The European market has faced recent challenges, with the pan-European STOXX Europe 600 Index ending lower amid concerns about U.S. trade tariffs and uncertainty over monetary policy, though hopes for geopolitical stability have helped mitigate some losses. In this environment, selecting dividend stocks that offer reliable income and have a track record of resilience can be an effective strategy for investors seeking stability in their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.47% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.19% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.53% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.73% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 3.99% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.33% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.09% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.83% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

Click here to see the full list of 234 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

Construcciones y Auxiliar de Ferrocarriles (BME:CAF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Construcciones y Auxiliar de Ferrocarriles, S.A. (BME:CAF) is a company engaged in the design, manufacture, maintenance, and supply of equipment and components for railway systems with a market cap of approximately €1.39 billion.

Operations: Construcciones y Auxiliar de Ferrocarriles generates revenue from two main segments: Railway (including Wheel Sets and Components) at €3.29 billion and Buses at €926.87 million.

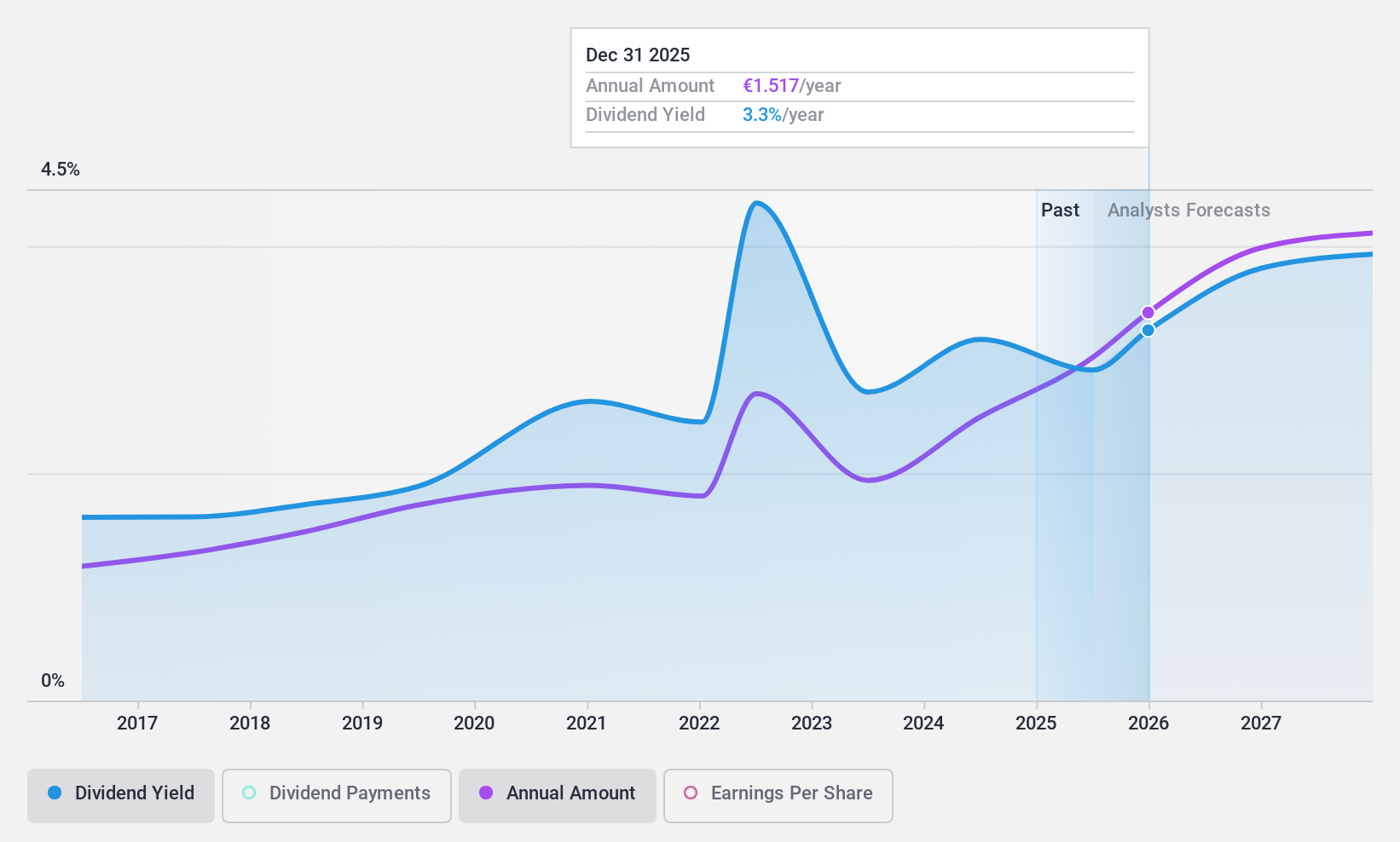

Dividend Yield: 3.3%

Construcciones y Auxiliar de Ferrocarriles, S.A. reported improved earnings for 2024, with sales reaching €4.22 billion and net income at €103.26 million. Despite a low dividend yield of 3.3%, the company's dividend payments are well covered by both earnings (payout ratio: 44.4%) and cash flows (cash payout ratio: 46.5%). While dividends have grown over the past decade, they remain volatile and unreliable, impacting their attractiveness for stable income-seeking investors in Europe.

- Delve into the full analysis dividend report here for a deeper understanding of Construcciones y Auxiliar de Ferrocarriles.

- Our expertly prepared valuation report Construcciones y Auxiliar de Ferrocarriles implies its share price may be lower than expected.

Amundi (ENXTPA:AMUN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with a market cap of approximately €15.09 billion.

Operations: Amundi generates its revenue primarily from its Asset Management segment, which accounts for €3.50 billion.

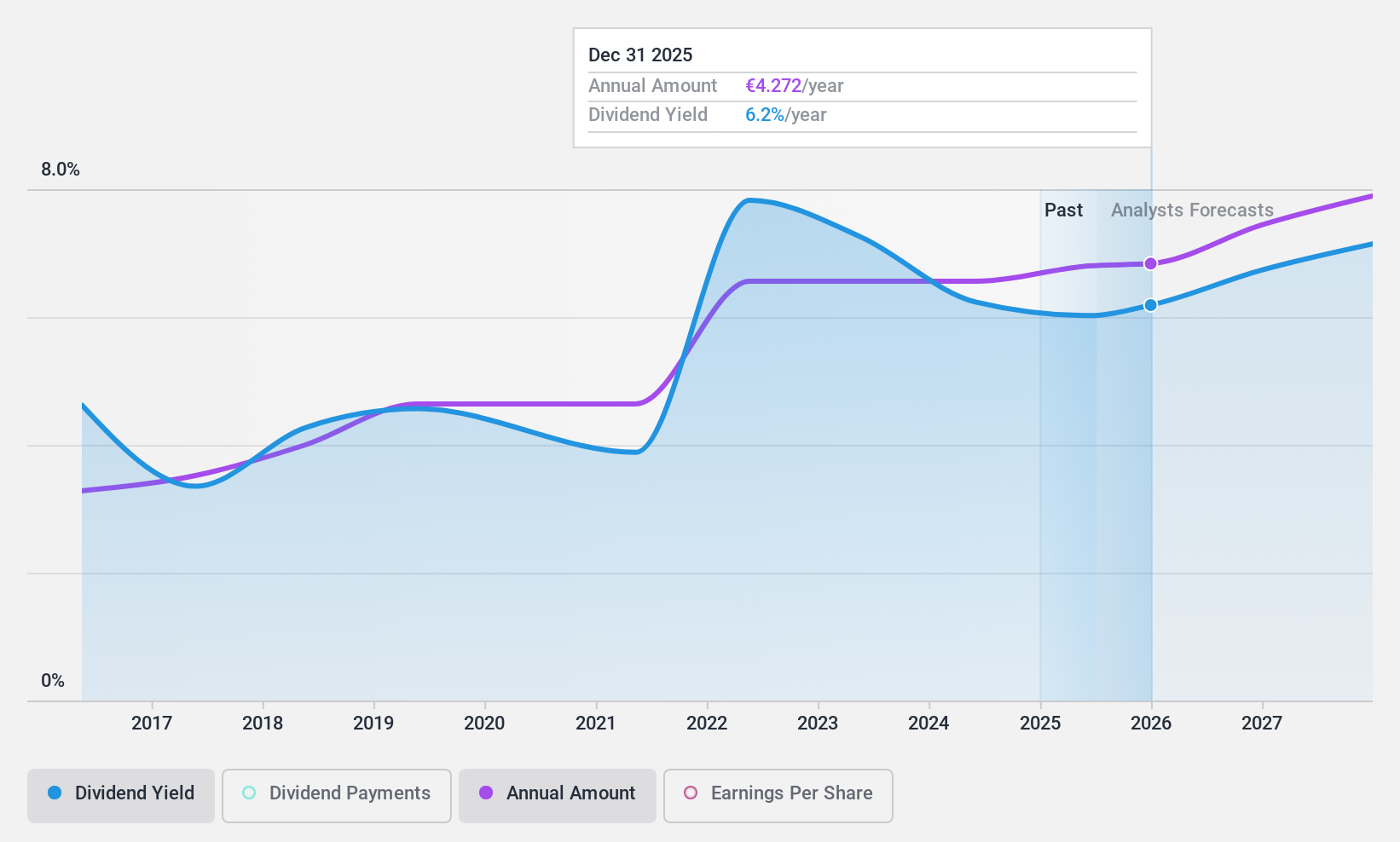

Dividend Yield: 5.7%

Amundi's dividend payments have been volatile over the past nine years, but recent increases suggest potential growth. The proposed €4.25 per share dividend for 2025 marks an increase from previous payouts. Despite its unstable history, Amundi’s dividends are well-covered by both earnings (63% payout ratio) and cash flows (61.7% cash payout ratio). Trading slightly below estimated fair value, Amundi offers a competitive dividend yield of 5.73%, ranking in the top 25% among French market peers.

- Get an in-depth perspective on Amundi's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Amundi's share price might be too pessimistic.

COLTENE Holding (SWX:CLTN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: COLTENE Holding AG is a company that develops, manufactures, and sells dental disposables, tools, and equipment across Europe, the Middle East, Africa, North America, Latin America, and Asia/Oceania with a market cap of CHF348.96 million.

Operations: COLTENE Holding AG's revenue primarily comes from its segment of disposables, tools, and equipment for dentists and dental laboratories, totaling CHF250.20 million.

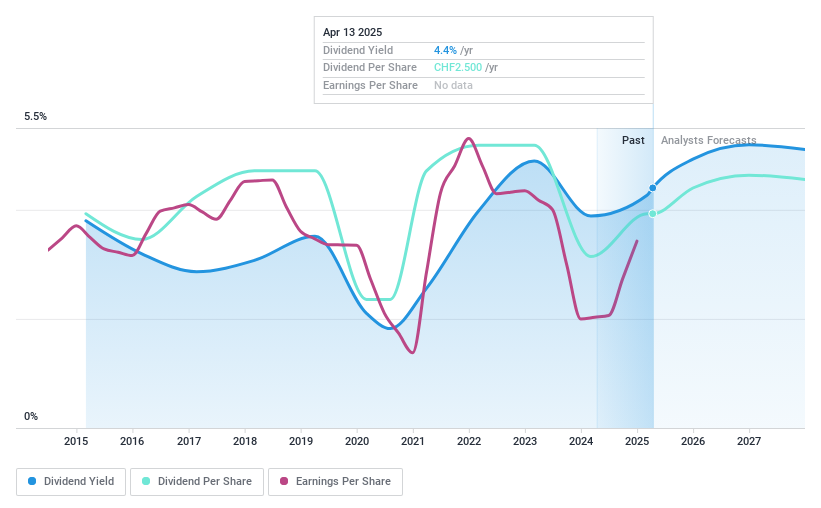

Dividend Yield: 4.3%

COLTENE Holding's dividend yield of 4.28% ranks in the top 25% of Swiss market payers, yet its dividend history over the past decade has been volatile and unreliable, with no growth. Despite this instability, dividends are well-covered by earnings (73.5% payout ratio) and cash flows (74.3%). Recent earnings growth to CHF 20.5 million for 2024 indicates financial improvement, but historical dividend inconsistency remains a concern for investors seeking stability.

- Unlock comprehensive insights into our analysis of COLTENE Holding stock in this dividend report.

- The valuation report we've compiled suggests that COLTENE Holding's current price could be quite moderate.

Next Steps

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 231 more companies for you to explore.Click here to unveil our expertly curated list of 234 Top European Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CAF

Construcciones y Auxiliar de Ferrocarriles

Construcciones y Auxiliar de Ferrocarriles, S.A.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives