- Switzerland

- /

- Basic Materials

- /

- SWX:AMRZ

Does the Recent Amrize Partnership Signal a New Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

Deciding what to do with Amrize at this moment can feel a bit like standing at a crossroads. Maybe you have watched the price tick up 2.4% over the last week and wondered if this is the start of a comeback. At the same time, the stock is still down 9.0% for the past 30 days and has lost 16.4% so far this year, reflecting the market’s uncertainty and shifting appetite for risk in this sector. Some recent developments in the broader market seem to have nudged investors’ perception of Amrize, highlighting both its resilience and its volatility.

The big question, of course, is whether the current share price of $38.52 represents a real opportunity or just a warning sign in disguise. That is where valuation comes in. Amrize’s value score sits at 4. Out of 6 different valuation checks, it is considered undervalued in 4. That might catch the eye of bargain hunters, but it does not tell the whole story on its own.

Let’s break down each of the major ways analysts judge whether a stock is undervalued, fairly priced, or overhyped. After looking at the standard valuation playbook, we will explore an approach that gives an even clearer picture of Amrize’s true worth.

Approach 1: Amrize Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future cash flows and discounting them back to today's value. This method captures what Amrize might be worth based on its ability to generate cash long term, instead of only assessing current earnings or assets.

Currently, Amrize reports a Last Twelve Months (LTM) Free Cash Flow of $1.24 Billion. Analyst forecasts suggest this figure will climb steadily, with projections reaching $2.50 Billion in annual Free Cash Flow by 2029, before transitioning to more modest extrapolated growth over the next years.

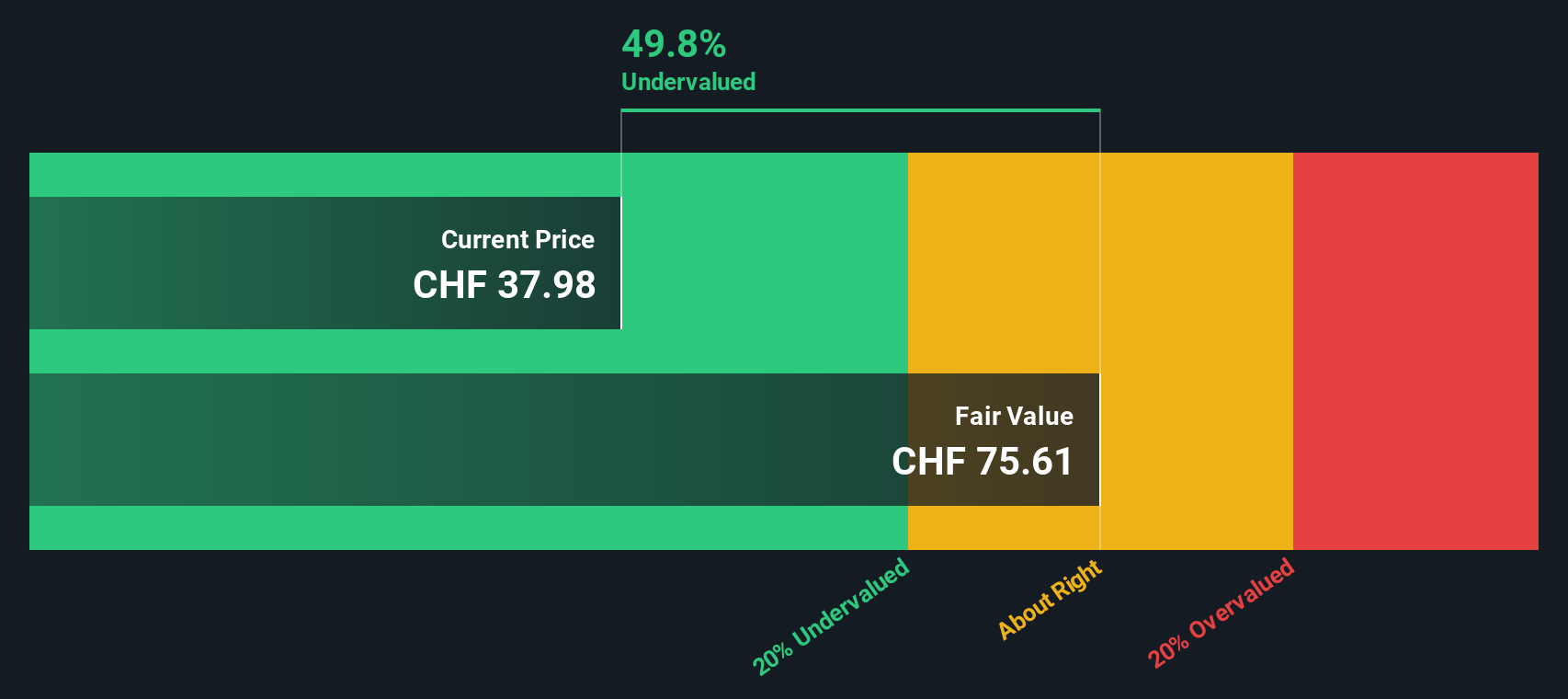

Using these cash flow estimates, combined with a 2 Stage Free Cash Flow to Equity approach, the DCF model calculates an intrinsic fair value of $75.07 per share for Amrize. This figure is significantly higher than the current share price of $38.52, indicating a 48.7% implied discount. In other words, the DCF signals that Amrize’s current market value does not fully reflect its long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amrize is undervalued by 48.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Amrize Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is the preferred method for valuing profitable companies like Amrize, as it directly relates the share price to the company's actual earnings. By showing how much investors are willing to pay for each dollar of earnings, the PE ratio offers a clear window into market expectations regarding profitability and future growth.

What constitutes a “normal” or “fair” PE ratio can shift depending on growth prospects and perceived risk. Companies expecting rapid and sustained earnings growth typically justify higher PE ratios. Those facing more uncertainty or slower growth often trade at a discount.

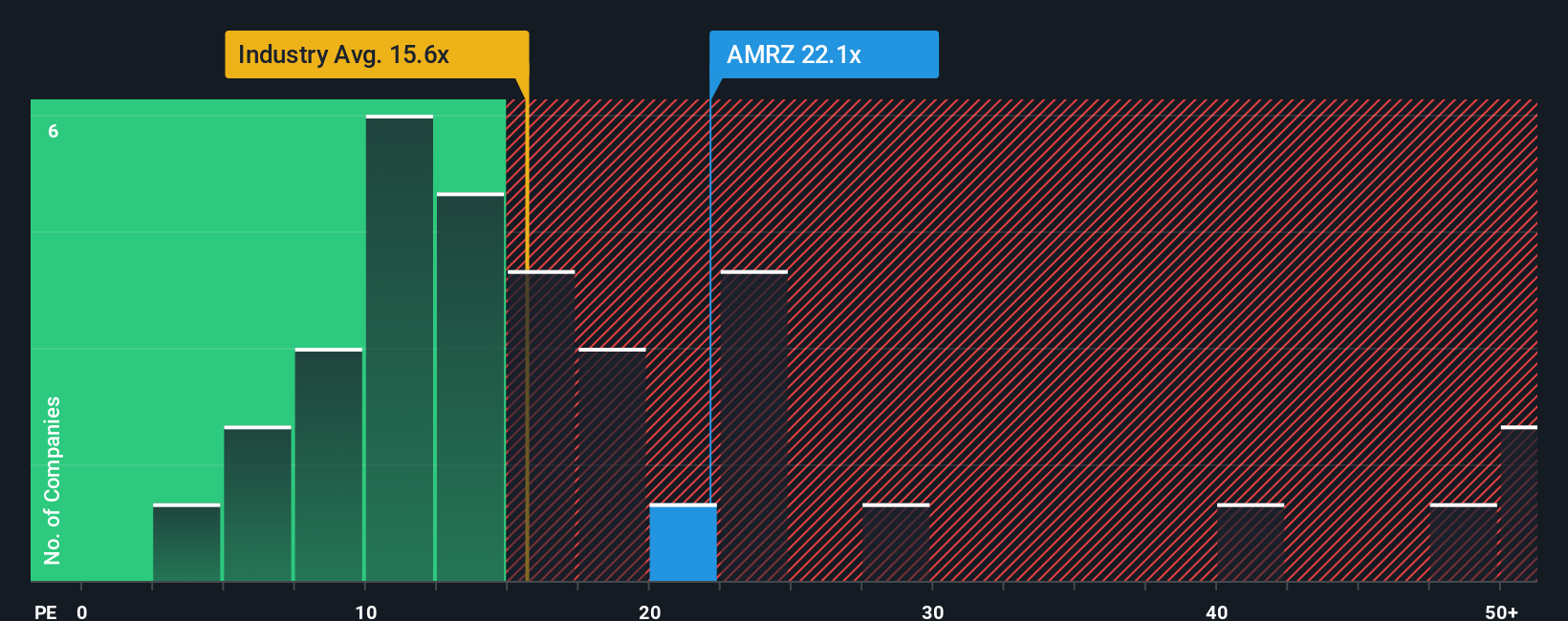

Amrize currently trades at a PE ratio of 22.6x. This is nearly identical to its peer average of 22.8x and significantly above the Basic Materials industry average of 15.6x. While raw comparisons can be helpful, they are incomplete.

Simply Wall St’s proprietary “Fair Ratio” goes a step further. Unlike basic benchmarks, the Fair Ratio estimates what a reasonable PE should be by factoring in not just peer and industry data but also Amrize’s specific earnings growth, profit margins, risk factors, and overall market capitalization. This tailored approach aims to give a more meaningful signal for investors weighing the current valuation.

Comparing Amrize’s actual PE to its Fair Ratio reveals how the market currently views the company relative to its fundamentals. Based on the data, the difference between Amrize’s PE and its Fair Ratio is minimal and well within the 0.10 range, suggesting the stock is valued about right compared to these advanced metrics.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amrize Narrative

Earlier, we mentioned there is an even better way to understand valuation, and this is where Narratives come into play. A Narrative is a simple yet powerful story that you create about a company, explaining your assumptions behind its future revenue, profits, and fair value. This approach essentially connects the company’s story with the numbers that drive investment decisions.

With Narratives, you can see how a company’s outlook transforms into a financial forecast and then into a fair value estimate, making your decision process much more transparent and personal. Narratives are accessible to everyone on Simply Wall St’s platform, where millions of investors share their perspectives on the Community page.

This tool makes it easy to compare your fair value estimate with the current share price, so you can judge for yourself whether it is the right time to buy or sell. In addition, Narratives automatically update with new information like news or earnings reports, helping you stay in sync with the latest developments.

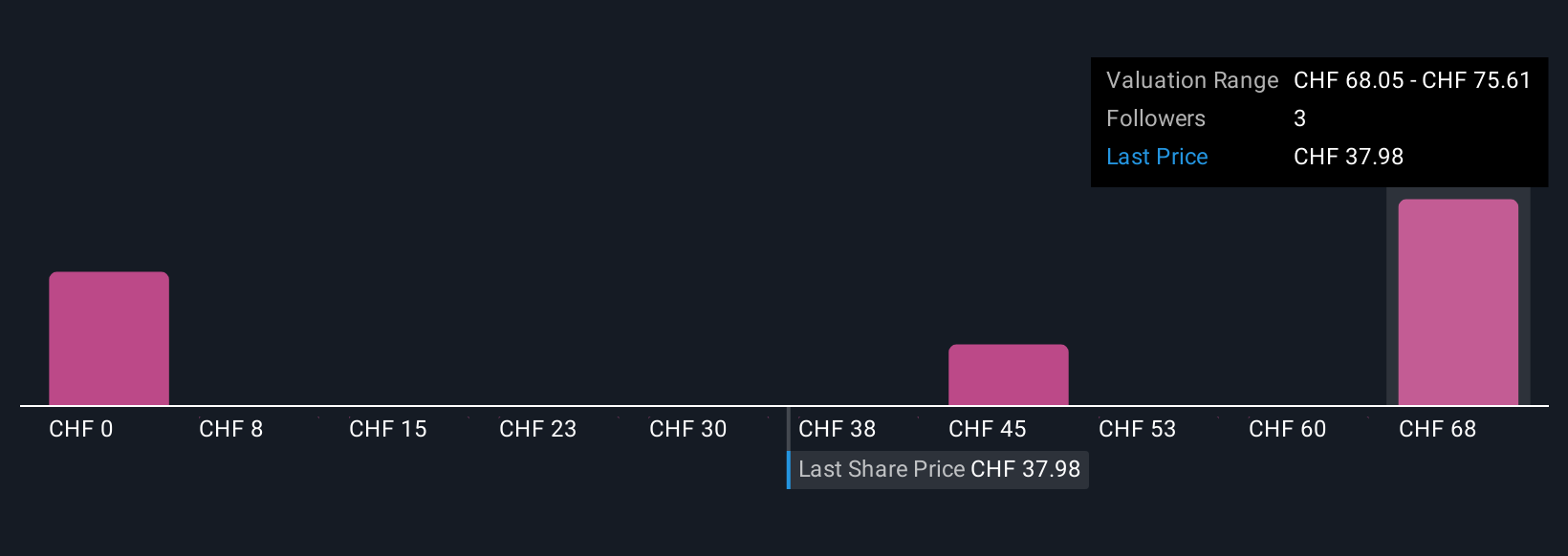

For example, on Amrize, some investors believe the fair value is as high as $102 based on strong future growth, while others estimate it as low as $36 due to concerns about market risks and profitability.

Do you think there's more to the story for Amrize? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:AMRZ

Amrize

Engages in the provision of various building solutions for infrastructure, commercial, and residential construction markets in North America.

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)