- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:6088

3 Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

In the midst of global market fluctuations, marked by uncertainty surrounding the incoming U.S. administration's policies and rising long-term interest rates, investors are increasingly focused on identifying opportunities that may be trading below their intrinsic value. A good stock in such a volatile environment is one that demonstrates strong fundamentals and potential for growth despite broader economic challenges, making it an attractive candidate for those seeking undervalued investments.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Giant Biogene Holding (SEHK:2367) | HK$49.10 | HK$97.68 | 49.7% |

| Oddity Tech (NasdaqGM:ODD) | US$43.12 | US$85.73 | 49.7% |

| Wistron (TWSE:3231) | NT$114.00 | NT$227.48 | 49.9% |

| SeSa (BIT:SES) | €75.75 | €150.40 | 49.6% |

| Jetpak Top Holding (OM:JETPAK) | SEK106.00 | SEK211.87 | 50% |

| Loihde Oyj (HLSE:LOIHDE) | €10.80 | €21.48 | 49.7% |

| Telix Pharmaceuticals (ASX:TLX) | A$22.20 | A$44.22 | 49.8% |

| EnomotoLtd (TSE:6928) | ¥1477.00 | ¥2942.16 | 49.8% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.96 | THB9.88 | 49.8% |

| Nokian Renkaat Oyj (HLSE:TYRES) | €7.388 | €14.69 | 49.7% |

Here we highlight a subset of our preferred stocks from the screener.

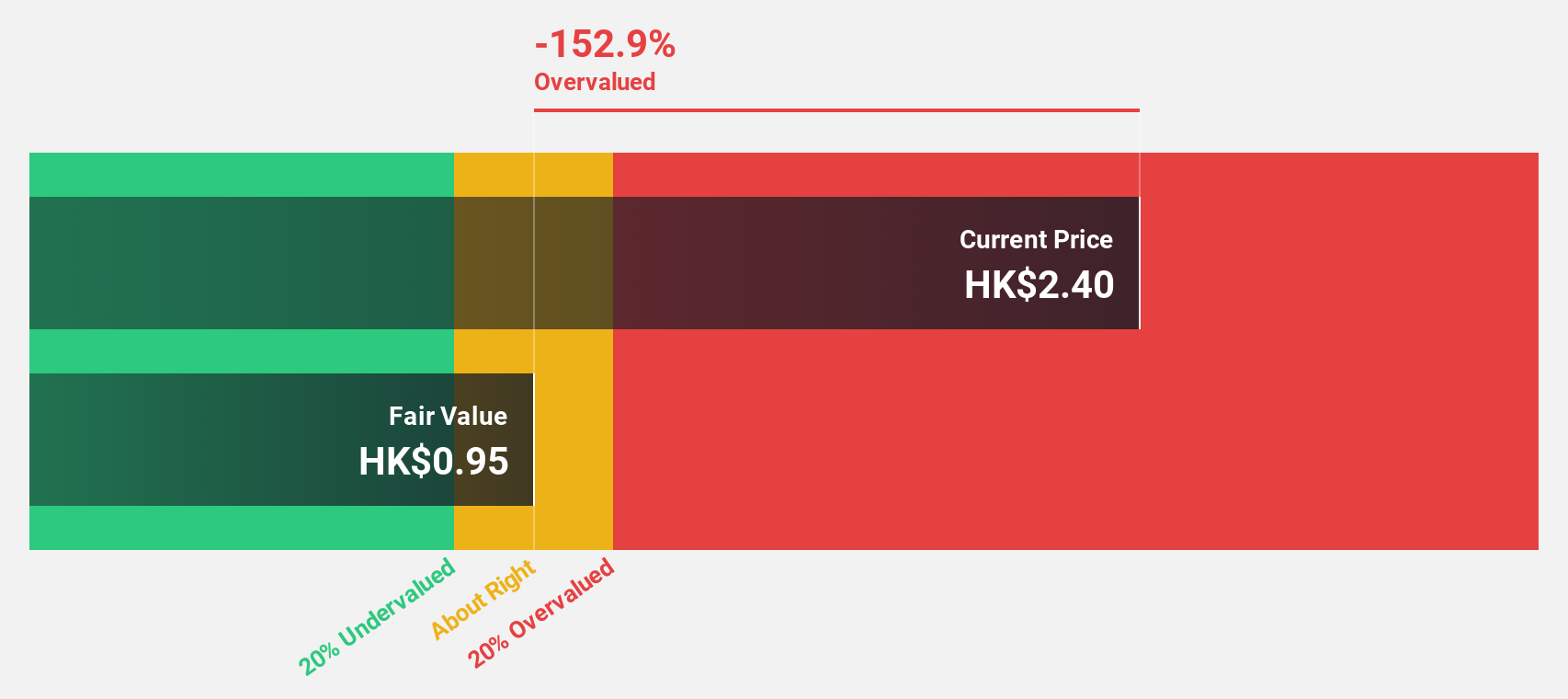

FIT Hon Teng (SEHK:6088)

Overview: FIT Hon Teng Limited manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally, with a market cap of HK$23.03 billion.

Operations: The company generates revenue from Consumer Products amounting to $690.95 million and Intermediate Products totaling $3.94 billion.

Estimated Discount To Fair Value: 23.2%

FIT Hon Teng is trading at HK$3.25, significantly below its estimated fair value of HK$4.23, indicating it may be undervalued based on cash flows. The company's earnings are projected to grow 31.7% annually over the next three years, outpacing the Hong Kong market's growth rate of 11.7%. Recent product innovations in AI data center connectivity and cooling technologies highlight FIT's commitment to maintaining a competitive edge in high-demand sectors despite recent share price volatility.

- Insights from our recent growth report point to a promising forecast for FIT Hon Teng's business outlook.

- Unlock comprehensive insights into our analysis of FIT Hon Teng stock in this financial health report.

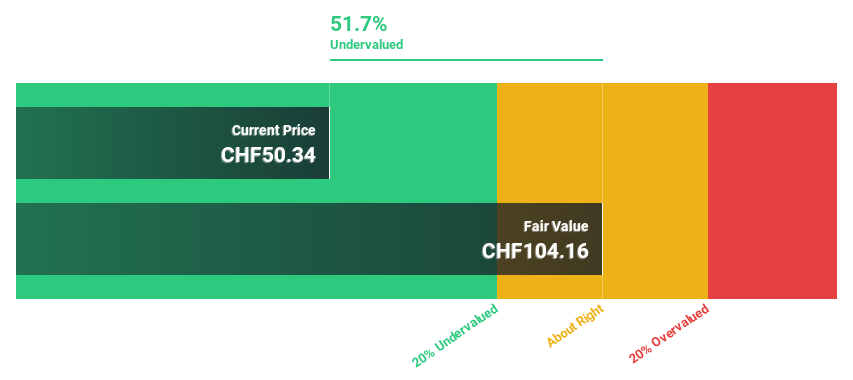

Julius Bär Gruppe (SWX:BAER)

Overview: Julius Bär Gruppe AG is a wealth management firm offering solutions across Switzerland, Europe, the Americas, Asia, and internationally with a market cap of CHF11.38 billion.

Operations: The company's revenue primarily comes from its Private Banking segment, which generated CHF3.15 billion.

Estimated Discount To Fair Value: 44.9%

Julius Bär Gruppe, trading at CHF55.58, is significantly below its estimated fair value of CHF100.82, highlighting a potential undervaluation based on cash flows. Earnings are projected to grow 22.48% annually over the next three years, surpassing the Swiss market's growth rate of 11.3%. Despite a lower profit margin this year and a high level of bad loans at 2.1%, recent fixed-income offerings enhance its financial flexibility for future growth initiatives.

- Upon reviewing our latest growth report, Julius Bär Gruppe's projected financial performance appears quite optimistic.

- Get an in-depth perspective on Julius Bär Gruppe's balance sheet by reading our health report here.

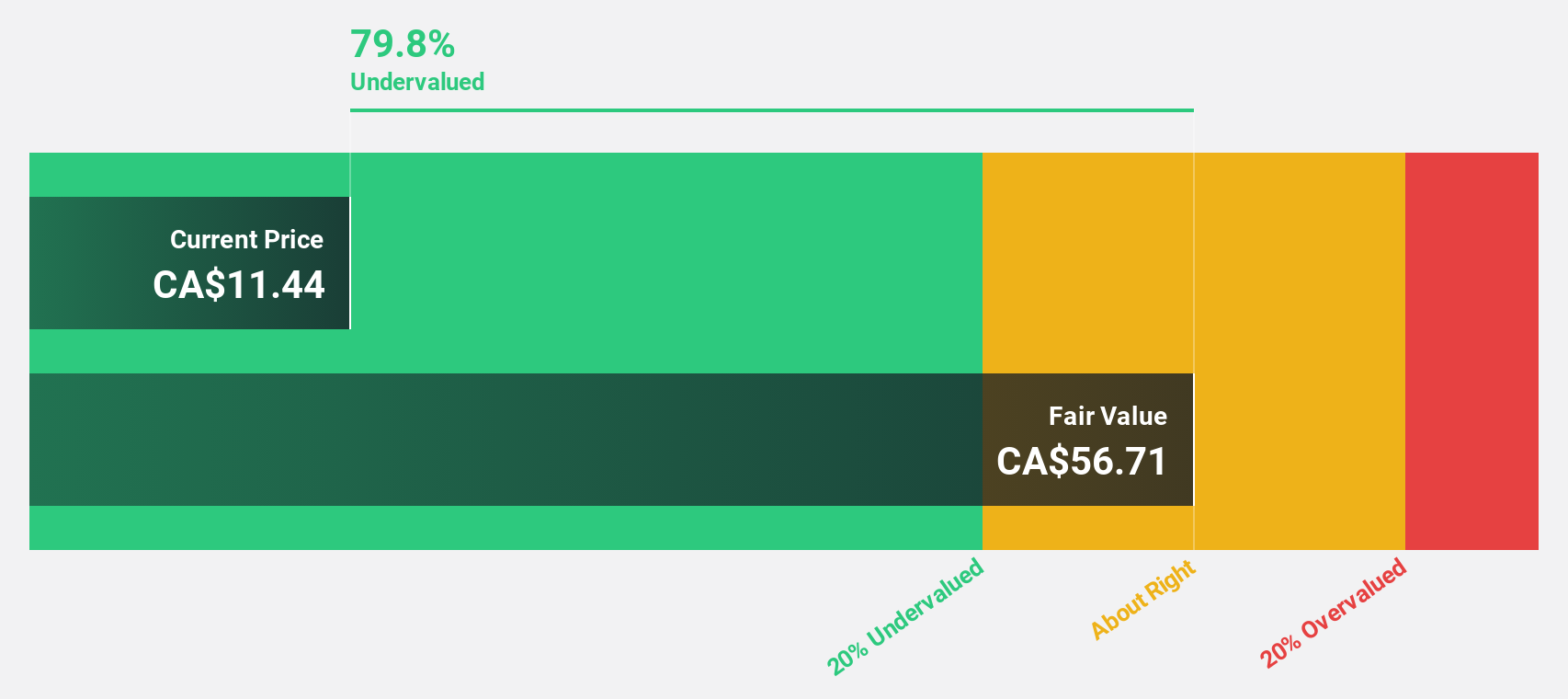

Advantage Energy (TSX:AAV)

Overview: Advantage Energy Ltd. operates in the acquisition, exploitation, development, and production of natural gas, crude oil, and natural gas liquids in Alberta, Canada with a market cap of CA$1.52 billion.

Operations: Revenue from Advantage's operations in natural gas, crude oil, and natural gas liquids amounted to CA$488.84 million.

Estimated Discount To Fair Value: 10.8%

Advantage Energy, trading at CA$9.6, is slightly below its fair value estimate of CA$10.76, suggesting some undervaluation based on cash flows. Earnings are forecast to grow significantly at 46.11% annually over the next three years, outpacing the Canadian market's growth rate of 16.4%. Despite this potential, recent financial results show a net loss for Q3 2024 and a substantial drop in profit margins compared to last year due to increased production costs and low AECO prices impacting revenues.

- The growth report we've compiled suggests that Advantage Energy's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Advantage Energy.

Make It Happen

- Embark on your investment journey to our 915 Undervalued Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6088

FIT Hon Teng

Manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally.

Excellent balance sheet and good value.