- Switzerland

- /

- Food

- /

- SWX:BARN

Barry Callebaut (SWX:BARN): Exploring Valuation After Recent Share Price Uptick

Reviewed by Kshitija Bhandaru

See our latest analysis for Barry Callebaut.

Zooming out, Barry Callebaut’s 1-year total shareholder return sits in negative territory and lags well behind the broader market. The share price has shown only a slight uptick in the past quarter. Recent upward movement may reflect investors reassessing the company’s long-term growth prospects after a challenging period. However, overall momentum remains subdued.

If you’re interested in expanding your search, why not check out fast growing stocks with high insider ownership for other rapidly growing companies where insiders have real skin in the game?

With shares still trailing their long-term highs and some analysts seeing upside from current levels, the question is whether Barry Callebaut is undervalued right now or if the market has already factored in its recovery prospects.

Most Popular Narrative: 11.1% Undervalued

Despite a fair value estimate of CHF 1,258, Barry Callebaut's last close at CHF 1,118 reflects investor uncertainty about future earnings potential. The company’s share price appears disconnected from improving long-term forecasts. The stage is set for a major catalyst that could validate the narrative’s projections.

The Next Level investment program is anticipated to generate CHF 250 million in synergies, with 75% expected to flow through to the P&L. This is expected to gradually enhance earnings over the next 12 months as cost savings take effect.

Curious what’s powering this aggressive fair value upgrade? The narrative hinges on a profit surge and bold margin expansion that rivals fast-growth sectors. Want to know which underlying assumptions make analysts this optimistic? Click through to uncover the full story behind these headline-grabbing projections.

Result: Fair Value of $1,258 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently high cocoa prices or delays in customer orders could quickly undermine these optimistic projections and shift sentiment in the opposite direction.

Find out about the key risks to this Barry Callebaut narrative.

Another View: Multiples Signal a Different Story

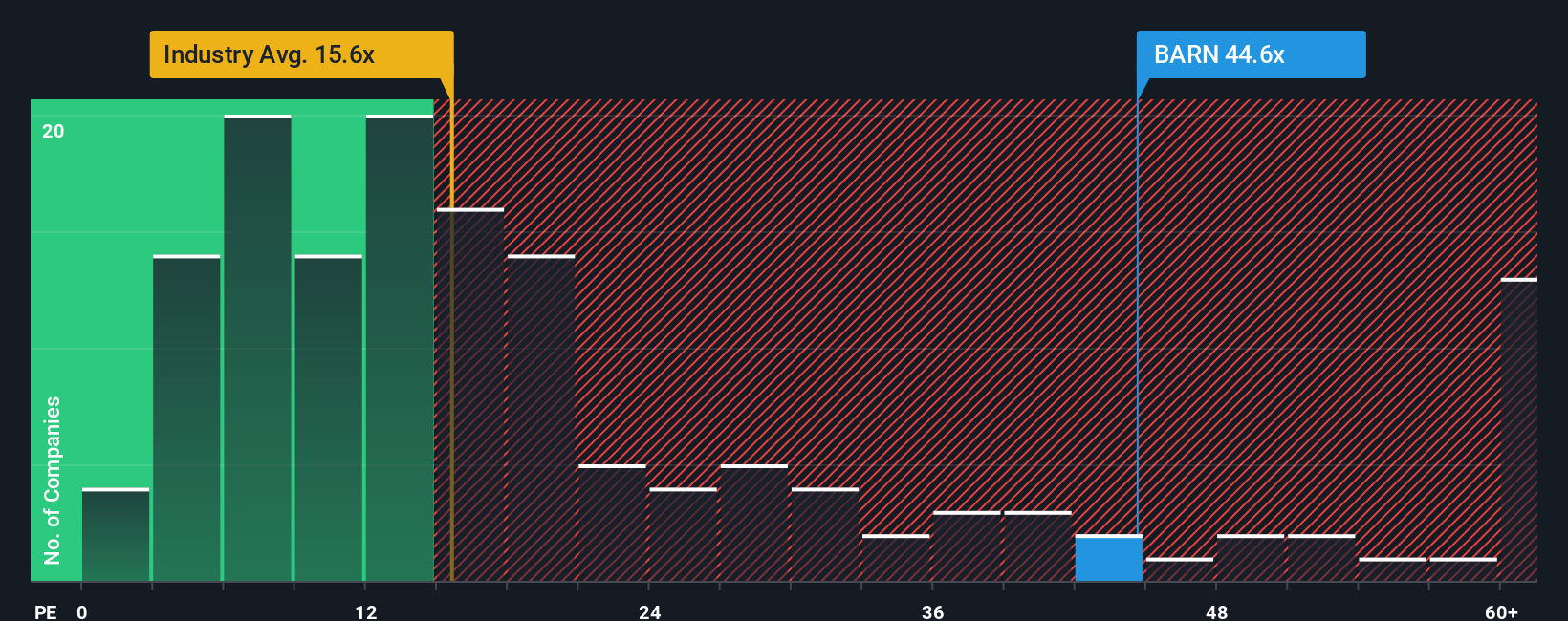

Looking at Barry Callebaut with a price-to-earnings ratio of 42.6x, the stock appears expensive compared to industry averages and even its own fair ratio. The European Food industry average stands at just 15.5x and peers average around 22x. The market may be pricing in higher growth or quality, but such a premium leaves little room for missteps. Will this stretched valuation limit future gains, or does it suggest untapped potential yet to be realized?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Barry Callebaut Narrative

If you see things differently or want to draw your own conclusions, you can analyze the data yourself and build a personalized view in just a few minutes with Do it your way.

A great starting point for your Barry Callebaut research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Every smart investor knows that truly exciting opportunities rarely stick around for long. Take the lead in shaping your portfolio with cutting-edge ideas from these handpicked stock lists.

- Tap into powerful income streams by evaluating opportunities through these 19 dividend stocks with yields > 3%, which features reliable companies with strong dividend yields of over 3%.

- Seize the potential of AI-driven innovation by selecting from these 24 AI penny stocks, where emerging leaders in artificial intelligence are setting new standards for growth.

- Accelerate your search for exceptional value by scanning these 896 undervalued stocks based on cash flows, a source for shares that appear attractive based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barry Callebaut might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BARN

Barry Callebaut

Engages in the manufacture and sale of chocolate and cocoa products.

Moderate risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives