- Switzerland

- /

- Food

- /

- SWX:BARN

How Weak Cocoa Prices and Softer Sales Guidance at Barry Callebaut (SWX:BARN) Have Changed Its Investment Story

Reviewed by Sasha Jovanovic

- In recent days, cocoa prices have fallen sharply to a 20-month low as improved crop prospects and increased farmer payments in Ivory Coast and Ghana boosted global cocoa supplies.

- At the same time, Barry Callebaut and other major chocolate makers have lowered their sales volume guidance, reflecting softer global demand and adding further pressure on cocoa markets.

- We’ll explore how this combination of falling cocoa prices and reduced sales outlook repositions Barry Callebaut’s investment narrative.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Barry Callebaut Investment Narrative Recap

To be a Barry Callebaut shareholder right now, you would need to believe that the company’s secure cocoa sourcing, ongoing cost initiatives, and focus on emerging markets can translate into resilient earnings despite short-term headwinds. With cocoa prices falling but global chocolate demand softening, the most important near-term catalyst, a stabilization in input costs, may face limits if weaker volumes persist. The chief risk to watch remains delayed customer orders adding pressure to already low coverage and stock levels; recent news does not appear to materially reduce this concern for now.

Among recent announcements, the company’s revised guidance for a low single-digit decrease in sales volumes stands out, reflecting the demand-side caution and reinforcing the latest trends in the cocoa market. This context maintains the importance of initiatives like supply chain expansion and cost efficiency for supporting future earnings, even as short-term volume risks remain front of mind.

By contrast, investors should be aware of the potential impact if customer order delays persist and inventory levels stay...

Read the full narrative on Barry Callebaut (it's free!)

Barry Callebaut's outlook forecasts CHF14.6 billion in revenue and CHF518.6 million in earnings by 2028. This assumes a 3.8% annual revenue growth and an earnings increase of CHF374.7 million from the current CHF143.9 million.

Uncover how Barry Callebaut's forecasts yield a CHF1258 fair value, a 9% upside to its current price.

Exploring Other Perspectives

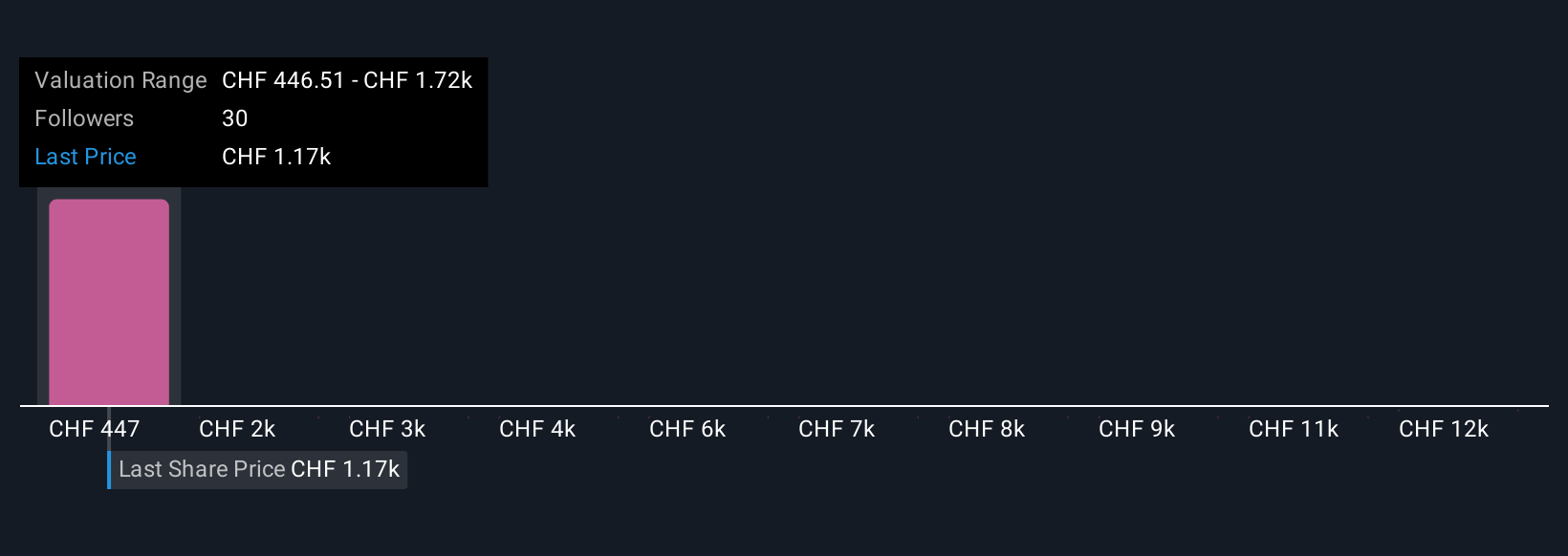

Four different fair value estimates from the Simply Wall St Community range from CHF446.51 to CHF13,151.66. With recent cocoa market shifts raising fresh questions, explore these diverse perspectives to better understand how risks around customer demand and inventory could shape future returns.

Explore 4 other fair value estimates on Barry Callebaut - why the stock might be a potential multi-bagger!

Build Your Own Barry Callebaut Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Barry Callebaut research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Barry Callebaut research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Barry Callebaut's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barry Callebaut might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BARN

Barry Callebaut

Engages in the manufacture and sale of chocolate and cocoa products.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives