As European markets experience a lift from easing trade tensions and optimism surrounding potential U.S. interest rate cuts, investors are keenly observing opportunities within the region's stock landscape. In this environment, identifying stocks that are trading below their estimated value can provide a strategic advantage, as these may offer potential for growth when market conditions stabilize further.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MilDef Group (OM:MILDEF) | SEK146.10 | SEK289.75 | 49.6% |

| Kuros Biosciences (SWX:KURN) | CHF27.80 | CHF54.72 | 49.2% |

| InPost (ENXTAM:INPST) | €13.45 | €26.70 | 49.6% |

| IDI (ENXTPA:IDIP) | €79.40 | €157.96 | 49.7% |

| Honkarakenne Oyj (HLSE:HONBS) | €2.80 | €5.53 | 49.4% |

| E-Globe (BIT:EGB) | €0.66 | €1.31 | 49.8% |

| Clemondo Group (OM:CLEM) | SEK9.80 | SEK19.21 | 49% |

| Bystronic (SWX:BYS) | CHF373.00 | CHF745.87 | 50% |

| Aquila Part Prod Com (BVB:AQ) | RON1.446 | RON2.86 | 49.5% |

| Andritz (WBAG:ANDR) | €63.45 | €126.15 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

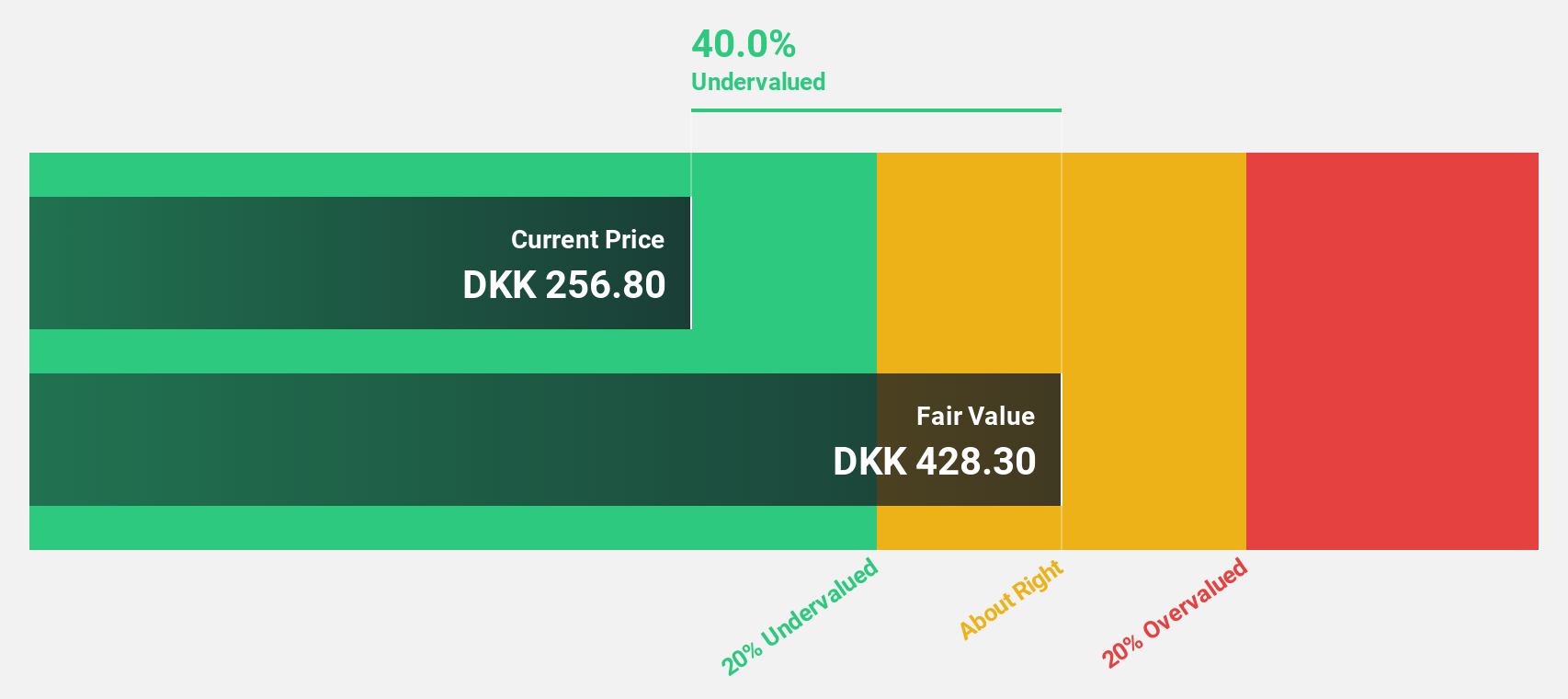

Demant (CPSE:DEMANT)

Overview: Demant A/S is a hearing healthcare company with operations across Europe, North America, Asia, the Pacific region, and internationally, and it has a market cap of DKK54.53 billion.

Operations: The company's revenue is primarily generated from its Hearing Healthcare segment, which accounts for DKK22.59 billion.

Estimated Discount To Fair Value: 40.1%

Demant is trading at DKK 256, significantly below its estimated fair value of DKK 427.46, suggesting potential undervaluation based on cash flows. Despite high debt levels, the company offers good relative value compared to peers and forecasts earnings growth of 11.7% annually, outpacing the Danish market's growth rate. Recent developments include a completed share buyback program and revised earnings guidance for 2025 with lowered organic growth expectations between 1%-3%.

- Our earnings growth report unveils the potential for significant increases in Demant's future results.

- Navigate through the intricacies of Demant with our comprehensive financial health report here.

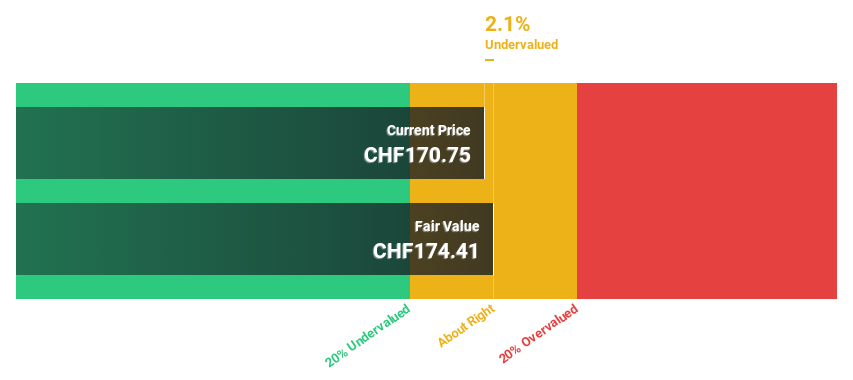

Swatch Group (SWX:UHR)

Overview: The Swatch Group AG designs, manufactures, and sells finished watches, jewelry, and watch movements and components globally, with a market cap of CHF7.35 billion.

Operations: The company's revenue is primarily derived from its Watches & Jewelry segment, which accounts for CHF6.01 billion, followed by the Electronic Systems segment at CHF355 million.

Estimated Discount To Fair Value: 29.4%

Swatch Group is trading at CHF 141.05, well below its estimated fair value of CHF 199.7, highlighting undervaluation based on cash flows. Despite a recent drop in net income to CHF 3 million for H1 2025 from CHF 136 million the previous year, earnings are forecasted to grow significantly at over 40% annually, surpassing Swiss market averages. However, profit margins have declined and dividend coverage remains weak.

- The analysis detailed in our Swatch Group growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Swatch Group stock in this financial health report.

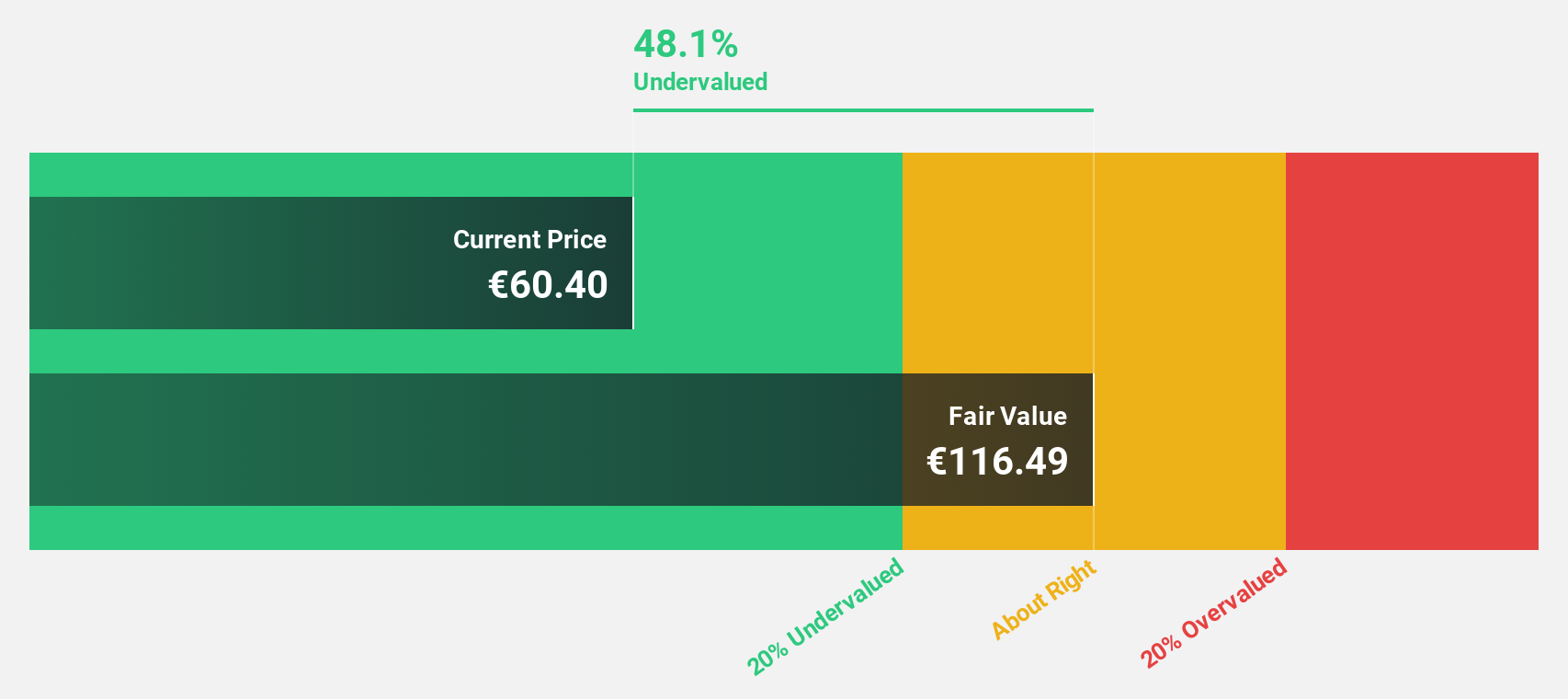

Andritz (WBAG:ANDR)

Overview: Andritz AG provides industrial machinery, equipment, and services globally, with a market cap of €6.19 billion.

Operations: The company's revenue segments consist of Metals (€1.71 billion), Hydro Power (€1.65 billion), Pulp & Paper (€3.10 billion), and Environment & Energy (€1.52 billion).

Estimated Discount To Fair Value: 49.7%

Andritz, currently trading at €63.45, is significantly undervalued with a fair value estimate of €126.15, reflecting strong cash flow potential. Despite a dip in recent earnings to €102.4 million for Q2 2025 from €119.7 million the previous year, Andritz's earnings are projected to grow at 13.8% annually, outpacing the Austrian market average of 11.1%. The company's robust order intake and strategic projects like the Cahora Bassa hydropower plant rehabilitation bolster its growth prospects amidst an unstable dividend history.

- According our earnings growth report, there's an indication that Andritz might be ready to expand.

- Dive into the specifics of Andritz here with our thorough financial health report.

Make It Happen

- Click this link to deep-dive into the 211 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:ANDR

Andritz

Engages in the provision of industrial machinery, equipment, and services in Europe, North America, South America, China, Asia, Africa, Australia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives