- Switzerland

- /

- Capital Markets

- /

- SWX:BAER

Montana Aerospace And Two Additional Stocks That May Be Trading Below Fair Value On SIX Swiss Exchange

Reviewed by Simply Wall St

Amidst a cautious atmosphere in the Switzerland market, with investors eyeing upcoming economic data, the Swiss Market Index (SMI) experienced slight fluctuations but ultimately closed with a marginal increase. In such a market environment, identifying stocks that may be trading below their fair value could offer potential opportunities for investors looking for value in uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| COLTENE Holding (SWX:CLTN) | CHF47.00 | CHF76.57 | 38.6% |

| Burckhardt Compression Holding (SWX:BCHN) | CHF607.00 | CHF848.46 | 28.5% |

| Julius Bär Gruppe (SWX:BAER) | CHF52.28 | CHF96.40 | 45.8% |

| Sonova Holding (SWX:SOON) | CHF278.30 | CHF463.68 | 40% |

| Temenos (SWX:TEMN) | CHF63.00 | CHF85.66 | 26.4% |

| Comet Holding (SWX:COTN) | CHF372.00 | CHF581.05 | 36% |

| SGS (SWX:SGSN) | CHF80.80 | CHF125.32 | 35.5% |

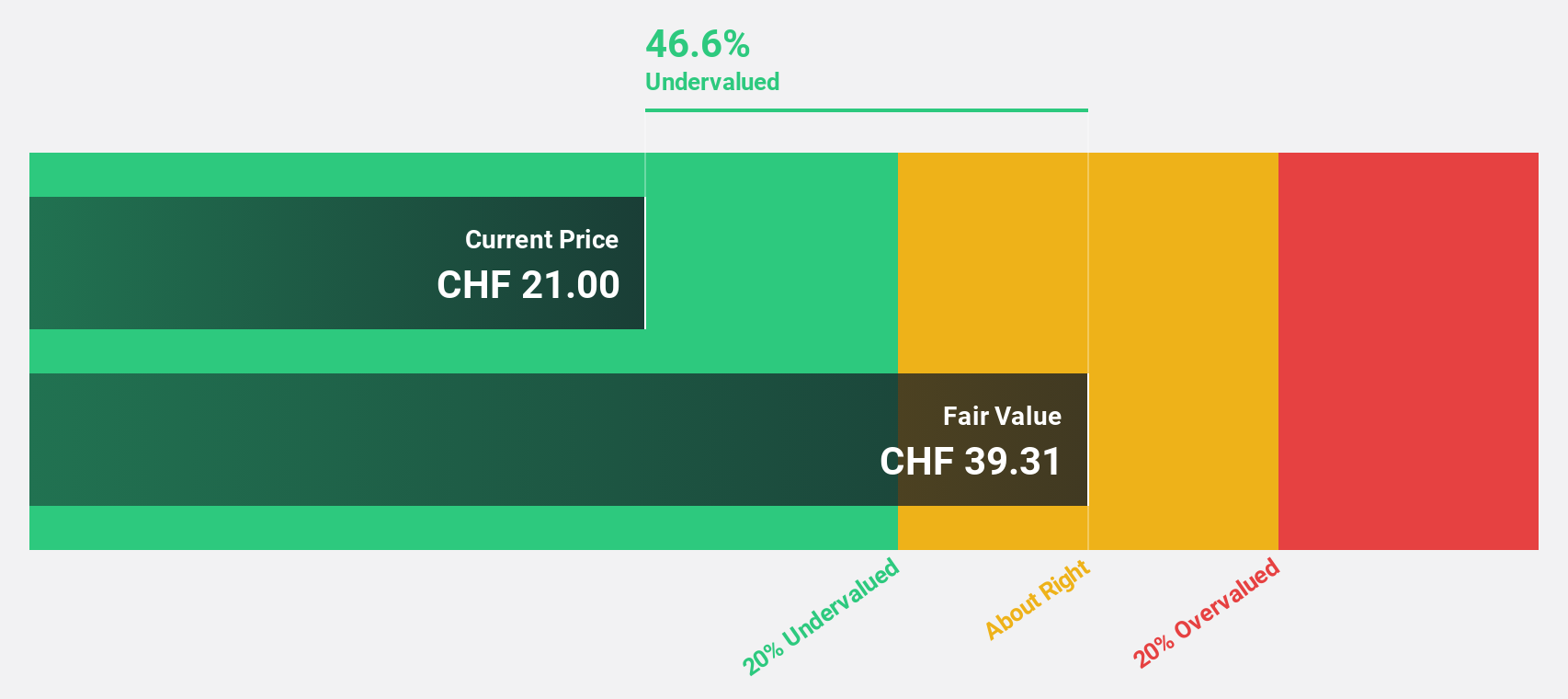

| Medartis Holding (SWX:MED) | CHF69.30 | CHF129.77 | 46.6% |

| Kudelski (SWX:KUD) | CHF1.44 | CHF1.87 | 23% |

| Sika (SWX:SIKA) | CHF255.80 | CHF328.87 | 22.2% |

Let's uncover some gems from our specialized screener

Montana Aerospace (SWX:AERO)

Overview: Montana Aerospace AG specializes in designing, developing, and manufacturing system components and assemblies for global markets, with a market capitalization of approximately CHF 1.19 billion.

Operations: The company's revenue is segmented into Energy (€575.17 million), E-Mobility (€154.42 million), and Aerostructures (€745.54 million).

Estimated Discount To Fair Value: 16.4%

Montana Aerospace, trading at CHF 19.14, appears undervalued based on discounted cash flow analysis with an estimated fair value of CHF 23.08, reflecting a 17.1% potential undervaluation. Despite slower revenue growth projections at 9% annually compared to a higher market average, the company has reversed from a net loss to reporting a Q1 net income of EUR 2.81 million and is expected to become profitable within three years, outpacing average market growth forecasts.

- Upon reviewing our latest growth report, Montana Aerospace's projected financial performance appears quite optimistic.

- Take a closer look at Montana Aerospace's balance sheet health here in our report.

Julius Bär Gruppe (SWX:BAER)

Overview: Julius Bär Gruppe AG, a global firm headquartered in Switzerland, specializes in providing wealth management solutions across Europe, the Americas, Asia, and other international markets with a market capitalization of approximately CHF 10.71 billion.

Operations: The firm generates CHF 3.24 billion from its private banking segment.

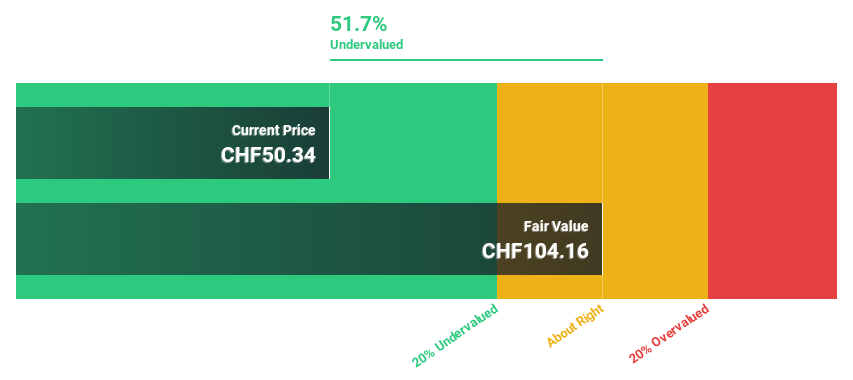

Estimated Discount To Fair Value: 45.8%

Julius Bär Gruppe, priced at CHF 51.18, is significantly undervalued based on a fair value estimate of CHF 96.31. Despite a challenging year with profit margins dropping from 24.6% to 14%, the bank's revenue and earnings growth projections outpace the Swiss market, expected at 9.3% and 21.89% per year respectively. Recent strategic hires in Asia suggest a focus on expanding its market presence, potentially bolstering future performance despite current concerns over dividend coverage and a high level of bad loans (2%).

- In light of our recent growth report, it seems possible that Julius Bär Gruppe's financial performance will exceed current levels.

- Navigate through the intricacies of Julius Bär Gruppe with our comprehensive financial health report here.

Barry Callebaut (SWX:BARN)

Overview: Barry Callebaut AG operates in the manufacturing and sale of chocolate and cocoa products, with a market capitalization of approximately CHF 8.43 billion.

Operations: The company's revenue from its cocoa-related activities amounts to approximately CHF 5.31 billion.

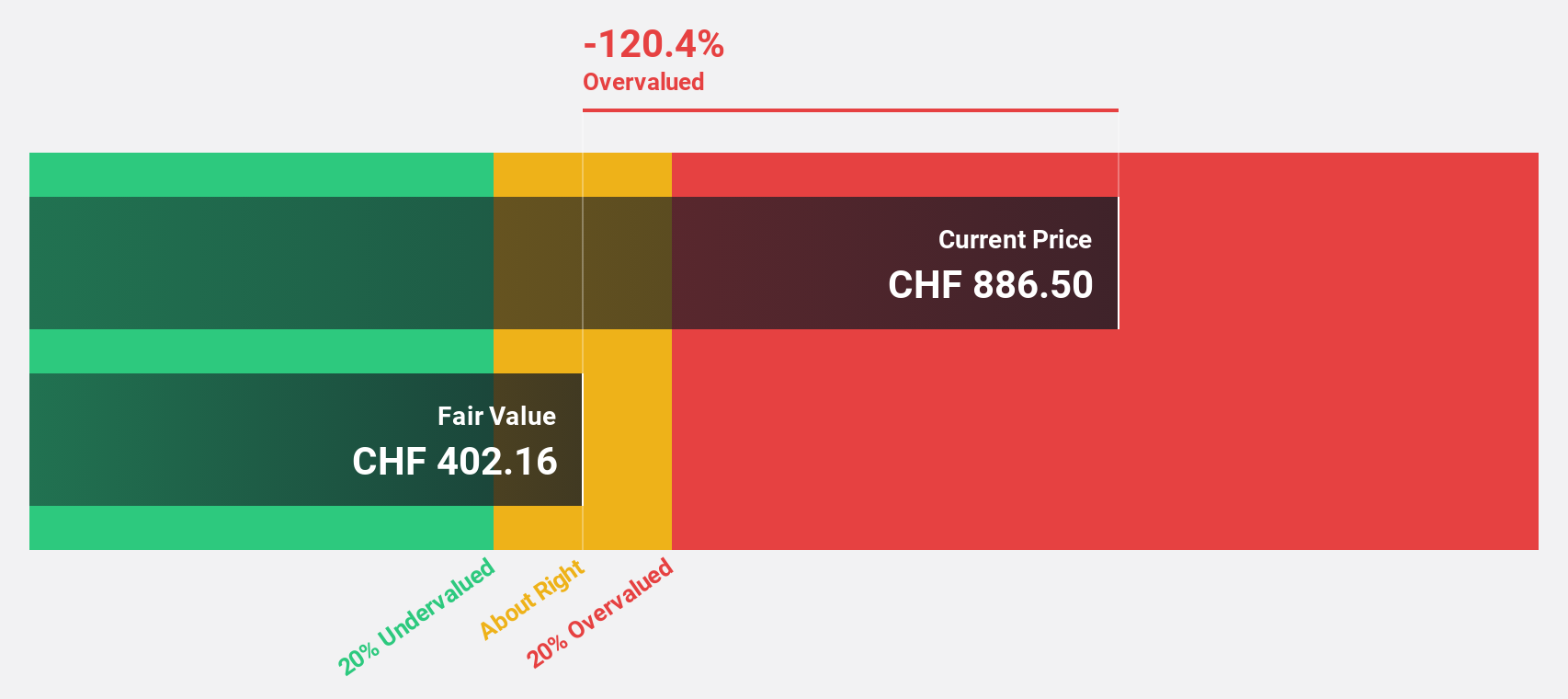

Estimated Discount To Fair Value: 14.6%

Barry Callebaut, with a current price of CHF 1522, is slightly undervalued against a fair value of CHF 1804.13. Despite recent earnings struggles, reporting a significant drop in net income to CHF 77.93 million from last year's CHF 235.49 million, the company is expected to see earnings grow by about 25% annually over the next three years. However, its debt is poorly covered by operating cash flow and it faces high share price volatility.

- Our comprehensive growth report raises the possibility that Barry Callebaut is poised for substantial financial growth.

- Click here to discover the nuances of Barry Callebaut with our detailed financial health report.

Make It Happen

- Click through to start exploring the rest of the 10 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BAER

Julius Bär Gruppe

Provides wealth management solutions in Switzerland, Europe, the Americas, Asia, and internationally.

Established dividend payer with reasonable growth potential.