- Switzerland

- /

- Medical Equipment

- /

- SWX:YPSN

Ypsomed Holding (SWX:YPSN) Partners with Astria for STAR-0215 Autoinjector Amid Valuation Concerns

Reviewed by Simply Wall St

Click here and access our complete analysis report to understand the dynamics of Ypsomed Holding.

Competitive Advantages That Elevate Ypsomed Holding

Ypsomed Holding has demonstrated impressive financial health, with a notable improvement in net profit margins from 10.3% to 14.3% over the past year. The company's earnings growth of 52.8% surpasses the Medical Equipment industry average, reflecting its strong market position. This growth is supported by a seasoned management team, which contributes to strategic goal achievement through experienced decision-making. The recent strategic alliance with Astria Therapeutics for the development of the STAR-0215 autoinjector showcases Ypsomed's commitment to innovation and product enhancement, potentially boosting market share and customer satisfaction.

To gain deeper insights into Ypsomed Holding's historical performance, explore our detailed analysis of past performance.Strategic Gaps That Could Affect Ypsomed Holding

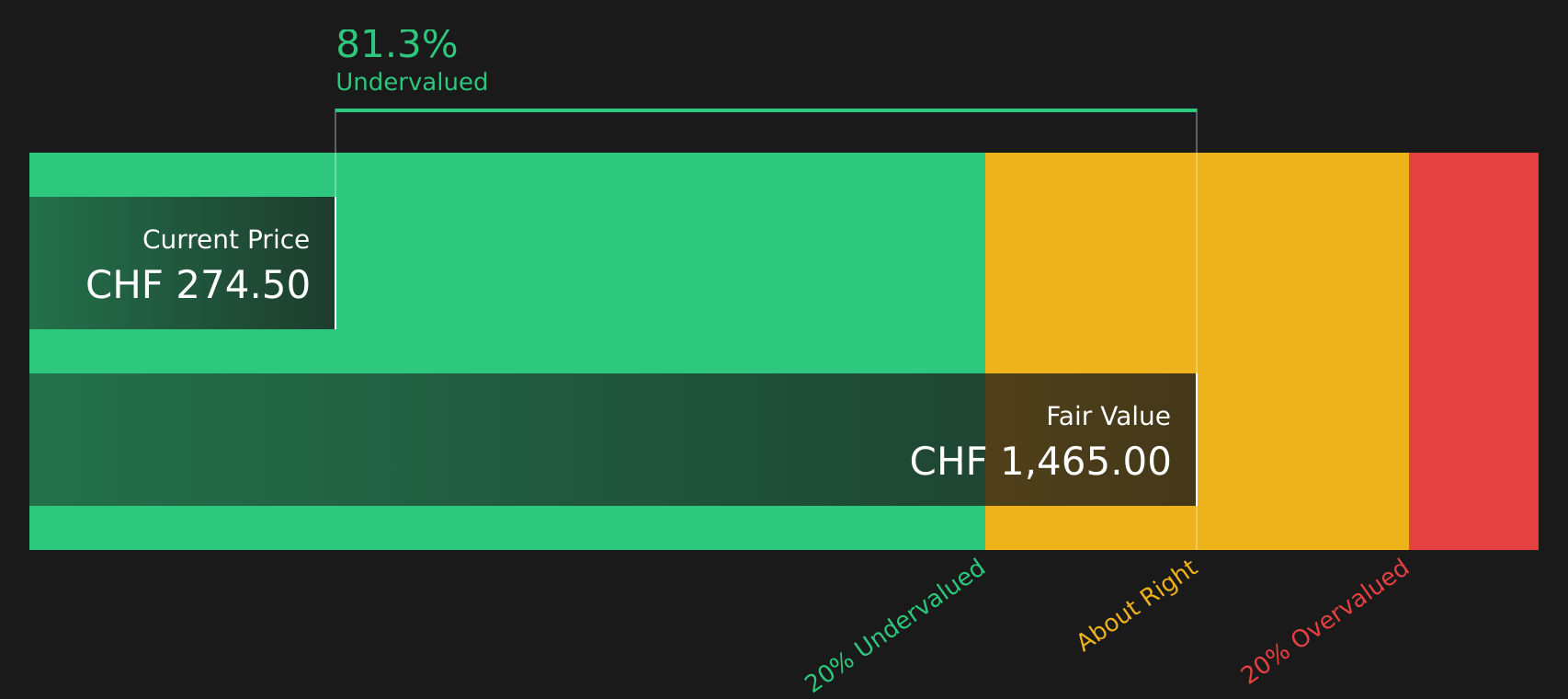

Despite its growth, Ypsomed's Price-To-Earnings Ratio of 67.5x is significantly higher than the industry average of 30.6x, raising concerns about its valuation. The company's Return on Equity stands at 12.7%, which is below the desired threshold of 20%, indicating potential inefficiencies in generating returns from equity. Moreover, the forecasted revenue growth of 18.4% per year, while strong, lags behind the ideal growth rate of 20% per year, suggesting room for improvement in revenue generation strategies.

To dive deeper into how Ypsomed Holding's valuation metrics are shaping its market position, check out our detailed analysis of Ypsomed Holding's Valuation.Emerging Markets Or Trends for Ypsomed Holding

The forecasted revenue growth exceeding the Swiss market average of 4.1% per year presents a significant opportunity for Ypsomed. The strategic partnership with Astria Therapeutics for the STAR-0215 autoinjector development highlights potential for further product innovation and market expansion. This collaboration could enhance Ypsomed's market position by capitalizing on emerging trends in medical technology and patient-centric solutions.

See what the latest analyst reports say about Ypsomed Holding's future prospects and potential market movements.Market Volatility Affecting Ypsomed Holding's Position

Ypsomed faces potential threats from economic headwinds and intensifying competition within the medical equipment sector. Regulatory changes could also impact operational costs, posing challenges to maintaining profitability. Additionally, the company's limited upside potential, with a target price less than 20% higher than the current share price, may deter investors seeking substantial returns. The absence of a notable dividend further limits its appeal to income-focused investors.

Learn about Ypsomed Holding's dividend strategy and how it impacts shareholder returns and financial stability.Conclusion

Ypsomed Holding's impressive financial health, marked by a significant increase in net profit margins and earnings growth, underscores its strong market position and effective management. However, its Price-To-Earnings Ratio of 67.5x, which is significantly higher than both the industry and peer averages, raises concerns about its current valuation, potentially limiting investor interest. While the strategic alliance with Astria Therapeutics and forecasted revenue growth exceeding the Swiss market average present opportunities for innovation and expansion, the company's lower-than-desired Return on Equity and limited upside potential may pose challenges in sustaining long-term investor confidence. Overall, while Ypsomed's commitment to innovation positions it well for future growth, addressing valuation concerns and improving equity returns are crucial for enhancing its appeal to a broader investor base.

Summing It All Up

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SWX:YPSN

Ypsomed Holding

Develops, manufactures, and sells injection and infusion systems for pharmaceutical and biotechnology companies.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives