- Switzerland

- /

- Capital Markets

- /

- SWX:CFT

Did S&P Global BMI Index Inclusion Just Shift Compagnie Financière Tradition's (SWX:CFT) Investment Narrative?

Reviewed by Sasha Jovanovic

- Compagnie Financière Tradition SA was recently added to the S&P Global BMI Index, elevating its status on the international investment stage.

- This kind of index inclusion can increase the company's visibility among institutional investors and portfolio managers who track the index.

- We'll examine how inclusion in a major global index influences the company's investment narrative and potential institutional interest.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Compagnie Financière Tradition's Investment Narrative?

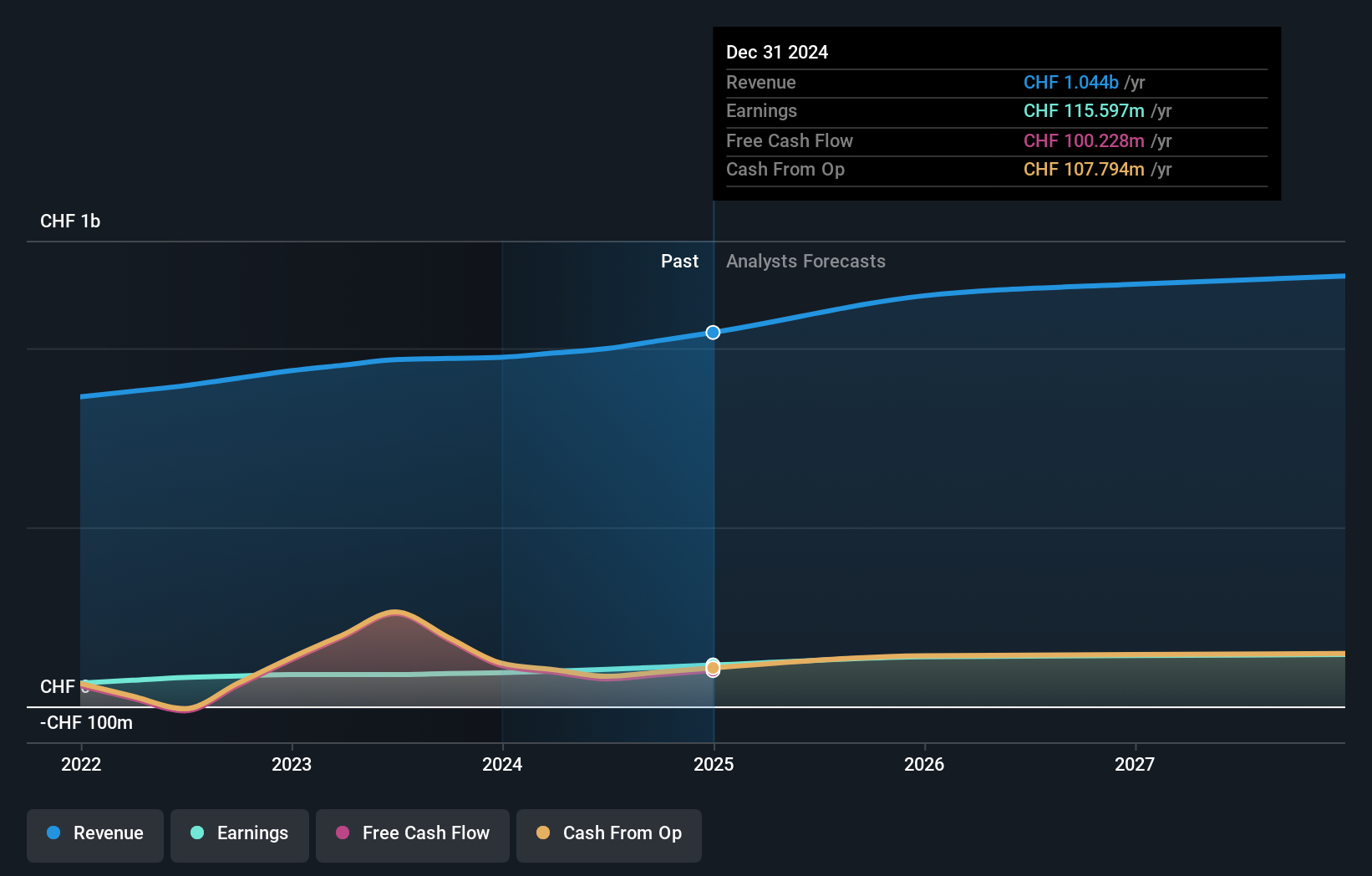

For anyone considering Compagnie Financière Tradition SA as a long-term holding, the big picture centers around ongoing profitability, prudent capital returns, and consistent operational discipline in a relatively mature capital markets sector. The recent addition to the S&P Global BMI Index potentially brings added institutional attention, which could enhance trading liquidity and help set a more stable valuation floor. That said, while high-profile index inclusion occasionally acts as a catalyst for price moves or re-ratings, the initial share price reaction has been relatively muted, suggesting limited immediate impact compared to core drivers like future earnings growth, margin trends, and competitive positioning. Current risks include the company's elevated price-to-earnings ratio versus peers and the broader market, exposing it to sentiment shifts if profit expansion slows or macro conditions worsen. With solid past profit growth and dividend increases, the key will be whether performance sustains as fresh institutional interest meets reality. On the flip side, the premium valuation could become a pressure point if growth expectations falter, details investors shouldn’t overlook.

Compagnie Financière Tradition's shares have been on the rise but are still potentially undervalued by 16%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on Compagnie Financière Tradition - why the stock might be worth just CHF338.52!

Build Your Own Compagnie Financière Tradition Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Compagnie Financière Tradition research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Compagnie Financière Tradition research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Compagnie Financière Tradition's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:CFT

Compagnie Financière Tradition

Operates as an interdealer broker of financial and non-financial products worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in