- France

- /

- Aerospace & Defense

- /

- ENXTPA:AIR

European Value Stocks Trading At Estimated Discounts Of Up To 46.1%

Reviewed by Simply Wall St

As European markets remain relatively stable, with the pan-European STOXX Europe 600 Index ending roughly flat amid ongoing U.S. and European trade discussions, investors are keenly observing potential opportunities within this environment. In such a climate, identifying undervalued stocks can be particularly appealing for those looking to capitalize on discrepancies between market price and intrinsic value, especially when economic indicators suggest room for growth or recovery in specific sectors.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Talenom Oyj (HLSE:TNOM) | €3.50 | €6.97 | 49.8% |

| Surgical Science Sweden (OM:SUS) | SEK149.50 | SEK294.40 | 49.2% |

| Sparebank 68° Nord (OB:SB68) | NOK180.00 | NOK358.61 | 49.8% |

| Selvita (WSE:SLV) | PLN31.80 | PLN62.51 | 49.1% |

| QPR Software Oyj (HLSE:QPR1V) | €0.802 | €1.60 | 50% |

| Profoto Holding (OM:PRFO) | SEK22.00 | SEK43.22 | 49.1% |

| InPost (ENXTAM:INPST) | €12.92 | €25.32 | 49% |

| Cambi (OB:CAMBI) | NOK21.90 | NOK42.87 | 48.9% |

| Atea (OB:ATEA) | NOK143.80 | NOK284.71 | 49.5% |

| adidas (XTRA:ADS) | €205.00 | €408.67 | 49.8% |

Let's uncover some gems from our specialized screener.

Airbus (ENXTPA:AIR)

Overview: Airbus SE, with a market cap of €146.62 billion, is involved in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions globally through its subsidiaries.

Operations: The company generates revenue through its segments: Airbus Helicopters (€8.08 billion), Airbus Defence and Space (€12.34 billion), and Airbus, which includes holding functions and bank activities (€51 billion).

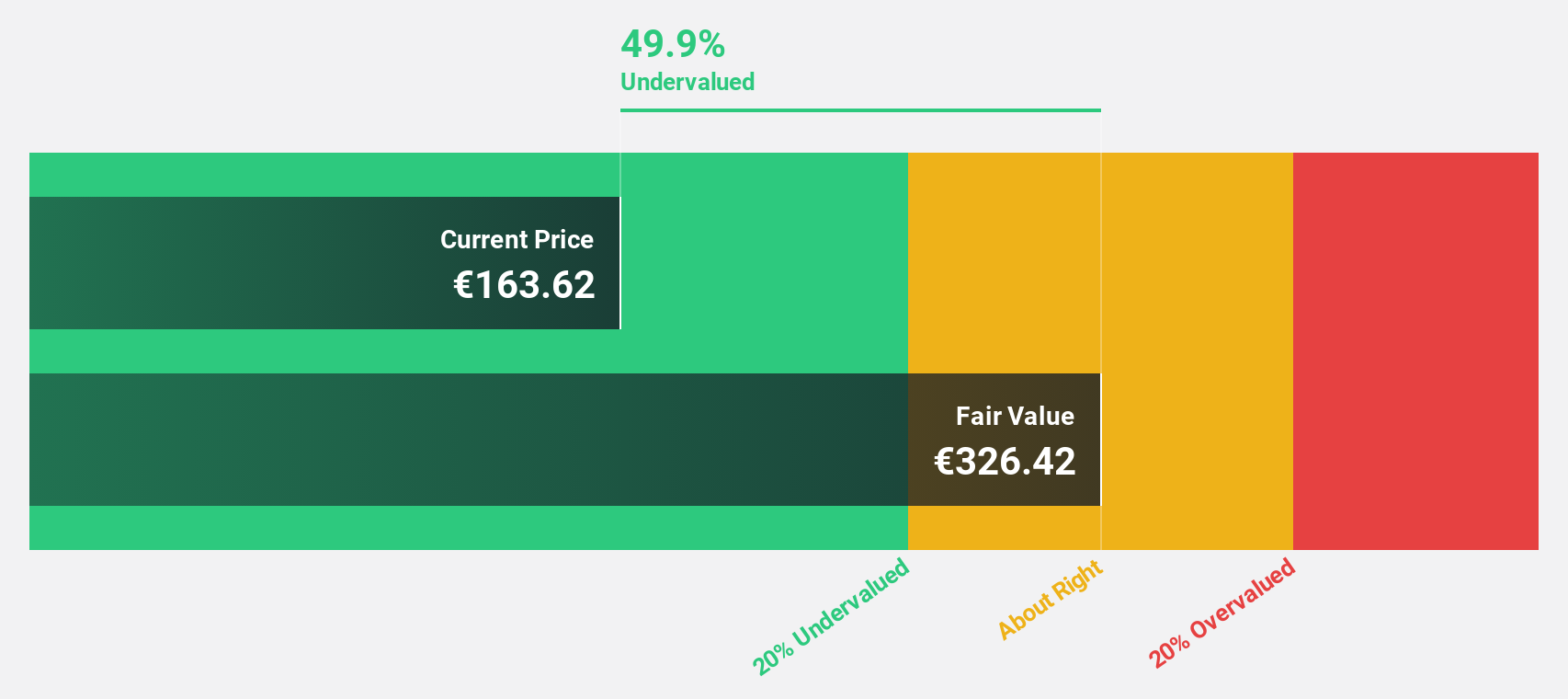

Estimated Discount To Fair Value: 44.1%

Airbus is trading at 44.1% below its estimated fair value of €333.01, indicating potential undervaluation based on cash flows. Its earnings are projected to grow 16.67% annually, outpacing the French market's growth rate, while revenue is expected to increase by 9.9% per year. Recent agreements with STARLUX Airlines and strategic partnerships enhance Airbus's long-term prospects and may bolster cash flow through expanded sales and innovation initiatives in aerospace technology.

- Our earnings growth report unveils the potential for significant increases in Airbus' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Airbus.

Apotea (OM:APOTEA)

Overview: Apotea AB (publ) operates an online pharmacy in Sweden with a market cap of SEK10.50 billion.

Operations: The company's revenue is primarily generated from its operations as an online pharmacy in Sweden.

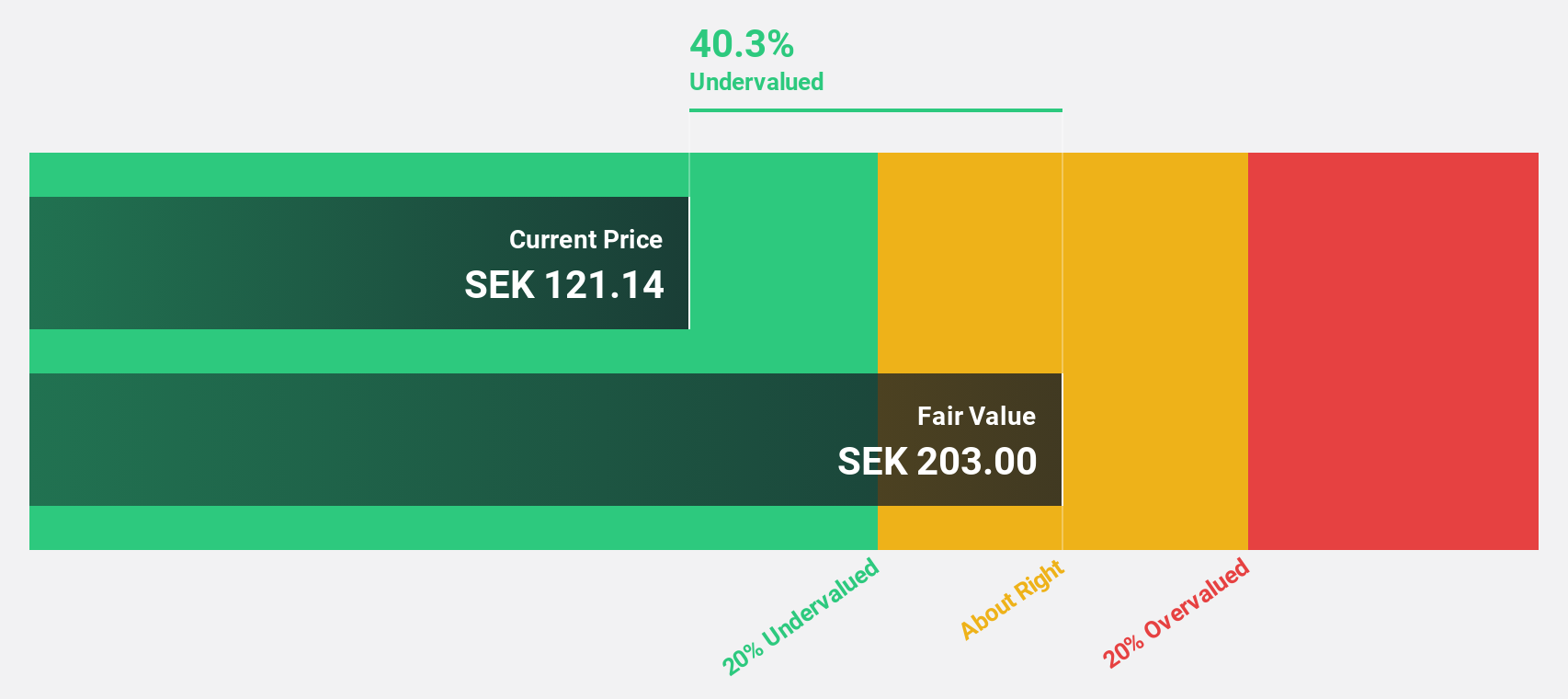

Estimated Discount To Fair Value: 46.1%

Apotea is trading 46.1% below its estimated fair value of SEK 202.27, suggesting undervaluation based on cash flows. The company's earnings are expected to grow at 17.88% annually, surpassing the Swedish market's rate, while revenue growth is forecasted at 13.6% per year. Recent Q2 results showed increased sales and net income compared to last year, reinforcing its financial robustness amidst strategic index inclusion and board changes in recent months.

- The growth report we've compiled suggests that Apotea's future prospects could be on the up.

- Click here to discover the nuances of Apotea with our detailed financial health report.

Swatch Group (SWX:UHR)

Overview: The Swatch Group AG designs, manufactures, and sells finished watches, jewelry, and watch movements and components worldwide with a market cap of CHF7.35 billion.

Operations: The company's revenue is primarily derived from its Watches & Jewelry segment, which accounts for CHF6.01 billion, followed by the Electronic Systems segment at CHF355 million.

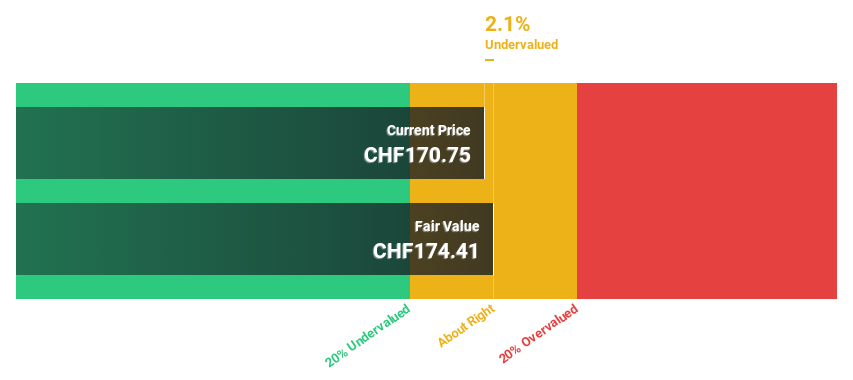

Estimated Discount To Fair Value: 27.9%

Swatch Group is trading 27.9% below its estimated fair value of CHF194.81, highlighting undervaluation based on cash flows. Earnings are projected to grow significantly at 36.6% annually, outpacing the Swiss market's growth rate. However, recent earnings showed a decline in sales and net income compared to last year, with profit margins dropping from 7.1% to 0.9%. Additionally, the dividend yield of 3.2% lacks coverage by earnings or free cash flows.

- The analysis detailed in our Swatch Group growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Swatch Group stock in this financial health report.

Make It Happen

- Navigate through the entire inventory of 174 Undervalued European Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AIR

Airbus

Engages in the design, manufacture, and delivery of aeronautics and aerospace products, services, and solutions worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives