- Switzerland

- /

- Luxury

- /

- SWX:CALN

Investors who have held CALIDA Holding (VTX:CALN) over the last three years have watched its earnings decline along with their investment

It's nice to see the CALIDA Holding AG (VTX:CALN) share price up 14% in a week. Meanwhile over the last three years the stock has dropped hard. In that time, the share price dropped 60%. Some might say the recent bounce is to be expected after such a bad drop. Perhaps the company has turned over a new leaf.

On a more encouraging note the company has added CHF17m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

CALIDA Holding became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. So it's worth looking at other metrics to try to understand the share price move.

With a rather small yield of just 1.0% we doubt that the stock's share price is based on its dividend. Arguably the revenue decline of 8.1% per year has people thinking CALIDA Holding is shrinking. After all, if revenue keeps shrinking, it may be difficult to find earnings growth in the future.

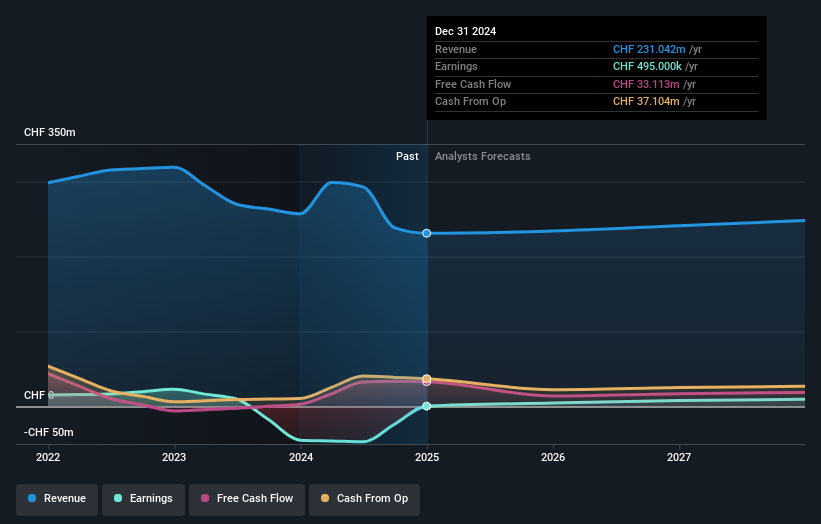

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that CALIDA Holding has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling CALIDA Holding stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for CALIDA Holding the TSR over the last 3 years was -58%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

CALIDA Holding shareholders are down 39% for the year (even including dividends), but the market itself is up 4.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 5% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of CALIDA Holding's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: CALIDA Holding may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

If you're looking to trade CALIDA Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:CALN

CALIDA Holding

Engages in the apparel business in Switzerland, France, Germany, rest of Europe, Asia, the United States, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives