- Switzerland

- /

- Medical Equipment

- /

- SWX:YPSN

Why The Story Behind Ypsomed Is Evolving Amid Analyst Debate and Market Shifts

Reviewed by Simply Wall St

Ypsomed Holding has seen its consensus analyst price target dip from CHF463.26 to CHF449.37, reflecting mixed analyst sentiment. Recent commentary highlights both bullish confidence in Ypsomed's leadership in the injectable market, as well as caution from others who question the sustainability of its growth following a company transformation. Stay tuned to discover how you can keep up with shifts in the evolving narrative for Ypsomed Holding stock.

What Wall Street Has Been Saying

Analyst coverage of Ypsomed Holding reflects a dynamic mix of optimism and caution as the company solidifies its status in the injectables market. Views across the street remain split on the sustainability of its transformation and future growth trajectory.

🐂 Bullish Takeaways

- Bullish analysts underscore Ypsomed's successful shift to a pure-play injectables company, noting strong execution and enhanced cost discipline following four key divestitures.

- They highlight the company's established leadership in the high-growth injectable segment as a critical driver of its sustained momentum, with unprecedented demand serving as a catalyst for further expansion.

- Firms such as Alpha Equity Partners raised their price target from CHF430 to CHF475 on September 22, pointing to improved transparency and consistent delivery on strategic milestones.

- However, some reservation remains among bullish corners regarding current valuation levels and whether near-term upside may already be priced in, especially after recent share gains.

🐻 Bearish Takeaways

- On the other hand, bearish analysts are re-entering coverage with a more cautious outlook. In Beta Research’s September 4 report, coverage was reinstated with an underperform rating and a price target set at CHF420.

- These analysts express concern about whether Ypsomed can sustain its recent growth rate now that the transformation is complete, especially as the competitive landscape intensifies.

- Ongoing valuation risks and the possibility that much of the future growth has already been factored into the current share price remain central to bearish strategies.

- They also flag operational risks tied to expanding manufacturing capacity and identify the potential for short-term performance volatility as key factors to monitor.

This divergence among analysts highlights ongoing debate over Ypsomed Holding’s valuation, the quality of its execution, and the longevity of its growth prospects as it navigates its post-divestiture chapter.

Do your thoughts align with the Bull or Bear Analysts? Perhaps you think there's more to the story. Head to the Simply Wall St Community to discover more perspectives or begin writing your own Narrative!

How This Changes the Fair Value For Ypsomed Holding

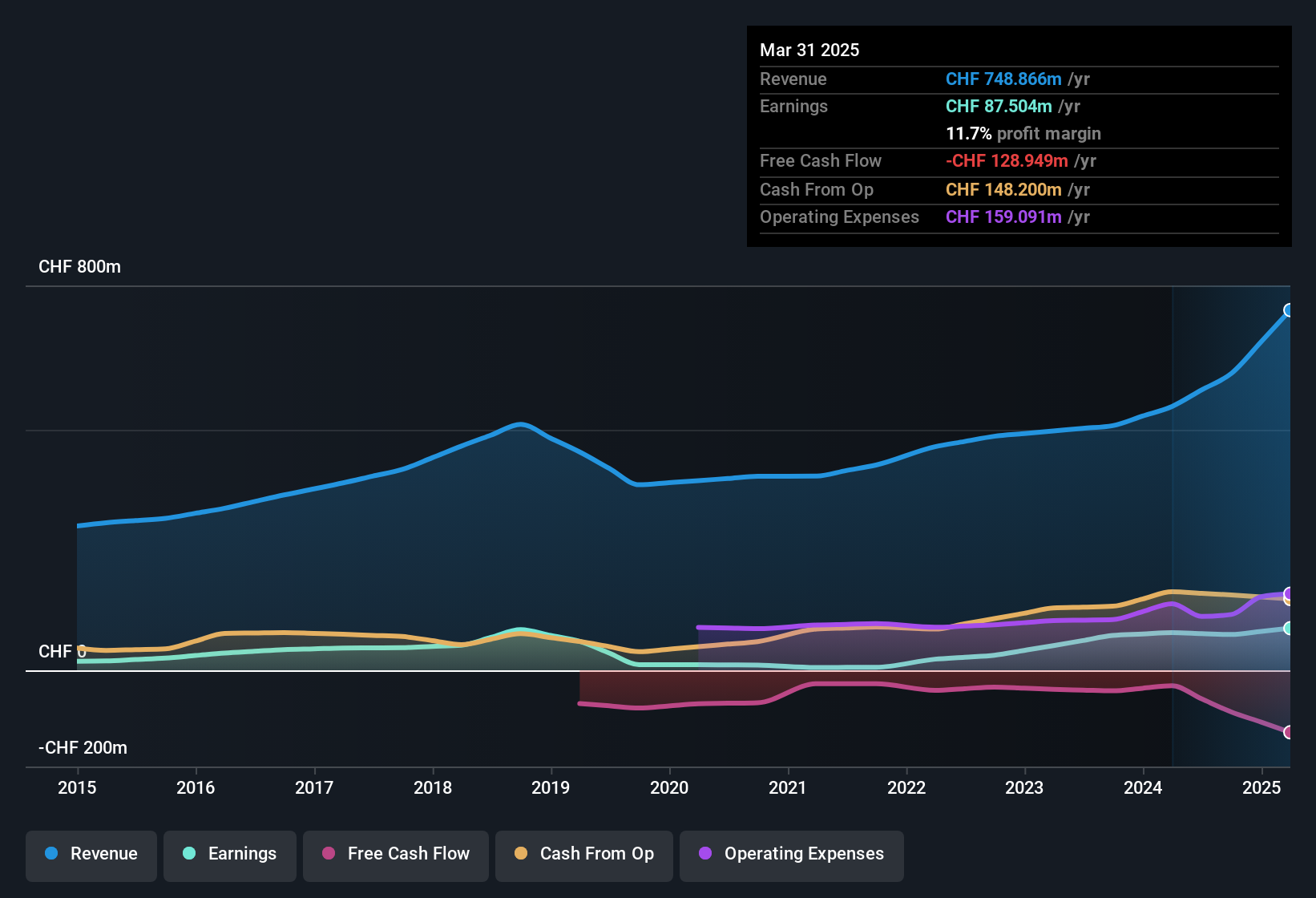

- The Consensus Analyst Price Target has fallen slightly from CHF463.26 to CHF449.37.

- The Consensus Revenue Growth forecasts for Ypsomed Holding have fallen from 6.7% per annum to 6.1% per annum.

- The Net Profit Margin for Ypsomed Holding has fallen slightly from 27.08% to 26.35%.

🔔 Never Miss an Update: Follow The Narrative

A Narrative connects the numbers to the story behind a company, letting investors share their perspective on where a business is headed, complete with forecasts, financial estimates, and fair value. Narratives on Simply Wall St make it easy to compare your view with others and see how new news or earnings dynamically update the story. Millions of investors use Narratives to get timely, actionable signals on when to buy or sell, available right on the Community page.

Want the full story and all the key numbers behind Ypsomed Holding? Read the original Narrative to stay on top of:

- How the shift to a pure B2B injectables model and local manufacturing could improve margins and reduce risks for Ypsomed.

- The impact of massive capacity expansions and over 200 ongoing projects, including more than 40 GLP-1 partnerships, on long-term revenue growth.

- What could go right or wrong, from liquidity and execution risks to potential rewards if strategic forecasts are realized.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:YPSN

Ypsomed Holding

Develops, manufactures, and sells injection and infusion systems for safe and simple self-medication companies.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)