525)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Rix Corporation manufactures and sells machinery equipment and industrial materials in Japan, with a market cap of ¥23.59 billion.

Operations: Rix Corporation's revenue is primarily derived from segments including Car at ¥11.42 billion, Steel and Iron at ¥14.34 billion, Electronics and Semiconductor at ¥6.84 billion, Rubber/Tire at ¥3.85 billion, Environment at ¥3.01 billion, Machine Tools at ¥2.24 billion, Paper and Pulp at ¥993 million, and Highly Functional Materials at ¥2.26 billion.

Dividend Yield: 4.1%

Rix Corporation's dividend yield of 4.12% ranks in the top 25% of Japanese payers, supported by a low payout ratio of 39%, indicating dividends are well covered by earnings and cash flows (51.8%). However, recent dividends have decreased to JPY 53 per share from JPY 70 a year ago, reflecting volatility over the past decade. Despite improved financial guidance for FY2025 with net sales expected at ¥52 billion, dividend reliability remains uncertain.

- Click here to discover the nuances of Rix with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Rix's share price might be too pessimistic.

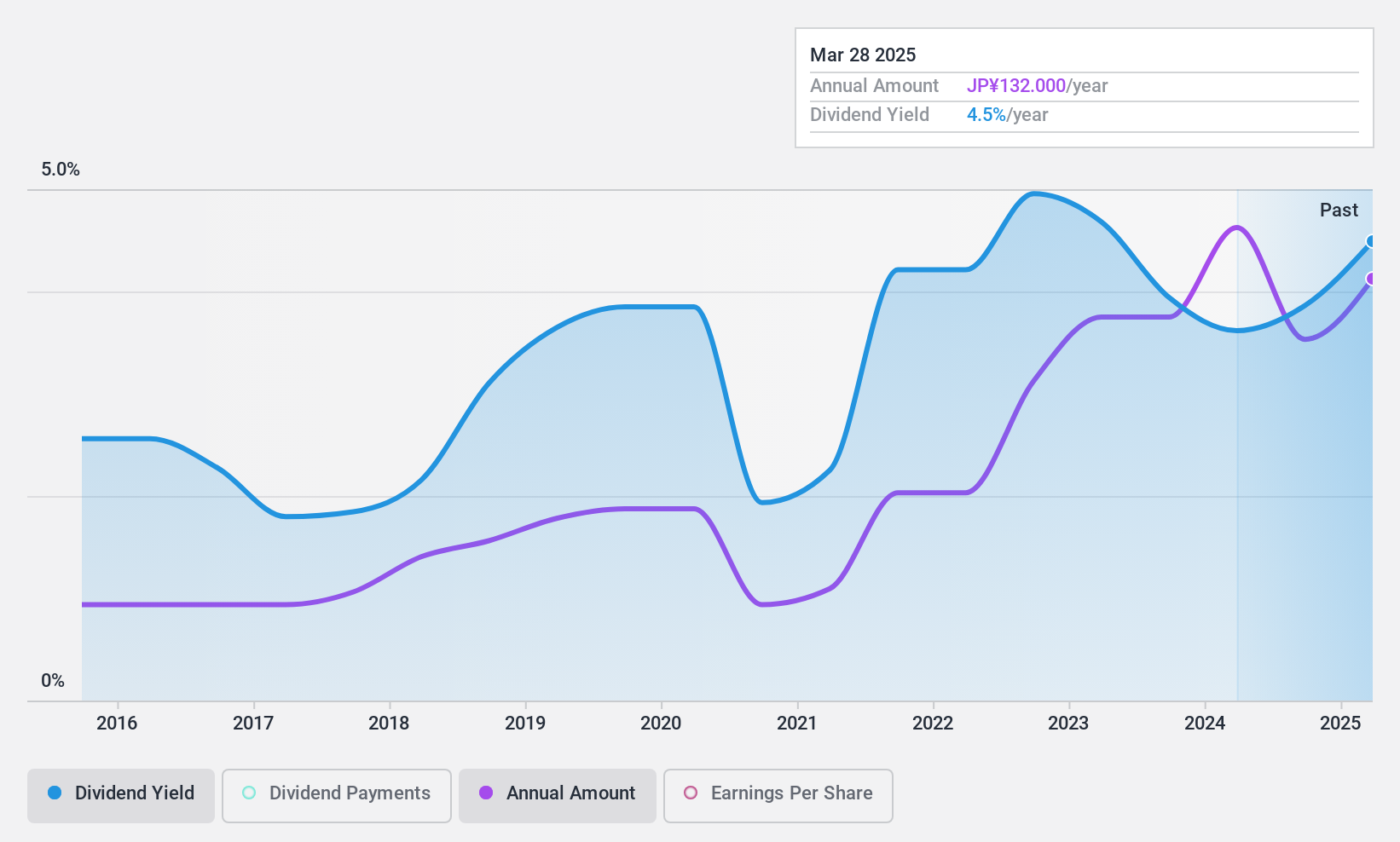

77 Bank (TSE:8341)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The 77 Bank, Ltd., along with its subsidiaries, offers banking products and services to corporate and individual clients in Japan, with a market cap of ¥336.99 billion.

Operations: The 77 Bank, Ltd. generates its revenue primarily from its Banking Business segment, which accounts for ¥154.27 billion.

Dividend Yield: 3.4%

77 Bank's dividend yield of 3.41% is below the top tier in Japan, yet it offers stability with a decade of reliable and growing payments. Recent increases to JPY 77.50 per share highlight its commitment to shareholders, supported by a low payout ratio of 33.7%. Despite high bad loans at 2%, earnings growth and revised profit forecasts suggest financial strength, though future dividend coverage remains uncertain due to insufficient data on sustainability.

- Get an in-depth perspective on 77 Bank's performance by reading our dividend report here.

- The analysis detailed in our 77 Bank valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Click this link to deep-dive into the 1959 companies within our Top Dividend Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CLN

Clariant

Engages in the development, manufacture, distribution, and sale of specialty chemicals worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives