- Philippines

- /

- Metals and Mining

- /

- PSE:APX

Undiscovered Gems Three Hidden Stocks with Promising Potential

Reviewed by Simply Wall St

As global markets experience broad-based gains, with smaller-cap indexes outperforming their larger counterparts and U.S. indexes nearing record highs, investors are increasingly looking for opportunities in lesser-known stocks that may offer unique growth potential. In this dynamic environment, identifying a good stock often involves finding companies with strong fundamentals and the ability to thrive amid economic shifts, such as those driven by recent labor market improvements and stabilizing mortgage rates.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 15.25% | 15.00% | ★★★★★★ |

| Hubei Three Gorges Tourism Group | 11.32% | -9.98% | 7.95% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 18.55% | 49.61% | 71.72% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Power HF | 2.91% | -6.25% | -22.13% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Apex Mining (PSE:APX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Apex Mining Co., Inc. and its subsidiaries are involved in the mining and processing of gold deposits in the Philippines, with a market capitalization of approximately ₱20.59 billion.

Operations: Apex Mining generates revenue primarily from the mining and processing of gold deposits in the Philippines. The company has a market capitalization of approximately ₱20.59 billion, reflecting its significant presence in the industry.

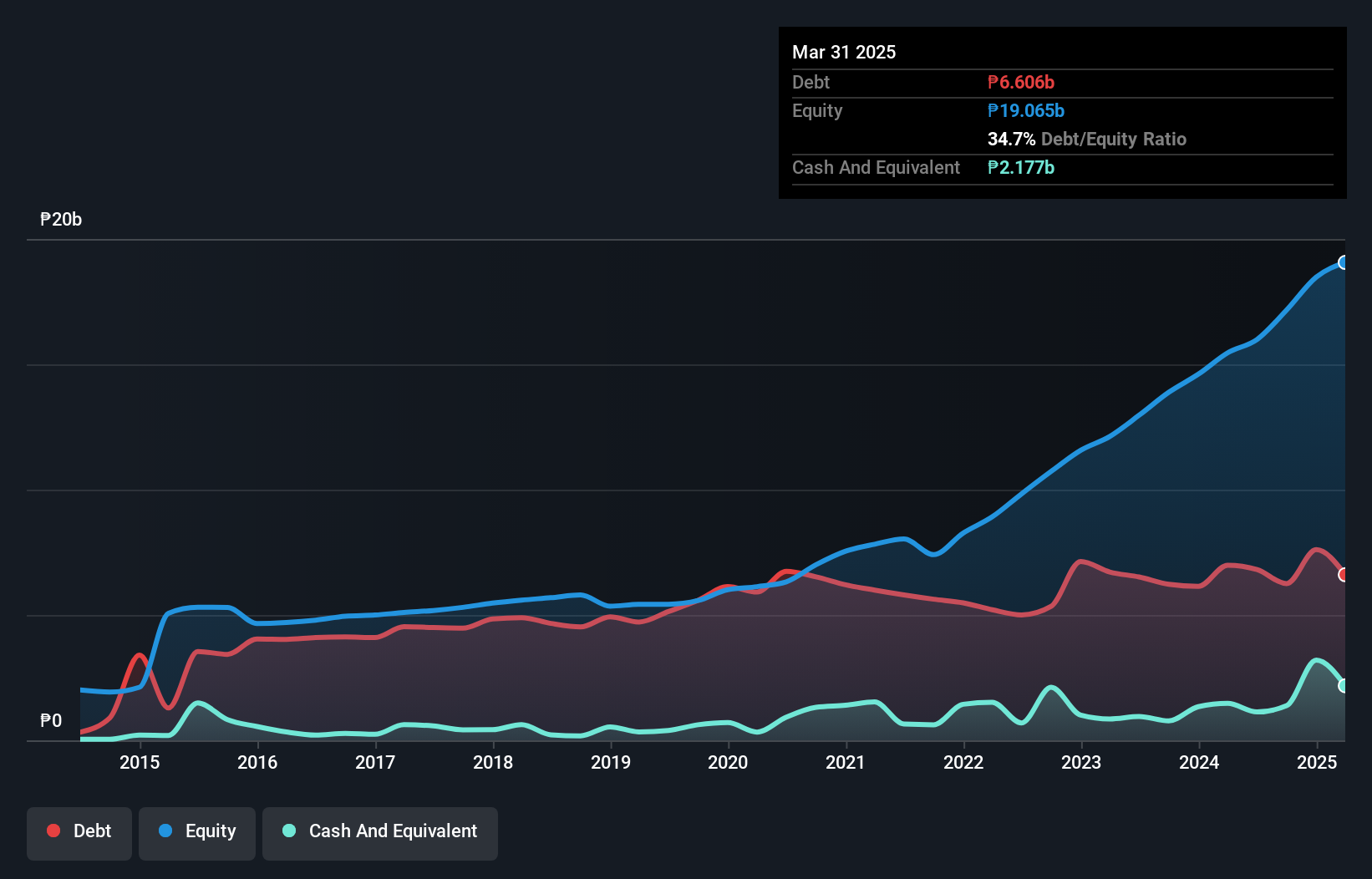

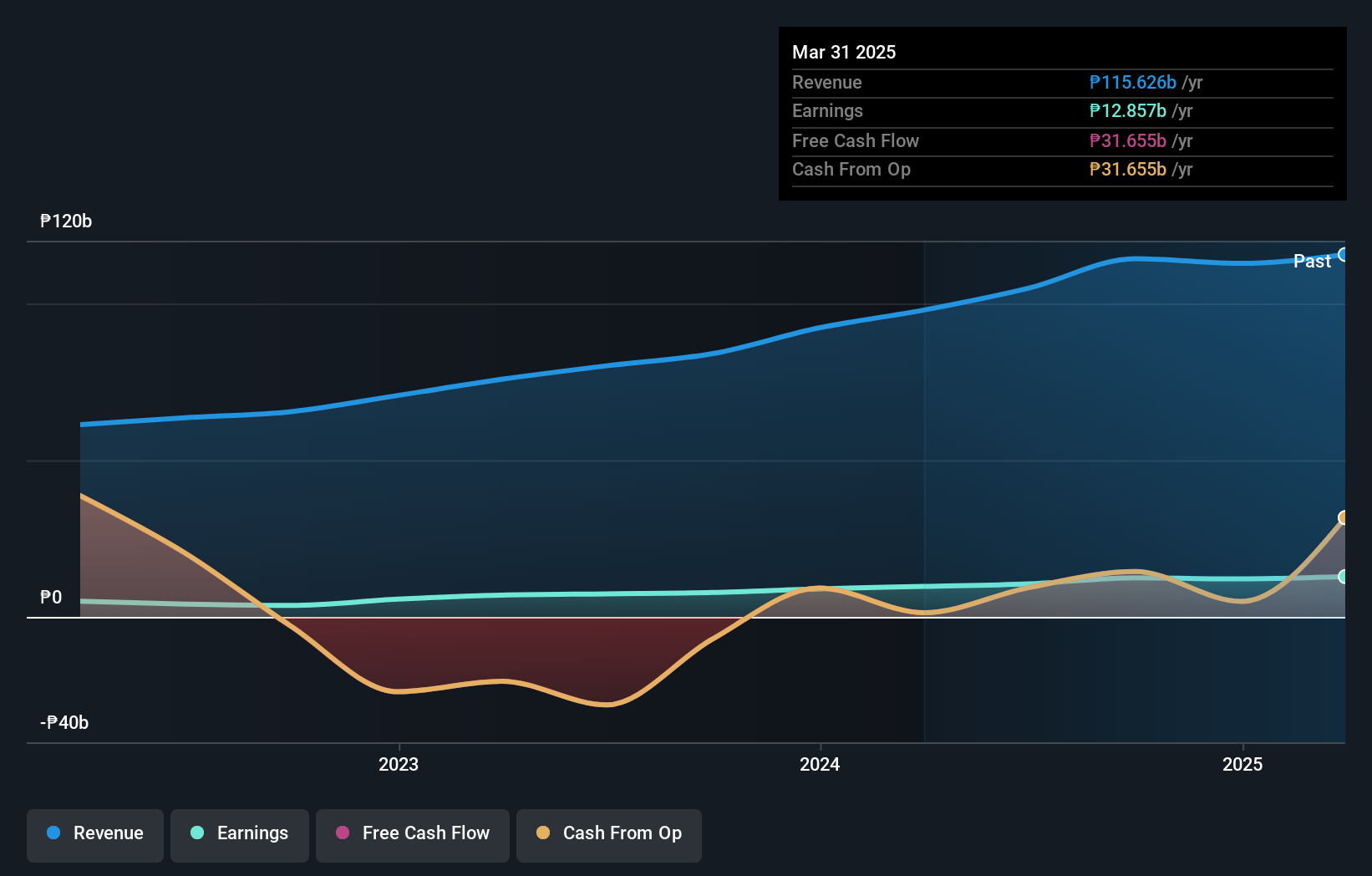

Apex Mining, a modestly-sized player in the mining sector, is trading at 59.7% below its estimated fair value, signaling potential undervaluation. The company has shown robust earnings growth of 30.9% over the past year, outpacing the industry average of -37.2%. Its net debt to equity ratio stands satisfactorily at 28.4%, and interest payments are comfortably covered by EBIT at 8.7 times coverage. Recent announcements highlight an increase in third-quarter revenue to PHP 3,900 million from PHP 3,037 million previously and a rise in net income to PHP 1,309 million from PHP 1,028 million last year.

- Get an in-depth perspective on Apex Mining's performance by reading our health report here.

Gain insights into Apex Mining's historical performance by reviewing our past performance report.

Filinvest Development (PSE:FDC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Filinvest Development Corporation is a diversified conglomerate in the Philippines with operations spanning real estate development, power and utilities, hospitality, and banking and financial services, boasting a market capitalization of approximately ₱47.48 billion.

Operations: Filinvest Development Corporation derives its revenue primarily from banking and financial services (₱50.56 billion), real estate operations (₱35.10 billion), and power and utilities (₱26.59 billion). The company also generates income from hospitality operations, contributing ₱4.48 billion, while sugar operations add ₱6.05 billion to its revenue streams.

Filinvest Development's recent performance paints an intriguing picture, with net income surging to PHP 3.91 billion in the third quarter from PHP 1.99 billion a year earlier, while revenue climbed to PHP 31.35 billion from PHP 21.96 billion. Despite a high net debt to equity ratio of 57.6%, the company's interest payments are well covered by EBIT at a multiple of 4.4x, suggesting manageable financial obligations for now. Earnings have notably grown by nearly 60% over the past year, outpacing industry averages and reflecting robust operational execution despite prior years' declines averaging around 5%. The stock trades significantly below its estimated fair value, potentially signaling investment appeal amidst these dynamics.

- Click here and access our complete health analysis report to understand the dynamics of Filinvest Development.

Understand Filinvest Development's track record by examining our Past report.

IVF Hartmann Holding (SWX:VBSN)

Simply Wall St Value Rating: ★★★★★★

Overview: IVF Hartmann Holding AG operates in the medical consumer goods sector, serving both Switzerland and international markets, with a market capitalization of CHF359.63 million.

Operations: IVF Hartmann Holding AG generates revenue primarily from Infection Management (CHF56.41 million), Wound Care (CHF41.97 million), and Incontinence Management (CHF33.07 million).

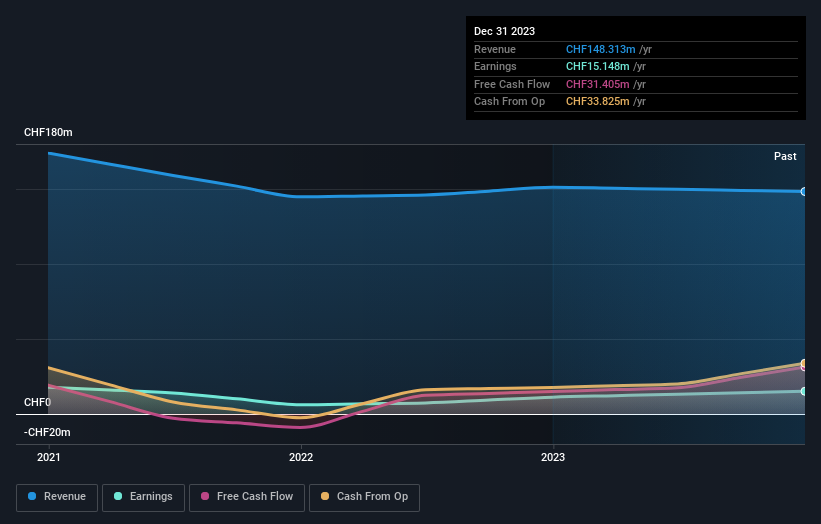

IVF Hartmann Holding, a compact player in the medical equipment sector, showcases robust financial health with no debt over the past five years and trades at 77.1% below its estimated fair value, making it an attractive proposition. The company has demonstrated impressive earnings growth of 33.4% over the last year, significantly outpacing the industry average of -1.6%. Its free cash flow remains positive at CHF 29.38 million as of June 2024, suggesting efficient operations and a solid foundation for future expansion without concerns about interest coverage due to its debt-free status.

- Click to explore a detailed breakdown of our findings in IVF Hartmann Holding's health report.

Explore historical data to track IVF Hartmann Holding's performance over time in our Past section.

Make It Happen

- Navigate through the entire inventory of 4631 Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:APX

Apex Mining

Engages in mining, milling, concentrating, converting, smelting, treating, and preparing gold deposits in the Philippines.

Undervalued with solid track record.